Shinhan Financial Group Co. Ltd. ADR (SHG): Price and Financial Metrics

SHG Price/Volume Stats

| Current price | $41.90 | 52-week high | $41.97 |

| Prev. close | $38.81 | 52-week low | $25.09 |

| Day low | $40.32 | Volume | 132,500 |

| Day high | $41.97 | Avg. volume | 124,447 |

| 50-day MA | $35.77 | Dividend yield | 3.11% |

| 200-day MA | $31.93 | Market Cap | 21.34B |

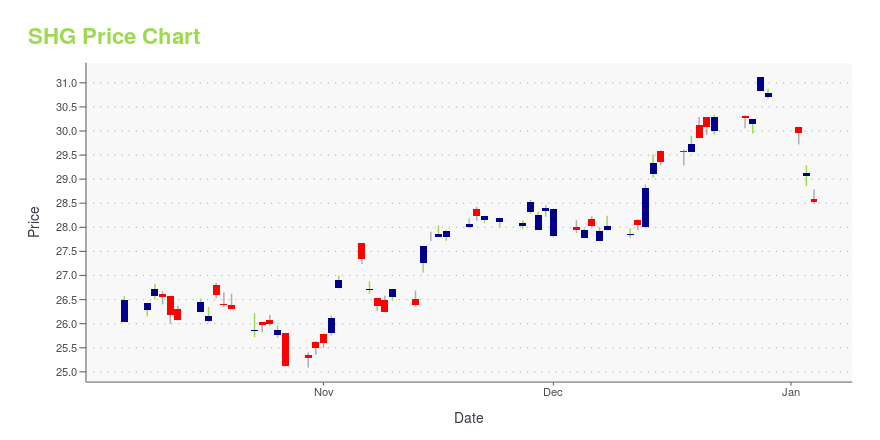

SHG Stock Price Chart Interactive Chart >

Shinhan Financial Group Co. Ltd. ADR (SHG) Company Bio

Shinhan Financial Group Co., Ltd. (Korean: 주식회사 신한금융지주회사; RR: Jusik Hoesa Sinhan Geumyung Jiju Hoesa) is a financial holding company headquartered in Seoul, South Korea. Its subsidiaries provide a full range of financial services, including banking, securities, life insurance, and investment banking. It is one of Korea's Big Five financial groups, along with KB Financial Group, NH Financial Group, Hana Financial Group and Woori Financial Group. (Source:Wikipedia)

Latest SHG News From Around the Web

Below are the latest news stories about SHINHAN FINANCIAL GROUP CO LTD that investors may wish to consider to help them evaluate SHG as an investment opportunity.

Shinhan Financial Group Co Ltd (SHG): A Deep Dive into Its Performance PotentialUnraveling the Factors That Could Limit Shinhan Financial Group Co Ltd's Outperformance |

Why Shinhan Financial (SHG) is a Top Dividend Stock for Your PortfolioDividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Shinhan Financial (SHG) have what it takes? Let's find out. |

Are Investors Undervaluing Nordea Bank (NRDBY) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Shinhan Financial (SHG) Could Be a Great ChoiceDividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Shinhan Financial (SHG) have what it takes? Let's find out. |

Best Income Stocks to Buy for August 22ndSHG, MBWM and GSBD made it to the Zacks Rank #1 (Strong Buy) income stocks list on August 22, 2023. |

SHG Price Returns

| 1-mo | 22.26% |

| 3-mo | 22.66% |

| 6-mo | 40.90% |

| 1-year | 57.58% |

| 3-year | 33.63% |

| 5-year | 24.62% |

| YTD | 39.76% |

| 2023 | 14.11% |

| 2022 | -7.49% |

| 2021 | 4.91% |

| 2020 | -21.83% |

| 2019 | 7.27% |

SHG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SHG

Here are a few links from around the web to help you further your research on Shinhan Financial Group Co Ltd's stock as an investment opportunity:Shinhan Financial Group Co Ltd (SHG) Stock Price | Nasdaq

Shinhan Financial Group Co Ltd (SHG) Stock Quote, History and News - Yahoo Finance

Shinhan Financial Group Co Ltd (SHG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...