The Simply Good Foods Company (SMPL): Price and Financial Metrics

SMPL Price/Volume Stats

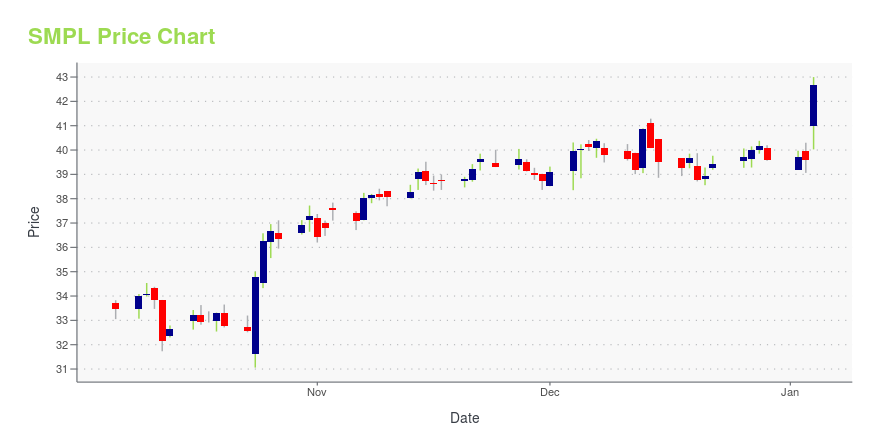

| Current price | $33.77 | 52-week high | $43.00 |

| Prev. close | $33.16 | 52-week low | $30.00 |

| Day low | $33.35 | Volume | 1,160,660 |

| Day high | $33.96 | Avg. volume | 889,830 |

| 50-day MA | $36.50 | Dividend yield | N/A |

| 200-day MA | $36.64 | Market Cap | 3.38B |

SMPL Stock Price Chart Interactive Chart >

The Simply Good Foods Company (SMPL) Company Bio

The Simply Good Foods Company develops, markets, and sells branded nutritional foods and snack products in the United States and internationally. Its products portfolio primarily consists of nutrition bars, ready-to-drink shakes, snacks, and confectionery products. The company markets its products under the Atkins, SimplyProtein, Atkins Endulge, and Atkins Harvest Trail brand names. The company is based in Greenwich, Connecticut.

Latest SMPL News From Around the Web

Below are the latest news stories about SIMPLY GOOD FOODS CO that investors may wish to consider to help them evaluate SMPL as an investment opportunity.

Fast-Growing Lamb Weston Highlights Latest Earnings Calendar, Along With RPM, Simply Good FoodsThe first earnings calendar in 2024 has a few interesting names on the docket, including Lamb Weston and top performer RPM. |

Simply Good Foods To Report First Quarter Fiscal Year 2024 Financial Results On Thursday, January 4, 2024DENVER, Dec. 14, 2023 (GLOBE NEWSWIRE) -- The Simply Good Foods Company (NASDAQ: SMPL) (“Simply Good Foods” or the “Company”), a developer, marketer and seller of branded nutritional foods and snacking products, today announced it will report financial results for the 13 week fiscal first quarter ended November 25, 2023, on Thursday, January 4, 2024, before market open. The Company will host a conference call to discuss these results with additional comments and details provided at that time. Pa |

Insider Sell: Director Brian Ratzan Sells 8,180 Shares of The Simply Good Foods Co (SMPL)Director Brian Ratzan of The Simply Good Foods Co has recently made a significant stock transaction, selling 8,180 shares of the company on December 7, 2023. |

Insider Sell: Director Brian Ratzan Sells 141,562 Shares of The Simply Good Foods Co (SMPL)In a notable insider transaction, Director Brian Ratzan sold 141,562 shares of The Simply Good Foods Co (NASDAQ:SMPL) on December 6, 2023. |

Will Simply Good Foods (SMPL) Beat Estimates Again in Its Next Earnings Report?Simply Good Foods (SMPL) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report. |

SMPL Price Returns

| 1-mo | -6.61% |

| 3-mo | -1.83% |

| 6-mo | -12.33% |

| 1-year | -8.85% |

| 3-year | -8.85% |

| 5-year | 22.53% |

| YTD | -14.72% |

| 2023 | 4.13% |

| 2022 | -8.52% |

| 2021 | 32.56% |

| 2020 | 9.88% |

| 2019 | 51.01% |

Continue Researching SMPL

Want to see what other sources are saying about Simply Good Foods Co's financials and stock price? Try the links below:Simply Good Foods Co (SMPL) Stock Price | Nasdaq

Simply Good Foods Co (SMPL) Stock Quote, History and News - Yahoo Finance

Simply Good Foods Co (SMPL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...