Snap One Holdings Corp. (SNPO): Price and Financial Metrics

SNPO Price/Volume Stats

| Current price | $10.75 | 52-week high | $12.06 |

| Prev. close | $10.74 | 52-week low | $6.70 |

| Day low | $10.74 | Volume | 911,000 |

| Day high | $10.76 | Avg. volume | 277,950 |

| 50-day MA | $10.42 | Dividend yield | N/A |

| 200-day MA | $8.87 | Market Cap | 822.76M |

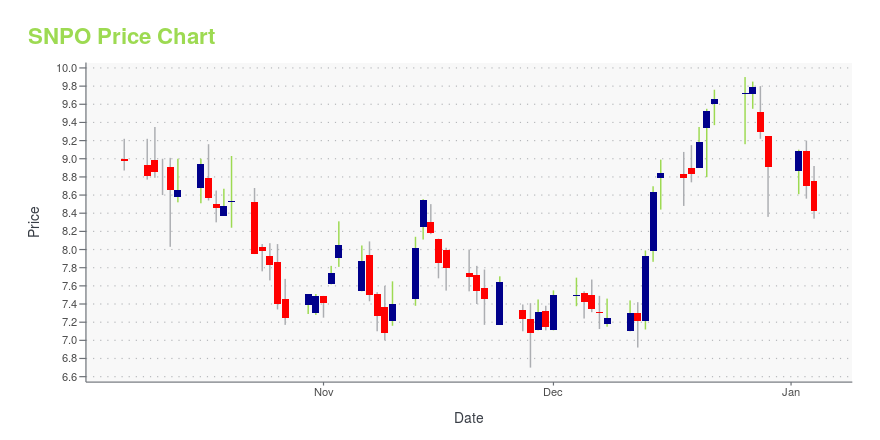

SNPO Stock Price Chart Interactive Chart >

Snap One Holdings Corp. (SNPO) Company Bio

Snap One Holdings Corp. provides smart living solutions in the United States and internationally. It offers connected products, including networking, control and lighting, surveillance, and IP-enabled power products; and entertainment products for indoor and outdoor solutions, such as media distribution products, as well as audio and video products comprising sound systems, amplifiers, televisions, projectors, and optimized screens. The company also provides infrastructure products, which include structured wiring and cable products, racks, and mounts; and software solutions consisting of OvrC and Control4 OS3 software solutions, and Parasol and 4Sight subscription-based services. It sells its through integrators and distributors, as well as through e-commerce portal. The company was formerly known as Crackle Intermediate Corp. and changed its name to Snap One Holdings Corp. in March 2021. The company was incorporated in 2017 and is headquartered in Charlotte, North Carolina. Snap One Holdings Corp. is a subsidiary of Crackle Holdings, L.P.

Latest SNPO News From Around the Web

Below are the latest news stories about SNAP ONE HOLDINGS CORP that investors may wish to consider to help them evaluate SNPO as an investment opportunity.

At US$7.30, Is It Time To Put Snap One Holdings Corp. (NASDAQ:SNPO) On Your Watch List?While Snap One Holdings Corp. ( NASDAQ:SNPO ) might not be the most widely known stock at the moment, it saw... |

Calculating The Intrinsic Value Of Snap One Holdings Corp. (NASDAQ:SNPO)Key Insights Snap One Holdings' estimated fair value is US$8.33 based on 2 Stage Free Cash Flow to Equity With US$7.64... |

Snap One Holdings Corp. (NASDAQ:SNPO) Q3 2023 Earnings Call TranscriptSnap One Holdings Corp. (NASDAQ:SNPO) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Good afternoon, and welcome to Snap One Holdings Corp.’s Fiscal Third Quarter 2023 Earnings Conference Call. [Operator Instructions] I would now like to turn the call over to Snap-on’s Senior Vice President of Finance, Eric Steele. Sir, please proceed. Eric Steele: […] |

Q3 2023 Snap One Holdings Corp Earnings CallQ3 2023 Snap One Holdings Corp Earnings Call |

Snap One Holdings Corp. (SNPO) Q3 Earnings and Revenues Lag EstimatesSnap One Holdings Corp. (SNPO) delivered earnings and revenue surprises of -6.25% and 3.14%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

SNPO Price Returns

| 1-mo | N/A |

| 3-mo | 1.61% |

| 6-mo | 27.22% |

| 1-year | 10.71% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 20.65% |

| 2023 | 20.24% |

| 2022 | -64.85% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...