SVB Financial Group (SIVB): Price and Financial Metrics

SIVB Price/Volume Stats

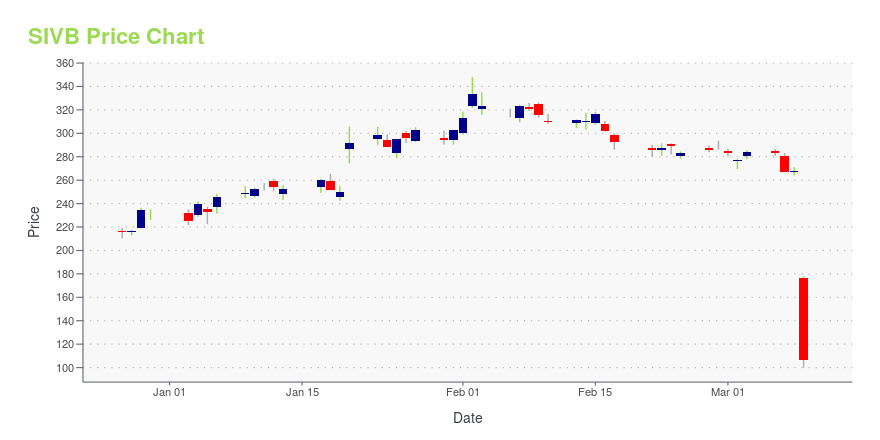

| Current price | $39.40 | 52-week high | $597.16 |

| Prev. close | $106.04 | 52-week low | $39.40 |

| Day low | $39.40 | Volume | 11,307,313 |

| Day high | $39.40 | Avg. volume | 1,899,047 |

| 50-day MA | $272.71 | Dividend yield | N/A |

| 200-day MA | $328.85 | Market Cap | 2.33B |

SIVB Stock Price Chart Interactive Chart >

SVB Financial Group (SIVB) Company Bio

Silicon Valley Bank, a subsidiary of SVB Financial Group, is a U.S.-based high-tech commercial bank. The bank has helped fund more than 30,000 start-ups.[2] SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits. (Source:Wikipedia)

Latest SIVB News From Around the Web

Below are the latest news stories about SVB FINANCIAL GROUP that investors may wish to consider to help them evaluate SIVB as an investment opportunity.

SVB Financial confirms that Goldman was buyer of underwater securities last weekSVB Financial (NASDAQ:SIVB) confirmed that Silicon Valley Bank sold a portfolio of securities with a book value of $23.97 billion to Goldman Sachs (GS) last week before the bank was shut down by the FDIC. The sale of the portfolio to Goldman resulted in a net loss for Silicon Valley Bank of about $1.8 billion, according to an 8-K filing<... |

Fed to consider tough rules for midsize banks following SVB failure- report

|

Silicon Valley Bank - How Worried Should We Be?The financial world has been rocked over the past few days. Shockwaves from this very fluid situation are still in process. |

The Big Mistake That Led To Silicon Valley Bank's CrashThe Trump-era rollback of banking regulations was a big mistake. |

Yes, The Latest Bank Bailout Is Really A Bailout, And You Are Paying For It.The FDIC was never intended to insure rich people with deposits well in excess of FDIC insurance maximums. Yet that is exactly what is now happening. |

SIVB Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -92.89% |

| 5-year | -83.15% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -66.07% |

| 2021 | 74.88% |

| 2020 | 54.49% |

| 2019 | 32.18% |

Continue Researching SIVB

Want to see what other sources are saying about Svb Financial Group's financials and stock price? Try the links below:Svb Financial Group (SIVB) Stock Price | Nasdaq

Svb Financial Group (SIVB) Stock Quote, History and News - Yahoo Finance

Svb Financial Group (SIVB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...