SILVERGATE CAPITAL CORP (SI): Price and Financial Metrics

SI Price/Volume Stats

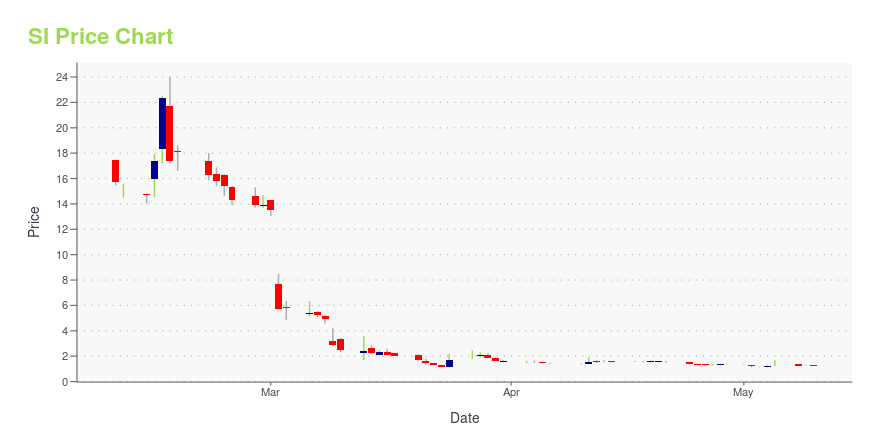

| Current price | $1.25 | 52-week high | $108.11 |

| Prev. close | $1.24 | 52-week low | $1.10 |

| Day low | $1.25 | Volume | 1,168,300 |

| Day high | $1.32 | Avg. volume | 14,795,615 |

| 50-day MA | $2.23 | Dividend yield | N/A |

| 200-day MA | $37.76 | Market Cap | 39.57M |

SI Stock Price Chart Interactive Chart >

SILVERGATE CAPITAL CORP (SI) Company Bio

Silvergate Capital Corp. is a holding company, which engages in the provision of banking and loan services. It focuses on the financial infrastructure solutions and services for participants in the nascent and digital currency industry. The company was founded in 1988 and is headquartered in La Jolla, CA.

Latest SI News From Around the Web

Below are the latest news stories about SILVERGATE CAPITAL CORP that investors may wish to consider to help them evaluate SI as an investment opportunity.

KRE ETF Alert: What Is Going on With the Regional Banking ETF?The KRE ETF is once again in focus for many investors, as regional banks continue to see heightened volatility of late. |

3 Risky Bank Stocks to Sell Before They Implode in 2023The banking crisis may not be over yet, and unlike depositors, investors in bank stocks will not be covered. |

Gold Suppression Expected Ahead Of The FOMCA review and analysis of the gold and silver markets. |

7 Underperforming Stocks to Dump NowInvesting is always a gamble and stocks sometimes become a bitter disappointment. |

7 Short-Squeeze Stocks That Are Breaking All the RulesAlthough the bears have every reason to cynically target these troubled enterprises, they vexingly represent short-squeeze stocks. |

SI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -98.81% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -88.26% |

| 2021 | 99.43% |

| 2020 | 367.06% |

| 2019 | N/A |

Loading social stream, please wait...