Sumitomo Mitsui Financial Group Inc. ADR (SMFG): Price and Financial Metrics

SMFG Price/Volume Stats

| Current price | $14.45 | 52-week high | $16.74 |

| Prev. close | $14.70 | 52-week low | $10.74 |

| Day low | $14.44 | Volume | 1,747,863 |

| Day high | $14.61 | Avg. volume | 1,814,617 |

| 50-day MA | $14.88 | Dividend yield | 0.74% |

| 200-day MA | $14.42 | Market Cap | 93.29B |

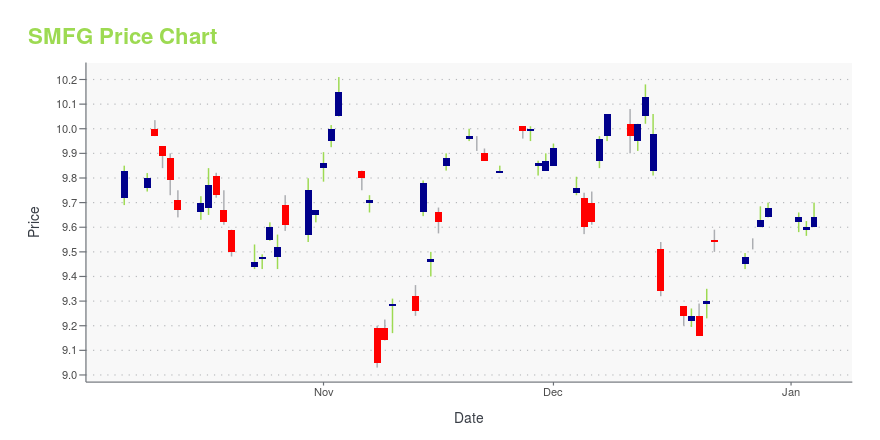

SMFG Stock Price Chart Interactive Chart >

Sumitomo Mitsui Financial Group Inc. ADR (SMFG) Company Bio

Sumitomo Mitsui Banking Corporation Group (SMBC Group; 株式会社三井住友銀行, Kabushiki-gaisha Mitsui Sumitomo Ginkō) is a Japanese multinational banking and financial services institution headquartered in Yurakucho, Chiyoda, Tokyo, Japan. The group operates in retail, corporate, and investment banking segment worldwide. It provides financial products and services to a wide range of clients, including individuals, small and medium-sized enterprises, large corporations, financial institutions and public sector entities. Since 2011, it has been included into the Financial Stability Board's list of global systemically important banks. (Source:Wikipedia)

SMFG Price Returns

| 1-mo | -4.05% |

| 3-mo | 6.56% |

| 6-mo | -1.63% |

| 1-year | 5.43% |

| 3-year | 160.68% |

| 5-year | 187.11% |

| YTD | -0.28% |

| 2024 | 52.68% |

| 2023 | 22.45% |

| 2022 | 21.08% |

| 2021 | 14.97% |

| 2020 | -14.60% |

SMFG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SMFG

Want to see what other sources are saying about Sumitomo Mitsui Financial Group Inc's financials and stock price? Try the links below:Sumitomo Mitsui Financial Group Inc (SMFG) Stock Price | Nasdaq

Sumitomo Mitsui Financial Group Inc (SMFG) Stock Quote, History and News - Yahoo Finance

Sumitomo Mitsui Financial Group Inc (SMFG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...