Siemens AG (SIEGY): Price and Financial Metrics

SIEGY Price/Volume Stats

| Current price | $92.52 | 52-week high | $102.81 |

| Prev. close | $91.55 | 52-week low | $63.31 |

| Day low | $91.93 | Volume | 87,500 |

| Day high | $92.62 | Avg. volume | 154,648 |

| 50-day MA | $94.42 | Dividend yield | 1.98% |

| 200-day MA | $89.49 | Market Cap | 148.03B |

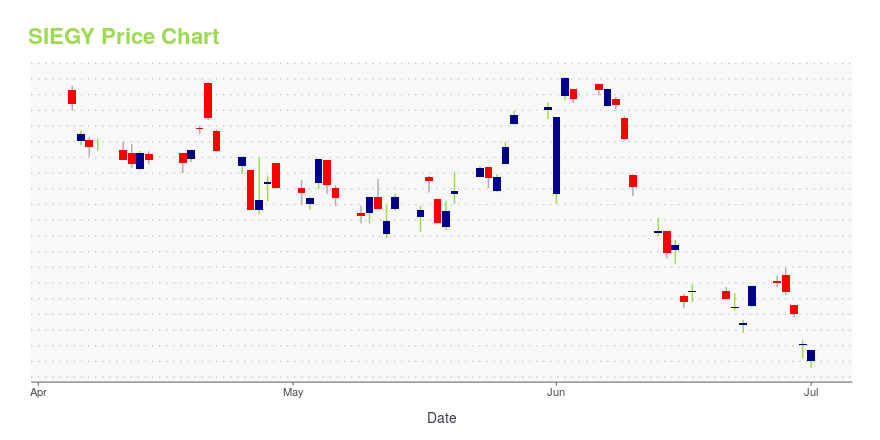

SIEGY Stock Price Chart Interactive Chart >

Siemens AG (SIEGY) Company Bio

Siemens AG is an engineering and manufacturing company. The Company focuses on areas of electrification, automation, and digitalization. Siemens also provides engineering solutions in automation and control, power, transportation, and medical diagnosis.

Latest SIEGY News From Around the Web

Below are the latest news stories about SIEMENS AKTIENGESELLSCHAFT that investors may wish to consider to help them evaluate SIEGY as an investment opportunity.

10 Robotics Stocks to Buy for 2022 and BeyondThe most popular stocks for a robotics-based portfolio are IRBT, ISRG, and NVDA. |

Siemens Critical Infrastructure Defense Center latest investment in Canada’s cybersecurity networkFREDERICTON, New Brunswick, March 31, 2022 (GLOBE NEWSWIRE) -- Siemens Canada continues to expand its footprint in New Brunswick and increase its global cybersecurity offering with the official inauguration of the Critical Infrastructure Defense Center (CIDC). The center is the first facility of its kind in the Siemens realm dedicated to Critical Infrastructure Protection (CIP) focused on Operations Technology (OT). Siemens has been investing in its Canadian cyber initiatives since launching its |

Global Industrial (GIC) Stock Jumps 6.2%: Will It Continue to Soar?Global Industrial (GIC) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Siemens AG (SIEGY) Soars 7.1%: Is Further Upside Left in the Stock?Siemens AG (SIEGY) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Siemens Foundation and Northern Trust Commit Additional $10M Investment in Community Development Financial Institutions in Their Continued Effort to Support Social Equity in Underserved CommunitiesWASHINGTON, March 16, 2022--The Siemens Foundation and Northern Trust today announced a commitment of $10 million to two Community Development Financial Institutions Funds (CDFI), PeopleFund and Disability Opportunity Fund (DOF), to support social equity and entrepreneurial success in underserved communities. This investment follows an initial $10M investment from the partners in January 2021 to two CDFIs in the affordable housing and community clinic sectors, totaling a $20 million investment i |

SIEGY Price Returns

| 1-mo | -0.46% |

| 3-mo | -2.86% |

| 6-mo | 3.62% |

| 1-year | 11.21% |

| 3-year | 24.92% |

| 5-year | 82.26% |

| YTD | 0.96% |

| 2023 | 38.92% |

| 2022 | -18.91% |

| 2021 | 22.97% |

| 2020 | 13.34% |

| 2019 | 19.14% |

SIEGY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...