Sintx Technologies, Inc. (SINT): Price and Financial Metrics

SINT Price/Volume Stats

| Current price | $5.27 | 52-week high | $324.00 |

| Prev. close | $4.97 | 52-week low | $4.12 |

| Day low | $4.85 | Volume | 121,800 |

| Day high | $5.54 | Avg. volume | 187,267 |

| 50-day MA | $7.79 | Dividend yield | N/A |

| 200-day MA | $41.21 | Market Cap | 3.23M |

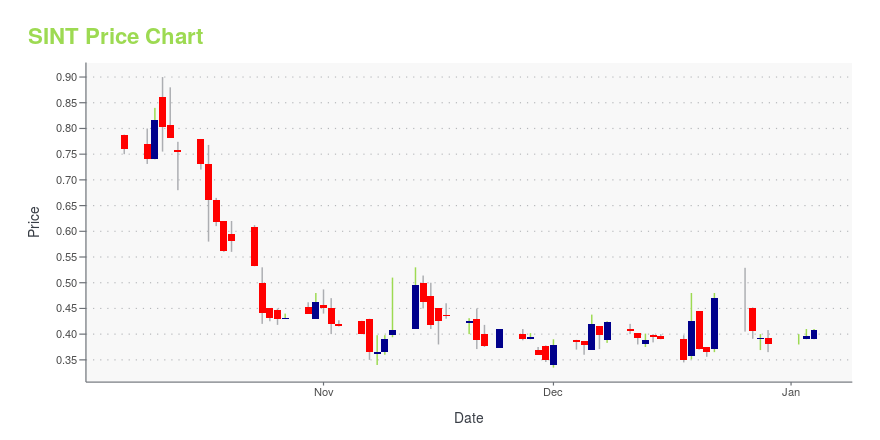

SINT Stock Price Chart Interactive Chart >

Sintx Technologies, Inc. (SINT) Company Bio

Sintx Technologies, Inc. operates as a commercial biomaterial company. The Company focuses on using silicon nitride technology platform to develop, manufacture, and sell a range of medical devices, as well as markets spinal fusion products and develops products for use in total hip and knee joint replacements. Sintx Technologies serves clients in the United States.

Latest SINT News From Around the Web

Below are the latest news stories about SINTX TECHNOLOGIES INC that investors may wish to consider to help them evaluate SINT as an investment opportunity.

We Think Shareholders Are Less Likely To Approve A Pay Rise For Sintx Technologies, Inc.'s (NASDAQ:SINT) CEO For NowKey Insights Sintx Technologies' Annual General Meeting to take place on 5th of December Salary of US$400.0k is part of... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday as we check out all of the biggest movements happening this morning! |

SINTX TECHNOLOGIES ENTERS A LONG-TERM SUPPLY AGREEMENT FOR AEROSPACE COMPONENTSSALT LAKE CITY, Nov. 07, 2023 (GLOBE NEWSWIRE) -- SINTX Technologies, Inc. (www.sintx.com) (NASDAQ: SINT; “SINTX” or the “Company”), a manufacturer and developer of advanced ceramic materials and related technologies, announced that it has entered a Long-Term Agreement (LTA) to supply jet engine components made of its silicon nitride. The agreement materialized after a rigorous 2-year qualification of the Company’s Operational and Quality Management Systems and manufacturing capabilities, and su |

SINTX Technologies Awarded Phase II NIH Grant for Silicon Nitride-PEEK 3D Printed Composite Spinal ImplantsSiNtx Technologies, Inc. 3DP SN-PEEK cages SALT LAKE CITY, Oct. 11, 2023 (GLOBE NEWSWIRE) -- SINTX Technologies, Inc. (www.sintx.com) (NASDAQ: SINT) (“SINTX” or the “Company”), an original equipment manufacturer of advanced ceramics, announced today it has been awarded a Phase II grant of $1,972,826 by the National Institutes of Health (NIH) to develop a 3D printed (3DP) composite silicon nitride – polyetheretherketone (SN-PEEK) spinal implant. This represents the fourth NIH grant awarded to SIN |

11 ChatGPT Penny Stock PicksIn this article, we will take a look at the 11 ChatGPT penny stock picks. To see more such companies, go directly to 5 ChatGPT Penny Stock Picks. The AI boom that started with the launch of ChatGPT from OpenAI seems to have no end in sight. A McKinsey report compared the fickle rise of […] |

SINT Price Returns

| 1-mo | 0.00% |

| 3-mo | -34.78% |

| 6-mo | -91.21% |

| 1-year | -98.27% |

| 3-year | -99.98% |

| 5-year | -99.99% |

| YTD | -93.09% |

| 2023 | -96.06% |

| 2022 | -84.92% |

| 2021 | -59.11% |

| 2020 | 5.37% |

| 2019 | -72.41% |

Continue Researching SINT

Want to do more research on Sintx Technologies Inc's stock and its price? Try the links below:Sintx Technologies Inc (SINT) Stock Price | Nasdaq

Sintx Technologies Inc (SINT) Stock Quote, History and News - Yahoo Finance

Sintx Technologies Inc (SINT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...