Southern States Bancshares, Inc. (SSBK): Price and Financial Metrics

SSBK Price/Volume Stats

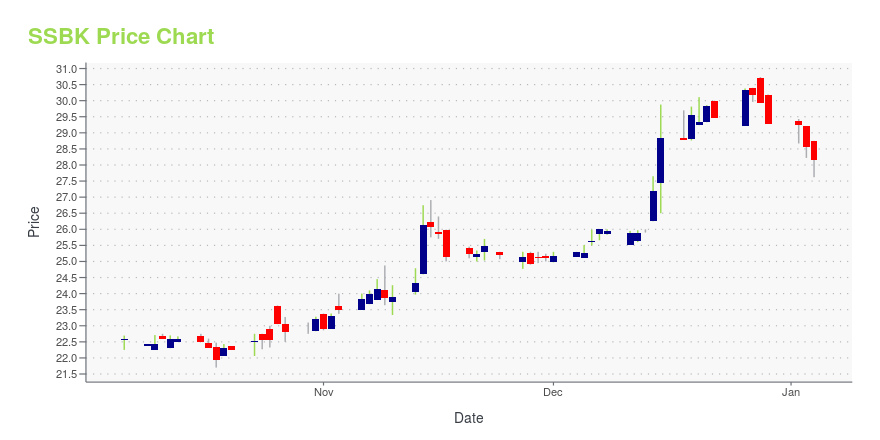

| Current price | $33.00 | 52-week high | $34.72 |

| Prev. close | $33.51 | 52-week low | $21.70 |

| Day low | $32.95 | Volume | 26,799 |

| Day high | $34.30 | Avg. volume | 17,794 |

| 50-day MA | $27.32 | Dividend yield | 1.11% |

| 200-day MA | $25.94 | Market Cap | 293.96M |

SSBK Stock Price Chart Interactive Chart >

Southern States Bancshares, Inc. (SSBK) Company Bio

outhern States Bancshares, Inc. operates as the bank holding company for Southern States Bank that provides community banking services to businesses and individuals. It offers various deposit products, such as NOW, savings, money market, and noninterest-bearing demand accounts; certificates of deposit; and time deposits. The company also provides real estate loan products, which include loans for real estate construction and development, residential mortgages, and commercial real estate mortgage loans; commercial and industrial loans; and direct consumer installment loans, overdrafts, and other revolving credit loans. In addition, it offers online and mobile banking, and ATM services. The company operates 15 offices in Alabama and Georgia. Southern States Bancshares, Inc. was founded in 2007 and is headquartered in Anniston, Alabama.

Latest SSBK News From Around the Web

Below are the latest news stories about SOUTHERN STATES BANCSHARES INC that investors may wish to consider to help them evaluate SSBK as an investment opportunity.

Southern States Bancshares, Inc. Announces Renewal of $10.0 Million Stock Repurchase ProgramANNISTON, Ala., Dec. 20, 2023 (GLOBE NEWSWIRE) -- Southern States Bancshares, Inc. (NASDAQ: SSBK) (“Southern States” or the “Company”), the holding company for Southern States Bank, an Alabama state-chartered commercial bank (the “Bank”), today announced that its Board of Directors has approved the renewal of the Company’s $10.0 million stock repurchase program, which currently expires on December 31, 2023. The renewed stock repurchase program (the “Program”) authorizes the Company to repurchase |

A fantastic week for Southern States Bancshares, Inc.'s (NASDAQ:SSBK) 28% institutional owners, one-year returns continue to impressKey Insights Significantly high institutional ownership implies Southern States Bancshares' stock price is sensitive to... |

Southern States Bancshares, Inc. (NASDAQ:SSBK) Passed Our Checks, And It's About To Pay A US$0.09 DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Southern... |

Southern States Bancshares Inc (SSBK) Announces Q3 2023 Financial ResultsStrong Loan Growth and Increased Net Interest Income Highlight the Quarter |

Southern States Bancshares, Inc. Announces Third Quarter 2023 Financial ResultsThird Quarter 2023 Performance and Operational Highlights Core net income(1) of $9.6 million, or $1.06 per diluted share(1) Net income of $6.6 million, or $0.73 per diluted share Net interest income of $20.7 million, an increase of $1.3 million from the prior quarter Net interest margin (“NIM”) of 3.78%, up 5 basis points from the prior quarter NIM of 3.79% on a fully-taxable equivalent basis (“NIM - FTE”)(1) Return on average assets (“ROAA”) of 1.15%; return on average stockholders’ equity (“RO |

SSBK Price Returns

| 1-mo | 28.76% |

| 3-mo | 36.07% |

| 6-mo | 20.51% |

| 1-year | 33.63% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 13.51% |

| 2023 | 2.65% |

| 2022 | 50.19% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

SSBK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...