Sonendo, Inc. (SONX): Price and Financial Metrics

SONX Price/Volume Stats

| Current price | $0.08 | 52-week high | $1.47 |

| Prev. close | $0.07 | 52-week low | $0.05 |

| Day low | $0.07 | Volume | 17,000 |

| Day high | $0.08 | Avg. volume | 295,094 |

| 50-day MA | $0.08 | Dividend yield | N/A |

| 200-day MA | $0.15 | Market Cap | 5.39M |

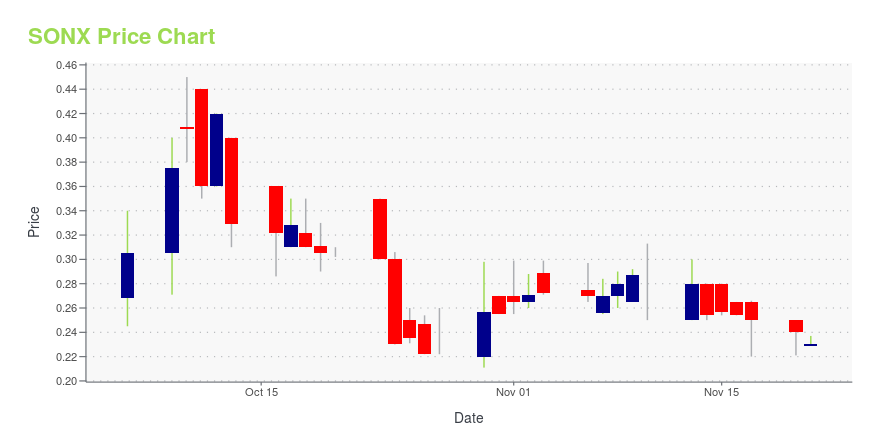

SONX Stock Price Chart Interactive Chart >

Sonendo, Inc. (SONX) Company Bio

Sonendo, Inc., a commercial-stage medical technology company, develops, manufactures, and commercializes devices for root canal therapy in the United States and Canada. It provides GentleWave, a tooth decay treatment device for cleaning and disinfecting the microscopic spaces within teeth without the need to remove tooth structure. The company also offers SoundSeal, a material used to build and create a sealing platform on the top of the crown; and Sonendo-branded liquid solution of ethylenediaminetetraacetic acid that is used to help debride and disinfect the root canal system. In addition, it provides The Digital Office, a practice management software that integrates digital office for dental practitioners. The company was formerly known as Dentatek Corporation and changed its name to Sonendo, Inc. in March 2011. Sonendo, Inc. was incorporated in 2006 and is headquartered in Laguna Hills, California.

Latest SONX News From Around the Web

Below are the latest news stories about SONENDO INC that investors may wish to consider to help them evaluate SONX as an investment opportunity.

ArrowMark Colorado Holdings LLC Reduces Stake in Sonendo IncArrowMark Colorado Holdings LLC (Trades, Portfolio) has recently adjusted its investment portfolio by reducing its stake in Sonendo Inc (NYSE:SONX). On October 31, 2023, the firm sold 3,887,500 shares of Sonendo Inc, resulting in a 65.27% decrease in its holdings. Post-trade, ArrowMark Colorado Holdings LLC (Trades, Portfolio) now holds 2,068,411 shares in Sonendo Inc, which represents a 3.93% stake in the company and a 0.01% position in the firm's portfolio. |

Sidoti Events, LLC’s Virtual November Micro-Cap ConferenceNEW YORK, NY / ACCESSWIRE / November 14, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day November Micro-Cap Conference taking place Wednesday and Thursday, November ... |

Sonendo, Inc. (NYSE:SONX) Q3 2023 Earnings Call TranscriptSonendo, Inc. (NYSE:SONX) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Hello, and welcome to Sonendo’s Third Quarter Earnings Conference Call. At this time, all participants are in a listen-only mode. We will be facilitating a question-and-answer session at the end of the today’s call. As a reminder, this call is being recorded for […] |

Need To Know: The Consensus Just Cut Its Sonendo, Inc. (NYSE:SONX) Estimates For 2024Today is shaping up negative for Sonendo, Inc. ( NYSE:SONX ) shareholders, with the analysts delivering a substantial... |

Sonendo Inc (SONX) Reports Modest Revenue Growth Amidst Economic ChallengesThird Quarter 2023 Financial Results Overview |

SONX Price Returns

| 1-mo | 10.19% |

| 3-mo | -16.67% |

| 6-mo | -42.90% |

| 1-year | -93.89% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -61.90% |

| 2023 | -92.58% |

| 2022 | -50.87% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...