Soligenix, Inc. (SNGX): Price and Financial Metrics

SNGX Price/Volume Stats

| Current price | $4.53 | 52-week high | $32.00 |

| Prev. close | $4.45 | 52-week low | $1.83 |

| Day low | $4.22 | Volume | 213,715 |

| Day high | $4.70 | Avg. volume | 1,236,567 |

| 50-day MA | $4.80 | Dividend yield | N/A |

| 200-day MA | $8.22 | Market Cap | 4.47M |

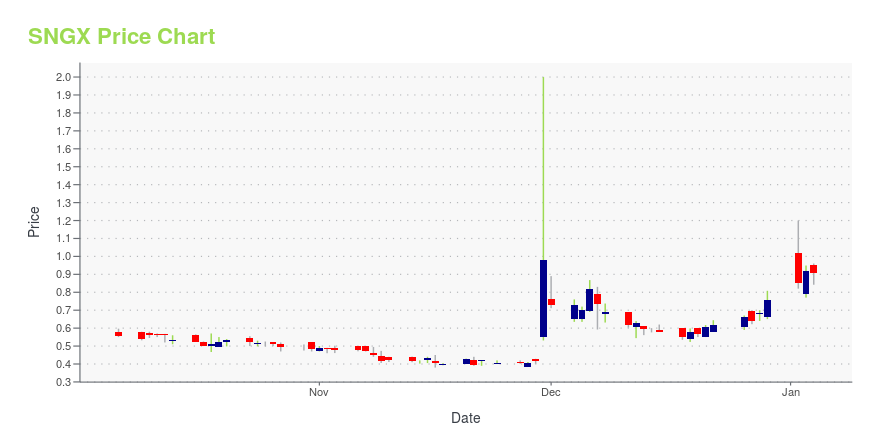

SNGX Stock Price Chart Interactive Chart >

Soligenix, Inc. (SNGX) Company Bio

Soligenix, Inc. develops therapeutics and vaccines. The Company researches treatments for gastrointestinal Graft-versus-Host disease and cancer, and develops vaccines for military and civilian applications.

Latest SNGX News From Around the Web

Below are the latest news stories about SOLIGENIX INC that investors may wish to consider to help them evaluate SNGX as an investment opportunity.

Here's Why We Think Soligenix, Inc.'s (NASDAQ:SNGX) CEO Compensation Looks FairKey Insights Soligenix will host its Annual General Meeting on 15th of December Total pay for CEO Christopher Schaber... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's the final day of trading this week and we're starting it with a breakdown of the biggest pre-market stock movers on Friday morning! |

"HyBryte™ Use in Early-Stage Cutaneous T-Cell Lymphoma" Published in Frontiers in Drug DiscoverySoligenix, Inc. (Nasdaq: SNGX) (Soligenix or the Company), a late-stage biopharmaceutical company focused on developing and commercializing products to treat rare diseases where there is an unmet medical need, announced today that an article describing the potential use of HyBryte™ in the treatment of cutaneous T-cell lymphoma (CTCL) has been published in Frontiers in Drug Discovery. The mini-review summarizes findings about the use, mechanism and effectiveness of HyBryte™ in the treatment of CT |

Jefferies Is Pounding the Table on Snap (SNAP) StockSnap stock is heading higher on Thursday after the social media company's shares were upgraded to a 'buy' rating by Jefferies analysts. |

TSLA Stock Alert: The Tesla Cybertruck Launches TodayTesla stock is on the move Thursday as investors in TSLA shares prepare for the official Cybertruck launch event taking place today! |

SNGX Price Returns

| 1-mo | 65.93% |

| 3-mo | -31.78% |

| 6-mo | -53.58% |

| 1-year | -55.06% |

| 3-year | -98.07% |

| 5-year | -98.22% |

| YTD | -62.61% |

| 2023 | -88.83% |

| 2022 | -31.55% |

| 2021 | -48.41% |

| 2020 | -11.72% |

| 2019 | 68.60% |

Continue Researching SNGX

Want to see what other sources are saying about Soligenix Inc's financials and stock price? Try the links below:Soligenix Inc (SNGX) Stock Price | Nasdaq

Soligenix Inc (SNGX) Stock Quote, History and News - Yahoo Finance

Soligenix Inc (SNGX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...