Sequans Communications S.A. American Depositary Shares, each representing one Ordinary Share (SQNS): Price and Financial Metrics

SQNS Price/Volume Stats

| Current price | $0.52 | 52-week high | $2.97 |

| Prev. close | $0.53 | 52-week low | $0.34 |

| Day low | $0.50 | Volume | 44,251 |

| Day high | $0.54 | Avg. volume | 317,836 |

| 50-day MA | $0.56 | Dividend yield | N/A |

| 200-day MA | $1.62 | Market Cap | 32.47M |

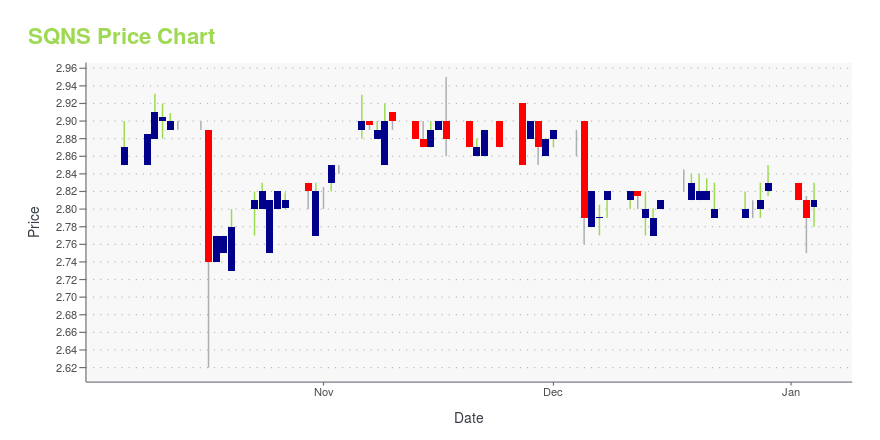

SQNS Stock Price Chart Interactive Chart >

Sequans Communications S.A. American Depositary Shares, each representing one Ordinary Share (SQNS) Company Bio

Sequans Communications S.A. engages in fabless designing, developing, and supplying 4G LTE and WiMAX semiconductor solutions for wireless broadband applications. The company was founded in 2003 and is based in Paris, France.

Latest SQNS News From Around the Web

Below are the latest news stories about SEQUANS COMMUNICATIONS that investors may wish to consider to help them evaluate SQNS as an investment opportunity.

Sequans Communications (NYSE:SQNS) investors are sitting on a loss of 55% if they invested three years agoThe truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Sequans... |

Renesas Extends Tender Offer for Proposed Acquisition of SequansShareholders to Receive U.S. $0.7575 per Ordinary Share and U.S. $3.03 per ADS in cash Tokyo, Japan and Paris, France--(Newsfile Corp. - December 19, 2023) - Renesas Electronics Corporation (TSE: 6723) ("Renesas") and Sequans Communications S.A. (NYSE: SQNS) ("Sequans") today announced that Renesas has extended the expiration date of its tender offer to acquire all of the outstanding ordinary shares of Sequans for $0.7575 per ordinary share and American Depositary Shares ("ADSs") of Sequans for |

Renesas Extends Tender Offer and Receives Taiwan Merger Control Approval for Proposed Acquisition of SequansShareholders to Receive U.S. $0.7575 per Ordinary Share and U.S. $3.03 per ADS in cash Tokyo, Japan and Paris, France--(Newsfile Corp. - December 5, 2023) - Renesas Electronics Corporation (TSE: 6723) ("Renesas") and Sequans Communications S.A. (NYSE: SQNS) ("Sequans") today announced that (i) Renesas has extended the expiration date of its tender offer to acquire all of the outstanding ordinary shares of Sequans for $0.7575 per ordinary share and American Depositary Shares ("ADSs") of Sequans . |

Loss-Making Sequans Communications S.A. (NYSE:SQNS) Expected To Breakeven In The Medium-TermSequans Communications S.A. ( NYSE:SQNS ) is possibly approaching a major achievement in its business, so we would like... |

Renesas Extends Tender Offer and Receives UK NSIA Clearance for Proposed Acquisition of SequansShareholders to Receive U.S. $0.7575 per Ordinary Share and U.S. $3.03 per ADS in cash Tokyo, Japan and Paris, France--(Newsfile Corp. - November 6, 2023) - Renesas Electronics Corporation (TSE: 6723) ("Renesas") and Sequans Communications S.A. (NYSE: SQNS) ("Sequans") today announced that (i) Renesas has extended the expiration date of its tender offer to acquire all of the outstanding ordinary shares of Sequans for $0.7575 per ordinary share and American Depositary Shares ("ADSs") of Sequans . |

SQNS Price Returns

| 1-mo | 4.00% |

| 3-mo | -0.99% |

| 6-mo | -82.01% |

| 1-year | -78.24% |

| 3-year | -89.94% |

| 5-year | -85.23% |

| YTD | -81.63% |

| 2023 | -14.76% |

| 2022 | -29.96% |

| 2021 | -21.52% |

| 2020 | 101.33% |

| 2019 | -3.85% |

Continue Researching SQNS

Want to do more research on Sequans Communications's stock and its price? Try the links below:Sequans Communications (SQNS) Stock Price | Nasdaq

Sequans Communications (SQNS) Stock Quote, History and News - Yahoo Finance

Sequans Communications (SQNS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...