Snap Inc. (SNAP): Price and Financial Metrics

SNAP Price/Volume Stats

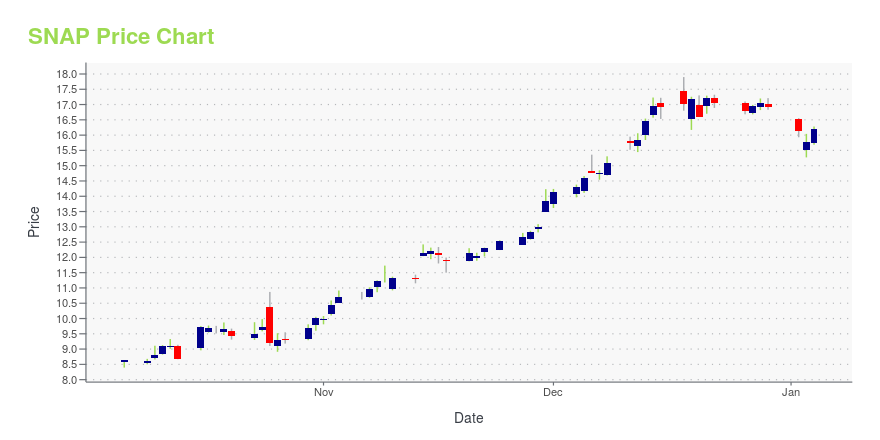

| Current price | $13.33 | 52-week high | $17.90 |

| Prev. close | $13.45 | 52-week low | $8.28 |

| Day low | $13.25 | Volume | 18,301,700 |

| Day high | $13.72 | Avg. volume | 27,157,768 |

| 50-day MA | $15.57 | Dividend yield | N/A |

| 200-day MA | $13.67 | Market Cap | 21.88B |

SNAP Stock Price Chart Interactive Chart >

Snap Inc. (SNAP) Company Bio

Snap Inc. operates as a camera company. It offers Snapchat, a camera application that helps people to communicate through short videos and images. The company also provides a suite of content tools for partners to build, edit, and publish snaps and attachments based on editorial content; and Spectacles, which are sunglasses that capture video from a human perspective. The company was formerly known as Snapchat, Inc. and changed its name to Snap Inc. in September 2016. Snap Inc. was founded in 2010 and is headquartered in Venice, California.

Latest SNAP News From Around the Web

Below are the latest news stories about SNAP INC that investors may wish to consider to help them evaluate SNAP as an investment opportunity.

Is it Time to Buy Social Media Stocks Going into 2024?An abundance of tech companies are showing signs of increased profitability amid easing inflation and investors might be wondering if Meta Platforms (META) and other social media operators will continue to benefit as well. |

Those who invested in Snap (NYSE:SNAP) five years ago are up 209%The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

15 Prominent NYSE Stocks That Hit 52-Week Highs This WeekIn this article, we will take a look at the 15 prominent NYSE stocks that hit 52-week highs this week. To skip our analysis of the recent trends, and market activity, you can go directly to see the 5 Prominent NYSE Stocks That Hit 52-Week Highs This Week. The Wall Street ended another week in […] |

Snap Has a Brand New $300 Million Annual Business, and It's Already Grown 40% Since SeptemberThis is something that could radically change the business. |

The most searched companies of 2023Google search data revealed people's interest in a smelly water bottle, Tesla Cybertrucks, spots, and discounted clothes. |

SNAP Price Returns

| 1-mo | -20.51% |

| 3-mo | -8.38% |

| 6-mo | -17.97% |

| 1-year | 29.04% |

| 3-year | -81.98% |

| 5-year | -25.49% |

| YTD | -21.26% |

| 2023 | 89.16% |

| 2022 | -80.97% |

| 2021 | -6.07% |

| 2020 | 206.61% |

| 2019 | 196.37% |

Continue Researching SNAP

Here are a few links from around the web to help you further your research on Snap Inc's stock as an investment opportunity:Snap Inc (SNAP) Stock Price | Nasdaq

Snap Inc (SNAP) Stock Quote, History and News - Yahoo Finance

Snap Inc (SNAP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...