SomaLogic, Inc. (SLGC): Price and Financial Metrics

SLGC Price/Volume Stats

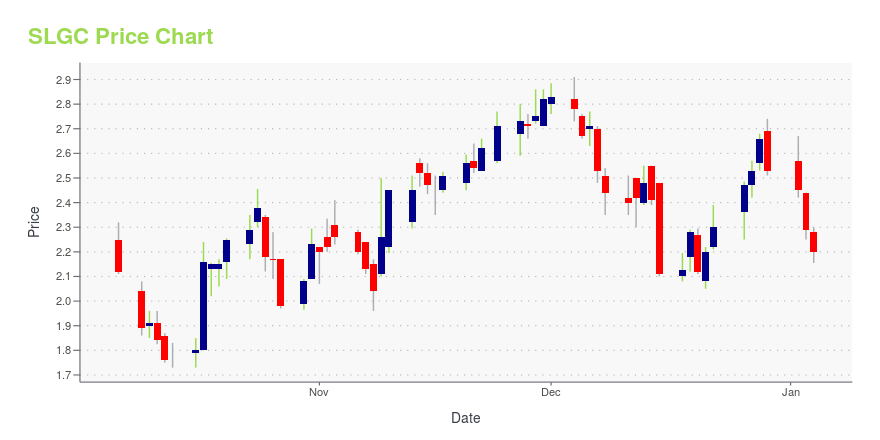

| Current price | $2.10 | 52-week high | $3.79 |

| Prev. close | $2.20 | 52-week low | $1.73 |

| Day low | $1.93 | Volume | 33,910,700 |

| Day high | $2.31 | Avg. volume | 10,825,875 |

| 50-day MA | $2.41 | Dividend yield | N/A |

| 200-day MA | $2.44 | Market Cap | 394.95M |

SLGC Stock Price Chart Interactive Chart >

SomaLogic, Inc. (SLGC) Company Bio

SomaLogic, Inc. operates as a protein biomarker discovery and clinical diagnostics company in the United States. It develops slow-offrate modified aptamers (SOMAmers), which are modified nucleic acid-based protein binding reagents that are specific for their cognate protein; and offers proprietary SomaScan services, which provide multiplex protein detection and quantification of protein levels in complex biological samples. The company's SOMAmers/SomaScan technology enables researchers to analyze various types of biological samples for protein biomarker signatures, which can be utilized in drug discovery and development. Its SomaScan's biomarker discoveries help in diagnostic applications in various areas of diseases, including cardiovascular and metabolic disease, nonalcoholic steatohepatitis, wellness, and others. The company's solutions also include SomaSignal tests, which are research use only tests for clinical trial applications. It serves research and clinical customers with a focus on pharmaceutical and biotechnology companies, and academic research institutions; and facilitates drug development, analysis of clinical trials, and new human biology insights by assessing protein-protein and protein-gene networks. The company was incorporated in 1999 and is headquartered in Boulder, Colorado.

Latest SLGC News From Around the Web

Below are the latest news stories about SOMALOGIC INC that investors may wish to consider to help them evaluate SLGC as an investment opportunity.

Dr. Larry Gold and Dr. Jason Cleveland Issue Open Letter to SomaLogic Stockholders Opposing SomaLogic's Proposed Merger with Standard BioToolsDr. Larry Gold, the founder of SomaLogic, Inc. ("SomaLogic" or the "Company") (Nasdaq: SLGC) and Dr. Jason Cleveland, SomaLogic's current Chief Technology Officer, are issuing the below letter to SomaLogic's stockholders regarding their opposition to the Company's proposed merger with Standard BioTools, Inc. ("Standard") (Nasdaq: LAB). |

SomaLogic Issues Statement Correcting Madryn Asset Management's Misleading DisclosureSomaLogic, Inc. (Nasdaq: SLGC), a leader in proteomics technology, today issued the following statement in response to a press release issued by Madryn Asset Management, LP ("Madryn") on December 26, 2023, regarding the pending merger with Standard BioTools (Nasdaq: LAB): |

Madryn Asset Management Releases Evidence That SomaLogic Ran a Flawed and Incomplete Review of AlternativesNEW YORK, December 26, 2023--Madryn Asset Management, LP (collectively with its affiliates, "Madryn" or "we"), a holder of approximately 4.2% of the outstanding common stock of SomaLogic, Inc. ("SomaLogic" or the "Company") (Nasdaq: SLGC), today disclosed that the Transaction Committee of the Company’s Board of Directors (the "Transaction Committee") did not pursue a substantive dialogue with Laboratory Corporation of America Holdings ("Labcorp") (NYSE: LH) – one of the industry’s most logical s |

Madryn Asset Management Sends Letter to ISS Respectfully Requesting it Withdraw "Cautionary Support" for SomaLogic’s Value-Destructive Proposed Merger with Standard BioToolsNEW YORK, December 24, 2023--Madryn Asset Management, LP (collectively with its affiliates, "Madryn" or "we"), a holder of approximately 4.2% of the outstanding common stock of SomaLogic, Inc. ("SomaLogic" or the "Company") (Nasdaq: SLGC), today issued the following letter to Institutional Shareholder Services, Inc. ("ISS") following ISS’ publication of a report that recommends "cautionary support" for the Company’s proposed merger (the "Proposed Merger") with Standard BioTools Inc. ("Standard B |

Madryn Asset Management Reiterates Alternative Path to SomaLogic’s Value-Destructive Proposed Merger with Standard BioToolsNEW YORK, December 23, 2023--Madryn Asset Management, LP ("Madryn Asset Management" and, collectively with its affiliates, "Madryn" or "we"), a holder of approximately 4.2% of the outstanding common stock of SomaLogic, Inc. ("SomaLogic" or the "Company") (Nasdaq: SLGC), today reiterated its view that there is a viable alternative to the proposed merger (the "Proposed Merger") with Standard BioTools Inc. (Nasdaq: LAB). Madryn issued the following statement: |

SLGC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -8.30% |

| 3-year | -81.33% |

| 5-year | N/A |

| YTD | -17.00% |

| 2023 | 0.80% |

| 2022 | -78.44% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...