Solid Biosciences Inc. (SLDB): Price and Financial Metrics

SLDB Price/Volume Stats

| Current price | $9.29 | 52-week high | $15.05 |

| Prev. close | $9.05 | 52-week low | $1.81 |

| Day low | $9.12 | Volume | 251,035 |

| Day high | $9.64 | Avg. volume | 383,996 |

| 50-day MA | $7.71 | Dividend yield | N/A |

| 200-day MA | $7.36 | Market Cap | 356.54M |

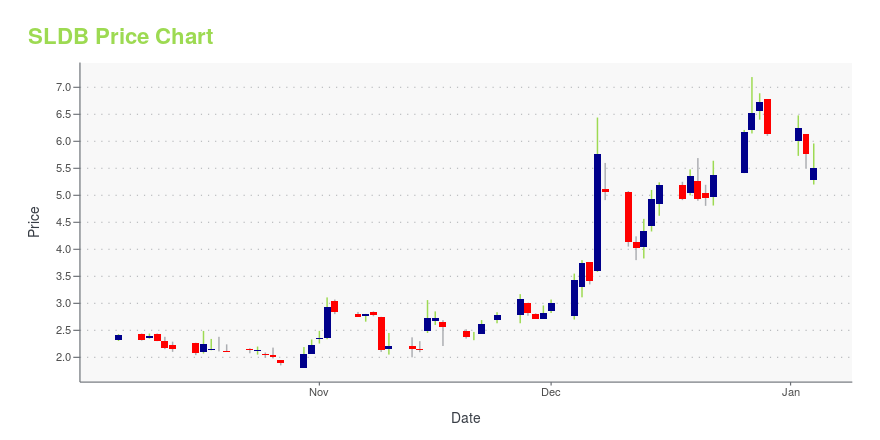

SLDB Stock Price Chart Interactive Chart >

Solid Biosciences Inc. (SLDB) Company Bio

Solid Biosciences, LLC engages in identifying and developing gene therapies for duchenne muscular dystrophy in the United States. Its lead product candidate includes SGT-001, a gene transfer candidate that is in Phase I/II clinical trial to restore functional dystrophin protein expression in patients’ muscles. The company was formerly known as Solid Ventures, LLC and changed its name to Solid Biosciences, LLC in June 2015. Solid Biosciences, LLC was founded in 2013 and is based in Cambridge, Massachusetts.

Latest SLDB News From Around the Web

Below are the latest news stories about SOLID BIOSCIENCES INC that investors may wish to consider to help them evaluate SLDB as an investment opportunity.

While institutions invested in Solid Biosciences Inc. (NASDAQ:SLDB) benefited from last week's 68% gain, private equity firms stood to gain the mostKey Insights The considerable ownership by private equity firms in Solid Biosciences indicates that they collectively... |

Solid Biosciences' (SLDB) DMD Drug Gets Fast Track Tag, Stock UpSolid Biosciences (SLDB) gains 68% as the FDA grants Fast Track designation to the company's gene therapy candidate, SGT-003, for the treatment of Duchenne muscular dystrophy. |

Solid Biosciences Receives FDA Fast Track Designation for Duchenne Muscular Dystrophy Gene Therapy SGT-003– Next-generation gene transfer therapy to treat Duchenne receives FDA Fast Track Designation – CHARLESTOWN, Mass., Dec. 07, 2023 (GLOBE NEWSWIRE) -- Solid Biosciences Inc. (Nasdaq: SLDB), a life sciences company developing precision genetic medicines for neuromuscular and cardiac diseases, today announced that it has received Fast Track Designation from the U.S. Food and Drug Administration (FDA) for SGT-003, the company’s next-generation Duchenne muscular dystrophy (Duchenne) gene therapy cand |

Solid Biosciences to Participate at 35th Annual Piper Sandler Healthcare ConferenceCHARLESTOWN, Mass., Nov. 22, 2023 (GLOBE NEWSWIRE) -- Solid Biosciences Inc. (Nasdaq: SLDB), a life sciences company developing precision genetic medicines for neuromuscular and cardiac diseases, today announced that Bo Cumbo, President and Chief Executive Officer, will present at the Piper Sandler Healthcare Conference on Thursday, November 30, 2023, at 1:00 pm ET. A live webcast of the presentation will be available on the Events page of the Investors section of the Company website or by click |

The Zacks Analyst Blog Highlights Arcellx, Bristol Myers Squibb, Solid Biosciences, Vertex Pharmaceuticals and CRISPR TherapeuticsArcellx, Bristol Myers Squibb, Solid Biosciences, Vertex Pharmaceuticals and CRISPR Therapeutics are included in this Analyst Blog. |

SLDB Price Returns

| 1-mo | 62.98% |

| 3-mo | 3.45% |

| 6-mo | 16.42% |

| 1-year | 113.56% |

| 3-year | -77.48% |

| 5-year | -89.36% |

| YTD | 51.30% |

| 2023 | 14.13% |

| 2022 | -79.50% |

| 2021 | -76.91% |

| 2020 | 70.34% |

| 2019 | -83.40% |

Loading social stream, please wait...