SK Telecom Co. Ltd. ADR (SKM): Price and Financial Metrics

SKM Price/Volume Stats

| Current price | $22.02 | 52-week high | $22.71 |

| Prev. close | $21.87 | 52-week low | $19.34 |

| Day low | $21.90 | Volume | 207,200 |

| Day high | $22.05 | Avg. volume | 291,013 |

| 50-day MA | $21.13 | Dividend yield | 4.97% |

| 200-day MA | $21.19 | Market Cap | 9.72B |

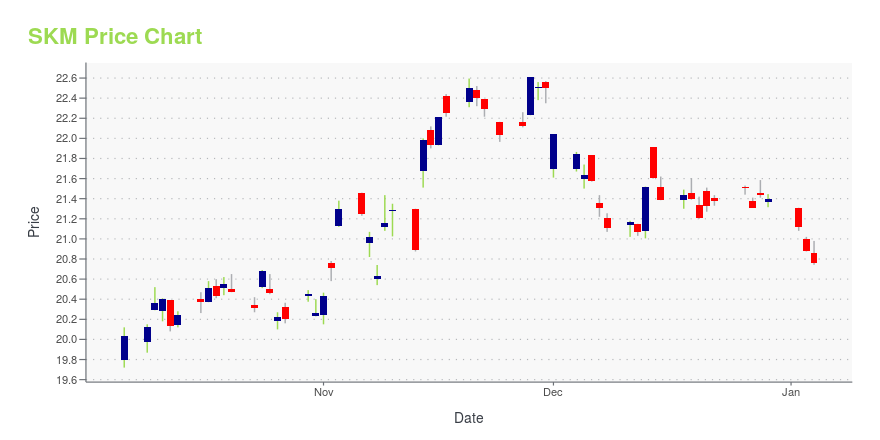

SKM Stock Price Chart Interactive Chart >

SK Telecom Co. Ltd. ADR (SKM) Company Bio

SK Telecom Co., Ltd. (Korean: SK텔레콤 or 에스케이텔레콤) is a South Korean wireless telecommunications operator and is part of the SK Group, one of the country's largest chaebols. It leads the local market with 50.5 percent share as of 2008. SK Telecom is the largest wireless carrier in South Korea, with 27.019 million subscribers as of Q4 2017. (Source:Wikipedia)

Latest SKM News From Around the Web

Below are the latest news stories about SK TELECOM CO LTD that investors may wish to consider to help them evaluate SKM as an investment opportunity.

Sapeon, backed by South Korea's SK Group, launches new AI chipSapeon, an artificial intelligence (AI) chip startup backed by South Korea's telecom-to-chip conglomerate SK Group, has launched its latest chip for data centres, the company said on Thursday, joining the global race to develop AI chips with bigger rivals like Nvidia . The new Sapeon X330 chip "represents roughly twice the computational performance and 1.3 times better power efficiency" than competitors' products launched this year, the company said in a statement, without elaborating further on the competitors. The product, which supports large language models (LLMs), a type of AI software used to create services like ChatGPT, is set for mass production in the first half of next year, according to Sapeon. |

SK Telecom Co.,Ltd (NYSE:SKM) Q3 2023 Earnings Call TranscriptSK Telecom Co.,Ltd (NYSE:SKM) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Good morning and good evening. First of all, thank you all for joining this conference call. And now, we will begin the conference of the fiscal year 2023 Third Quarter Earnings Results by SK Telecom. This conference will start with a presentation […] |

SK Telecom Collaborates With Aptos and Atomrigs Lab To Enhance T Wallet Web3 ServicesSK Telecom, South Korea's largest mobile carrier, has announced a collaboration with Aptos and Atomrigs Lab to further enhance its web3 wallet service, T wallet. |

What Makes SK Telecom (SKM) a Good Fit for 'Trend Investing'SK Telecom (SKM) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move. |

Beat the Market the Zacks Way: Novo Nordisk, Lifeway Foods, Casey's in FocusOur time-tested methodologies were at work to help investors navigate the market well last week. Here are some of our key performance data from the past three months. |

SKM Price Returns

| 1-mo | 5.87% |

| 3-mo | 6.84% |

| 6-mo | 7.31% |

| 1-year | 12.74% |

| 3-year | -44.64% |

| 5-year | -28.17% |

| YTD | 4.15% |

| 2023 | 8.22% |

| 2022 | -19.85% |

| 2021 | -26.17% |

| 2020 | 6.25% |

| 2019 | -13.57% |

SKM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SKM

Want to see what other sources are saying about Sk Telecom Co Ltd's financials and stock price? Try the links below:Sk Telecom Co Ltd (SKM) Stock Price | Nasdaq

Sk Telecom Co Ltd (SKM) Stock Quote, History and News - Yahoo Finance

Sk Telecom Co Ltd (SKM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...