Sumitomo Mitsui Financial Group Inc. ADR (SMFG): Price and Financial Metrics

SMFG Price/Volume Stats

| Current price | $13.88 | 52-week high | $14.35 |

| Prev. close | $13.64 | 52-week low | $8.55 |

| Day low | $13.74 | Volume | 699,900 |

| Day high | $13.91 | Avg. volume | 1,144,049 |

| 50-day MA | $13.18 | Dividend yield | 1.88% |

| 200-day MA | $11.16 | Market Cap | 91.43B |

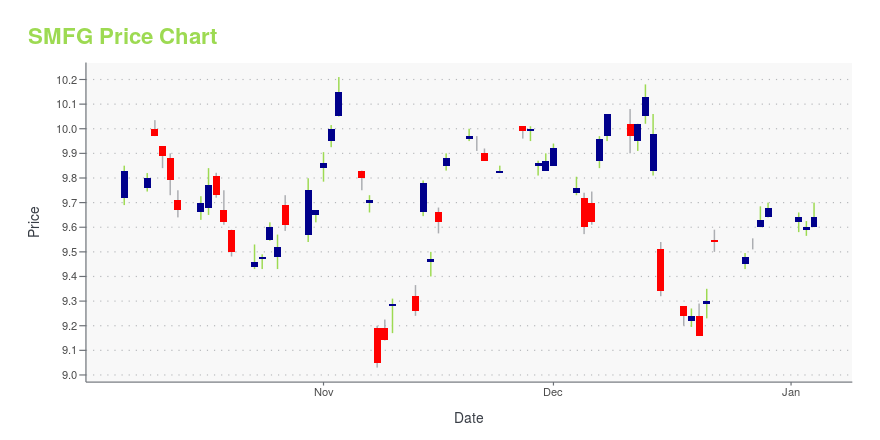

SMFG Stock Price Chart Interactive Chart >

Sumitomo Mitsui Financial Group Inc. ADR (SMFG) Company Bio

Sumitomo Mitsui Banking Corporation Group (SMBC Group; 株式会社三井住友銀行, Kabushiki-gaisha Mitsui Sumitomo Ginkō) is a Japanese multinational banking and financial services institution headquartered in Yurakucho, Chiyoda, Tokyo, Japan. The group operates in retail, corporate, and investment banking segment worldwide. It provides financial products and services to a wide range of clients, including individuals, small and medium-sized enterprises, large corporations, financial institutions and public sector entities. Since 2011, it has been included into the Financial Stability Board's list of global systemically important banks. (Source:Wikipedia)

Latest SMFG News From Around the Web

Below are the latest news stories about SUMITOMO MITSUI FINANCIAL GROUP INC that investors may wish to consider to help them evaluate SMFG as an investment opportunity.

Japan banks scramble to beef up asset management business amid govt reform pushTOKYO (Reuters) -The Japanese government's reform push for the country's $5 trillion asset management industry has sparked a series of action plans from top Japanese banking groups to beef up their long overlooked asset management business. Asset management has emerged as an area of focus for the banks this year as the financial regulator sought their help to shake up the industry in line with Japan's policy pledge to turn dormant household savings into investments. "We aim to build up the asset management business as the group's fourth pillar after banking, trust banking and brokerages," Mitsubishi UFJ Financial Group's chief executive Hironori Kamezawa told Reuters in an interview. |

REFILE-Japan banks scramble to beef up asset management business amid govt reform pushThe Japanese government's reform push for the country's $5 trillion asset management industry has sparked a series of action plans from top Japanese banking groups to beef up their long overlooked asset management business. Asset management has emerged as an area of focus for the banks this year as the financial regulator sought their help to shake up the industry in line with Japan's policy pledge to turn dormant household savings into investments. "We aim to build up the asset management business as the group's fourth pillar after banking, trust banking and brokerages," Mitsubishi UFJ Financial Group's chief executive Hironori Kamezawa told Reuters in an interview. |

10 Large-Cap Stocks Billionaires Like the LeastIn this article, we will take a look at the 10 large-cap stocks billionaires like the least. To skip our analysis of the recent market trends and activity, you can go directly to see the 5 Large-Cap Stocks Billionaires Like the Least. Stock markets in the United States have been on an upward trajectory for […] |

Manufacturers Bank Rebrands as SMBC MANUBANKLOS ANGELES, December 05, 2023--Manufacturers Bank, a wholly owned subsidiary of SMBC Americas Holdings, Inc., a member of SMBC Group, announced today that it has changed its name to SMBC MANUBANK. The new name reflects the bank’s strategic vision to transform and expand its commercial banking business, compete in the digital consumer bank space, and further align with SMBC Group. |

Sumitomo Mitsui Taps Nakashima as CEO Following Ohta’s Death(Bloomberg) -- Sumitomo Mitsui Financial Group Inc. named Toru Nakashima as chief executive officer, turning to an experienced insider to lead Japan’s second-largest bank following the death of his predecessor. Most Read from BloombergSaudi Arabia Offers Iran Investment to Blunt Gaza WarThese Are the World's Most Expensive Cities to Live In Right NowBiggest Blowout in Bonds Since the 1980s Sparks Everything RallyKissinger, Diplomat Who Defined US Foreign Policy, Dies at 100Charlie Munger, Who He |

SMFG Price Returns

| 1-mo | 6.93% |

| 3-mo | 23.71% |

| 6-mo | 37.15% |

| 1-year | 53.73% |

| 3-year | 117.48% |

| 5-year | 124.83% |

| YTD | 43.39% |

| 2023 | 22.45% |

| 2022 | 21.08% |

| 2021 | 14.97% |

| 2020 | -14.60% |

| 2019 | 15.99% |

SMFG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SMFG

Want to see what other sources are saying about Sumitomo Mitsui Financial Group Inc's financials and stock price? Try the links below:Sumitomo Mitsui Financial Group Inc (SMFG) Stock Price | Nasdaq

Sumitomo Mitsui Financial Group Inc (SMFG) Stock Quote, History and News - Yahoo Finance

Sumitomo Mitsui Financial Group Inc (SMFG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...