Squarespace, Inc. (SQSP): Price and Financial Metrics

SQSP Price/Volume Stats

| Current price | $43.91 | 52-week high | $44.29 |

| Prev. close | $43.91 | 52-week low | $26.70 |

| Day low | $43.88 | Volume | 792,700 |

| Day high | $44.02 | Avg. volume | 950,934 |

| 50-day MA | $43.72 | Dividend yield | N/A |

| 200-day MA | $35.02 | Market Cap | 6.04B |

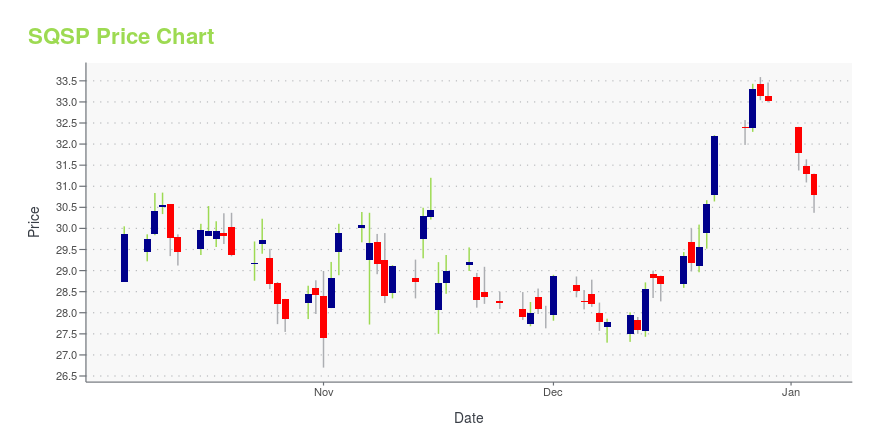

SQSP Stock Price Chart Interactive Chart >

Squarespace, Inc. (SQSP) Company Bio

Squarespace, Inc. operates platform for businesses and independent creators to build online presence, grow their brands, and manage their businesses across the internet. The company offers websites, domains, e-commerce, tools for managing a social media presence, marketing tools, and scheduling capabilities. It serves small and medium-sized businesses, and independent creators, such as restaurants, photographers, wedding planners, artists, musicians, and bloggers. Squarespace, Inc. was founded in 2003 and is headquartered in New York, New York.

Latest SQSP News From Around the Web

Below are the latest news stories about SQUARESPACE INC that investors may wish to consider to help them evaluate SQSP as an investment opportunity.

Squarespace Inc CFO Nathan Gooden Sells 9,635 SharesNathan Gooden, the CFO of Squarespace Inc (NYSE:SQSP), executed a sale of 9,635 shares in the company on December 21, 2023, according to a SEC Filing. |

Squarespace Inc CFO Nathan Gooden Sells 9,921 SharesNathan Gooden, the CFO of Squarespace Inc (NYSE:SQSP), executed a sale of 9,921 shares in the company on December 20, 2023, according to a recent SEC Filing. |

Insider Sell Alert: CFO Nathan Gooden Sells 19,555 Shares of Squarespace Inc (SQSP)In a notable insider transaction, CFO Nathan Gooden of Squarespace Inc (NYSE:SQSP) sold 19,555 shares of the company on December 14, 2023. |

Squarespace, Inc. (NYSE:SQSP) Could Be Less Than A Year Away From ProfitabilitySquarespace, Inc. ( NYSE:SQSP ) is possibly approaching a major achievement in its business, so we would like to shine... |

Squarespace to Present at Barclays 2023 Global Technology ConferenceSquarespace, Inc. (NYSE: SQSP), the design-driven platform helping entrepreneurs build brands and businesses online, today announced that Nathan Gooden, CFO, will present at the Barclays Global Technology Conference on Wednesday, December 6, 2023 at 4:55 p.m. ET / 1:55 p.m. PT. |

SQSP Price Returns

| 1-mo | 0.85% |

| 3-mo | 23.59% |

| 6-mo | 34.82% |

| 1-year | 39.31% |

| 3-year | -20.24% |

| 5-year | N/A |

| YTD | 33.02% |

| 2023 | 48.89% |

| 2022 | -24.85% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...