Block Inc. (SQ): Price and Financial Metrics

SQ Price/Volume Stats

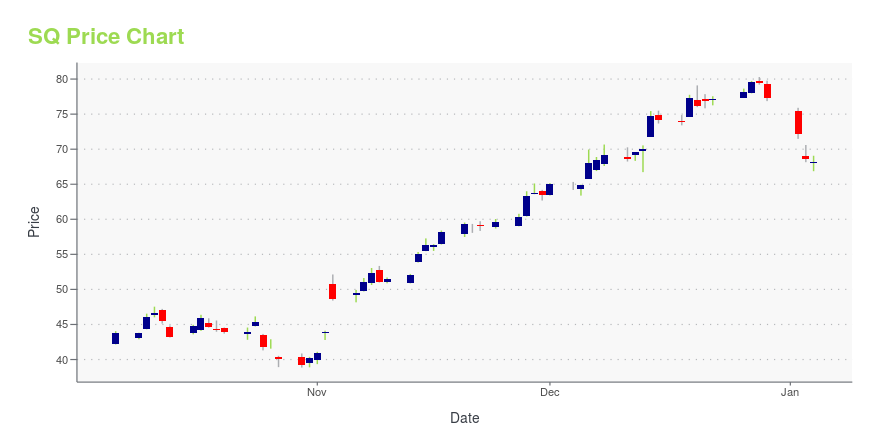

| Current price | $60.18 | 52-week high | $87.52 |

| Prev. close | $61.58 | 52-week low | $38.85 |

| Day low | $59.86 | Volume | 11,388,600 |

| Day high | $61.66 | Avg. volume | 8,896,449 |

| 50-day MA | $65.83 | Dividend yield | N/A |

| 200-day MA | $66.91 | Market Cap | 37.13B |

SQ Stock Price Chart Interactive Chart >

Block Inc. (SQ) Company Bio

Square Inc. is a software company offering solutions ranging from payments and point-of-sale services to financial and marketing services. It offers a free software app with its hardware to turn mobile devices into POS solutions in minutes. Square’s reader helps sellers accept chip cards and NFC payments and tools, such as the company’s Cash App, helps customers send money to family and friends instantly. Jack Dorsey is CEO and Chairman of Square which was founded in 2009 and is headquartered in San Francisco, California with over 5,400 employees.

Latest SQ News From Around the Web

Below are the latest news stories about BLOCK INC that investors may wish to consider to help them evaluate SQ as an investment opportunity.

3 Surprising Stock Gems to Turn Your $1,000 Into a FortuneAre you looking to turn your $1,000 into a fortune? |

Millennial Money Movers: 3 Stocks Resonating with Young InvestorsThese stocks that young investors align themselves with are uniquely positioned for strong growth in 2024 and beyond. |

Caution, PayPal Investors! Don’t Assume PYPL Stock Will Keep Bouncing Back.Sentiment for PYPL stock has improved in recent months, but the latest leaning toward bullishness could soon revert back to bearishness. |

The 3 Best Crypto Stocks to Buy for the 2024 RallyCrypto stocks should be on every investor's watch list. |

Is Square Stock A Buy Amid Cash App, Merchant Synergies?Square stock bulls focus on its merchant, Cash App and Afterpay synergies but bears worry over Bitcoin and business trends. |

SQ Price Returns

| 1-mo | -4.91% |

| 3-mo | -19.20% |

| 6-mo | -7.37% |

| 1-year | -20.58% |

| 3-year | -76.09% |

| 5-year | -26.44% |

| YTD | -22.20% |

| 2023 | 23.09% |

| 2022 | -61.09% |

| 2021 | -25.79% |

| 2020 | 247.89% |

| 2019 | 11.54% |

Continue Researching SQ

Want to do more research on Square Inc's stock and its price? Try the links below:Square Inc (SQ) Stock Price | Nasdaq

Square Inc (SQ) Stock Quote, History and News - Yahoo Finance

Square Inc (SQ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...