Stryve Foods, Inc. (SNAX): Price and Financial Metrics

SNAX Price/Volume Stats

| Current price | $1.95 | 52-week high | $5.16 |

| Prev. close | $1.93 | 52-week low | $1.04 |

| Day low | $1.64 | Volume | 53,400 |

| Day high | $2.30 | Avg. volume | 32,351 |

| 50-day MA | $1.92 | Dividend yield | N/A |

| 200-day MA | $1.94 | Market Cap | 6.40M |

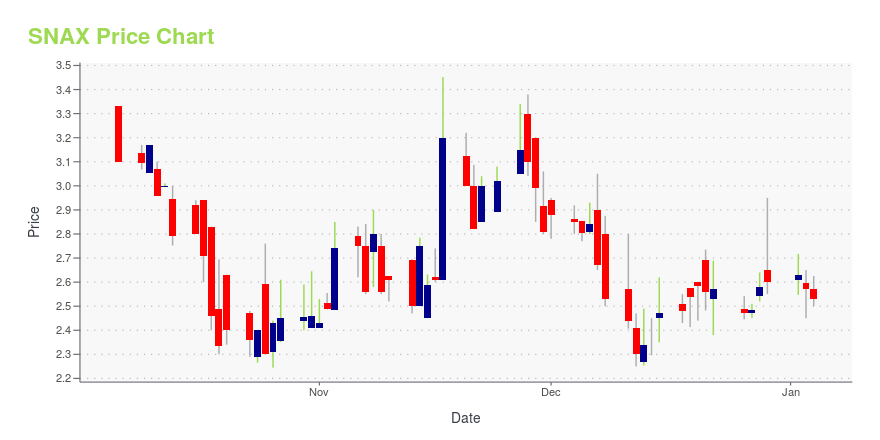

SNAX Stock Price Chart Interactive Chart >

Stryve Foods, Inc. (SNAX) Company Bio

Stryve Foods, Inc. manufactures, markets, and sells snacking products. Its product portfolio consists primarily of air-dried meat snack products marketed under the Stryve, Kalahari, Braaitime, and Vacadillos brand names. The company is headquartered in Plano, Texas.

Latest SNAX News From Around the Web

Below are the latest news stories about STRYVE FOODS INC that investors may wish to consider to help them evaluate SNAX as an investment opportunity.

Stryve Foods Announces Strategic Partnership with Acosta Group to Drive Retail Sales and Distribution GrowthPLANO, Texas, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Stryve Foods, Inc. (“Stryve” or “the Company”) (NASDAQ: SNAX), a pioneer in healthy protein snacks, is excited to announce a strategic partnership with Acosta Group (“Acosta”), a prominent sales and marketing agency. The collaboration brings together the expertise and market reach of both companies, with a shared commitment to delivering high-quality products to consumers across the nation. Chris Boever, CEO of Stryve, expressed enthusiasm about th |

Stryve Foods Announces Major Distribution Expansion into Leading Retailers Across the United StatesPLANO, Texas, Nov. 28, 2023 (GLOBE NEWSWIRE) -- Stryve Foods, Inc. (“Stryve” or “the Company”) (NASDAQ: SNAX), a pioneer in healthy protein snacks, is thrilled to announce its strategic distribution expansion into several prominent retail chains, solidifying its presence in key markets. The company's innovative and protein-packed snacks will now be available at Southeastern Grocers, Cub Foods, Lunds/Byerly's, Fresh Thyme, Lowes Foods, AAFES, Holiday Oil, Timewise, Family Express, and Dash In. Th |

Stryve Expands Distribution of Vacadillos, Now Available Nationwide at Albertsons Companies Inc. StoresPLANO, Texas, Nov. 20, 2023 (GLOBE NEWSWIRE) -- Stryve Foods, Inc. (“Stryve” or “the Company”) (NASDAQ: SNAX), an emerging healthy snack and eating platform disrupting traditional consumer packaged goods (CPG) categories, and a leader in the air-dried meat snack industry in the United States, is thrilled to announce the nationwide distribution of its popular Vacadillos brand at Albertsons Companies, Inc. (“Albertsons”) stores. This strategic expansion brings the bold flavors and nutritional bene |

Many Still Looking Away From Stryve Foods, Inc. (NASDAQ:SNAX)Stryve Foods, Inc.'s ( NASDAQ:SNAX ) price-to-sales (or "P/S") ratio of 0.2x may look like a pretty appealing... |

Stryve Foods, Inc. Reports Third Quarter Fiscal 2023 ResultsImproved Adj. EBITDA Loss by 35.0% Year-over-YearRetail Dollar Sales Growth of 21.0% Year-over-Year in Measured Channels146.8% Year-over-Year Reduction in YTD Operating Expenses Shows Transformation Progress PLANO, Texas, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Stryve Foods, Inc. (“Stryve” or “the Company”) (NASDAQ: SNAX), an emerging healthy snack and eating platform disrupting traditional consumer packaged goods (CPG) categories, and a leader in the air-dried meat snack industry in the United States |

SNAX Price Returns

| 1-mo | 9.55% |

| 3-mo | 43.38% |

| 6-mo | 31.76% |

| 1-year | -55.58% |

| 3-year | -98.40% |

| 5-year | -98.69% |

| YTD | -25.00% |

| 2023 | -76.21% |

| 2022 | -81.55% |

| 2021 | -62.95% |

| 2020 | 5.02% |

| 2019 | N/A |

Loading social stream, please wait...