Sundial Growers Inc. (SNDL): Price and Financial Metrics

SNDL Price/Volume Stats

| Current price | $2.24 | 52-week high | $2.93 |

| Prev. close | $2.13 | 52-week low | $1.30 |

| Day low | $2.18 | Volume | 2,236,300 |

| Day high | $2.25 | Avg. volume | 4,694,608 |

| 50-day MA | $2.11 | Dividend yield | N/A |

| 200-day MA | $1.74 | Market Cap | 371.88M |

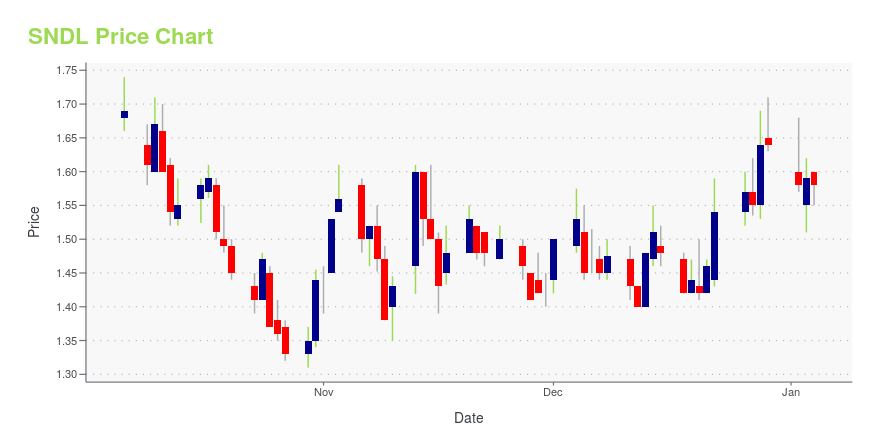

SNDL Stock Price Chart Interactive Chart >

Sundial Growers Inc. (SNDL) Company Bio

Sundial Growers, Inc. produces, distributes, and sells cannabis. It intends to target the premium segment of the adult-use cannabis market. The company was founded by Stanley J. Swiatek and is headquartered in Calgary, Canada.

Latest SNDL News From Around the Web

Below are the latest news stories about SNDL INC that investors may wish to consider to help them evaluate SNDL as an investment opportunity.

Is SNDL Stock's Turnaround Finally Here?After a period of major diversification, the stock looks increasingly ready to run. |

SNDL Inc.'s (NASDAQ:SNDL) Shift From Loss To ProfitWith the business potentially at an important milestone, we thought we'd take a closer look at SNDL Inc.'s... |

Is SNDL Stock a Buy After Hitting This Significant Milestone?SNDL (NASDAQ: SNDL) has been transforming its business in recent years. Most recently, the company also hit a significant milestone, by reporting positive free cash flow. Has the stock become a better buy after its latest quarter, and is it worth investing in today, or should investors remain cautious on SNDL? |

SNDL and Nova Cannabis Remain Committed to Partnership Following the Termination of the Implementation AgreementSNDL Inc. (Nasdaq: SNDL) ("SNDL") and Nova Cannabis Inc. (TSX: NOVC) ("Nova") today announced the mutual decision to terminate the implementation agreement, dated December 20, 2022, as amended (the "Implementation Agreement"), concerning their previously-announced strategic partnership (the "Transaction"). SNDL and Nova reaffirm their strong commitment to their ongoing partnership under the management and administrative services agreement. |

Sundial (SNDL) Stock Ticks Up 3% On Cash Flow, Share BuybackSNDL stock is up slightly higher on Monday morning after it reported positive free cash flow and a share repurchase extension. |

SNDL Price Returns

| 1-mo | 16.67% |

| 3-mo | 11.44% |

| 6-mo | 58.87% |

| 1-year | 45.45% |

| 3-year | -73.65% |

| 5-year | N/A |

| YTD | 36.59% |

| 2023 | -21.53% |

| 2022 | -63.86% |

| 2021 | 22.13% |

| 2020 | -84.27% |

| 2019 | N/A |

Loading social stream, please wait...