SenesTech, Inc. (SNES): Price and Financial Metrics

SNES Price/Volume Stats

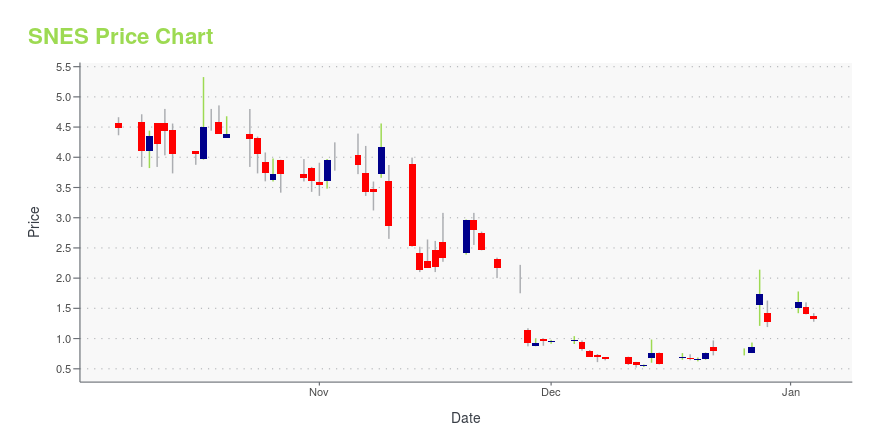

| Current price | $4.57 | 52-week high | $115.20 |

| Prev. close | $4.83 | 52-week low | $4.00 |

| Day low | $4.27 | Volume | 32,115 |

| Day high | $4.83 | Avg. volume | 29,961 |

| 50-day MA | $6.22 | Dividend yield | N/A |

| 200-day MA | $12.50 | Market Cap | 23.51M |

SNES Stock Price Chart Interactive Chart >

SenesTech, Inc. (SNES) Company Bio

SenesTech, Inc. develops a technology for managing animal pest populations through fertility control. It develops a pipeline of fertility control and animal health products, such as ContraPest, plant-based fertility control, feral animal fertility control, non-surgical spay and neutering, boar taint, and animal cancer treatment. The company was founded in 2004 and is based in Flagstaff, Arizona.

Latest SNES News From Around the Web

Below are the latest news stories about SENESTECH INC that investors may wish to consider to help them evaluate SNES as an investment opportunity.

SenesTech (SNES) Likely to Expand Into China With New DealThis partnership provides SenesTech (SNES) with a gateway into one of the largest pest control markets globally, with the support and expertise of Fruit Tree. |

SenesTech Announces Exclusive Distribution Agreement and Initial Order for Evolve™ Soft Bait in Hong Kong and MacauSenesTech, Inc. (Nasdaq: SNES; "SenesTech" or the "Company"), the leader in fertility control to manage animal pest populations, today announces entry into a Distribution Agreement with Fruit Tree Limited, a pest control service provider, manufacturer and distributor headquartered in Hong Kong. |

SenesTech Receives Substantial Orders for EVOLVE Soft BaitSenesTech, Inc. (Nasdaq: SNES; "SenesTech" or the "Company"), the leader in fertility control to manage animal pest populations, today announces the expansion of Evolve™ Soft Bait ("Evolve") with substantial initial orders. Initially launched in November 2023, Evolve is the first and only soft bait product featuring technology that targets rodent populations by using non-lethal methods to restrict fertility. |

IBN Announces Latest Episode of The Stock2Me Podcast featuring Joel Fruendt, President & CEO of SenesTech Inc.LOS ANGELES, Dec. 05, 2023 (GLOBE NEWSWIRE) -- via IBN -- IBN, a multifaceted communications organization engaged in connecting public companies to the investment community, is pleased to announce the release of the latest episode of The Stock2Me Podcast as part of its sustained effort to provide specialized content distribution via widespread syndication channels. The Stock2Me Podcast features a fascinating array of companies and individuals, many of whom are actively revolutionizing age-old bu |

SenesTech's ContraPest® Registered for Use in Puerto Rico to Combat Rat InfestationsSenesTech, Inc. (NASDAQ: SNES, "SenesTech" or the "Company"), (www.senestech.com) the leader in fertility control to manage animal pest populations, today announces its ContraPest® products have been registered for sale and immediate use in Puerto Rico. ContraPest is the first and only EPA-registered rat contraceptive impacting both male and female rats and fits seamlessly into all integrated pest management programs, significantly improving the overall goal of effective pest management. |

SNES Price Returns

| 1-mo | -27.40% |

| 3-mo | -37.27% |

| 6-mo | -41.49% |

| 1-year | -99.67% |

| 3-year | -99.99% |

| 5-year | -100.00% |

| YTD | -64.02% |

| 2023 | -99.71% |

| 2022 | -84.22% |

| 2021 | -43.26% |

| 2020 | -84.32% |

| 2019 | -5.98% |

Continue Researching SNES

Want to see what other sources are saying about SenesTech Inc's financials and stock price? Try the links below:SenesTech Inc (SNES) Stock Price | Nasdaq

SenesTech Inc (SNES) Stock Quote, History and News - Yahoo Finance

SenesTech Inc (SNES) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...