SM Energy Company (SM): Price and Financial Metrics

SM Price/Volume Stats

| Current price | $45.91 | 52-week high | $53.26 |

| Prev. close | $45.60 | 52-week low | $34.13 |

| Day low | $45.29 | Volume | 1,869,400 |

| Day high | $46.34 | Avg. volume | 1,725,543 |

| 50-day MA | $46.90 | Dividend yield | 1.6% |

| 200-day MA | $43.25 | Market Cap | 5.28B |

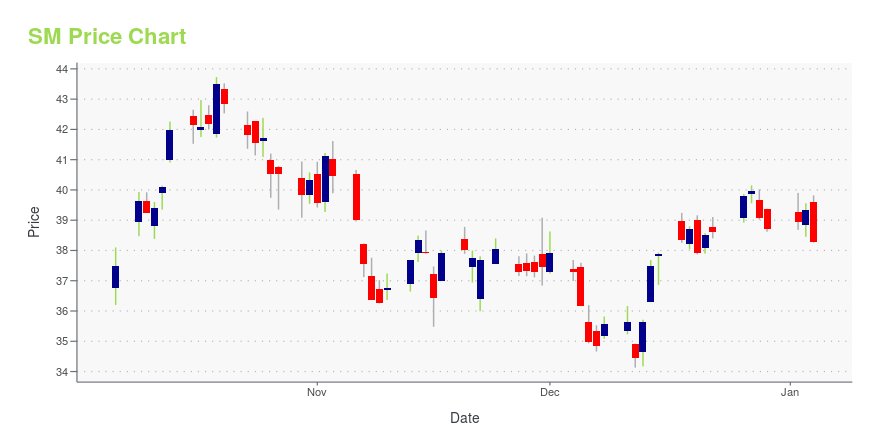

SM Stock Price Chart Interactive Chart >

SM Energy Company (SM) Company Bio

SM Energy is an independent energy company engaged in the acquisition, exploration, development, and production of crude oil, natural gas, and natural gas liquids in onshore North America. The company was founded in 1908 and is based in Denver, Colorado.

Latest SM News From Around the Web

Below are the latest news stories about SM ENERGY CO that investors may wish to consider to help them evaluate SM as an investment opportunity.

SM ENERGY DECLARES QUARTERLY CASH DIVIDENDSM Energy Company (NYSE: SM) today announces that its Board of Directors approved the increased quarterly cash dividend of $0.18 per share of common stock outstanding. The dividend will be paid on February 5, 2024, to stockholders of record as of the close of business on January 19, 2024. |

13 Cash-Rich Small Cap Stocks To Invest InIn this piece, we will take a look at the 13 cash rich small cap stocks to invest in. If you want to skip our introduction to small cap investing and the latest stock market news, then you can take a look at the 5 Cash-Rich Small Cap Stocks To Invest In. Small cap stocks […] |

Investors in SM Energy (NYSE:SM) have seen enviable returns of 843% over the past three yearsIt might be of some concern to shareholders to see the SM Energy Company ( NYSE:SM ) share price down 12% in the last... |

Forbes, Statista recognize SM as world's best employerSM Investments Corporation (SM Investments) was recognized for the fourth time, in the Forbes' World's Best Employers 2023 list in partnership with market research firm Statista. |

Zacks.com featured highlights G-III Apparel, Titan Machinery, SM Energy, Centene and AARG-III Apparel, Titan Machinery, SM Energy, Centene and AAR have been highlighted in this Screen of The Week article. |

SM Price Returns

| 1-mo | -4.82% |

| 3-mo | -9.35% |

| 6-mo | 24.37% |

| 1-year | 34.56% |

| 3-year | 160.84% |

| 5-year | 424.84% |

| YTD | 20.06% |

| 2023 | 13.14% |

| 2022 | 18.58% |

| 2021 | 382.16% |

| 2020 | -44.85% |

| 2019 | -26.72% |

SM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SM

Want to do more research on SM Energy Co's stock and its price? Try the links below:SM Energy Co (SM) Stock Price | Nasdaq

SM Energy Co (SM) Stock Quote, History and News - Yahoo Finance

SM Energy Co (SM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...