Sharecare, Inc. (SHCR): Price and Financial Metrics

SHCR Price/Volume Stats

| Current price | $1.38 | 52-week high | $1.41 |

| Prev. close | $1.38 | 52-week low | $0.48 |

| Day low | $1.37 | Volume | 977,156 |

| Day high | $1.38 | Avg. volume | 2,765,136 |

| 50-day MA | $1.10 | Dividend yield | N/A |

| 200-day MA | $0.99 | Market Cap | 500.13M |

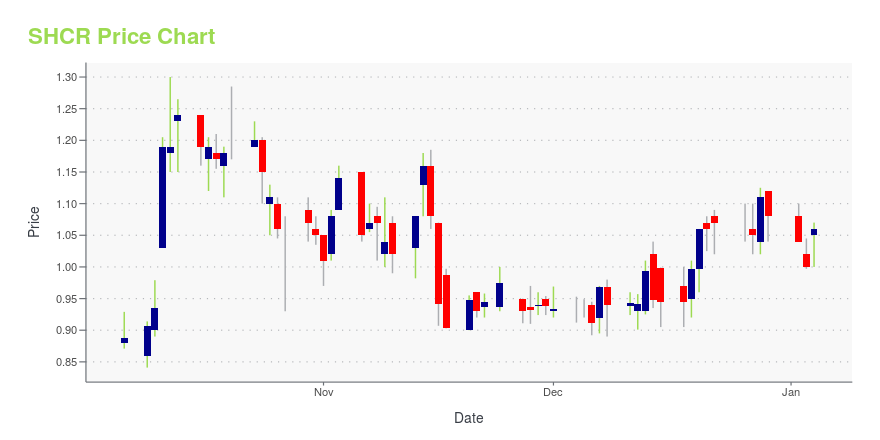

SHCR Stock Price Chart Interactive Chart >

Sharecare, Inc. (SHCR) Company Bio

Sharecare, Inc. operates as a digital health company. Its virtual health platform is designed to help people, providers, employers, health plans, government organizations, and communities optimize individual and population-wide well-being by driving positive behavior change. The company was founded in 2010 and sis based in Atlanta, Georgia.

Latest SHCR News From Around the Web

Below are the latest news stories about SHARECARE INC that investors may wish to consider to help them evaluate SHCR as an investment opportunity.

Sharecare to present at 42nd Annual J.P. Morgan Healthcare ConferenceATLANTA, Dec. 22, 2023 (GLOBE NEWSWIRE) -- Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced that its founder and executive chairman, Jeff Arnold, and incoming chief executive officer, Brent Layton, will present at the 42nd Annual J.P. Morgan Healthcare Conference on Wednesday, Jan. 10, 2024 at 8:15 a.m. PST. A live audio webcast and replay of the event will be available online for a period of 30 days at https://investors |

Sharecare wins 22 Digital Health Awards in Fall 2023 competitionCompany bestowed seven awards for its solutions for large employers and health plans, including its proprietary digital therapeutics and flagship well-being and health navigation platformATLANTA, Dec. 07, 2023 (GLOBE NEWSWIRE) -- Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced it has won 22 Digital Health Awards in the Health Information Resource Center’s Fall 2023 competition. Celebrating its 25th anniversary this year |

Sharecare Inc (SHCR) Reports Narrowed Net Loss and Record Adjusted EBITDA Margins in Q3 2023Financial Highlights and Operational Progress Amidst Market Challenges |

Sharecare announces longtime Centene executive Brent Layton as next CEO; founder Jeff Arnold to serve as executive chairmanAnnounced in conjunction with Sharecare’s strong third quarter 2023 financial results, Layton to assume new role on Jan. 2, 2024ATLANTA , Nov. 09, 2023 (GLOBE NEWSWIRE) -- Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced, in conjunction with its third quarter 2023 financial results, that healthcare industry veteran and board member Brent Layton will succeed Jeff Arnold as CEO. Formerly president and chief operating offic |

Sharecare announces third quarter 2023 financial results and operational highlightsIn the quarter, Sharecare exceeds high end of revenue guidance, reports decrease in net loss and record adjusted EBITDA marginsATLANTA, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced financial results for the quarter ended September 30, 2023. “I am pleased with our strong financial results in the third quarter, including record adjusted EBITDA margins, execution against our core KPIs, |

SHCR Price Returns

| 1-mo | 0.73% |

| 3-mo | 70.37% |

| 6-mo | 28.97% |

| 1-year | 11.29% |

| 3-year | -78.96% |

| 5-year | N/A |

| YTD | 27.78% |

| 2023 | -32.50% |

| 2022 | -64.37% |

| 2021 | -57.40% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...