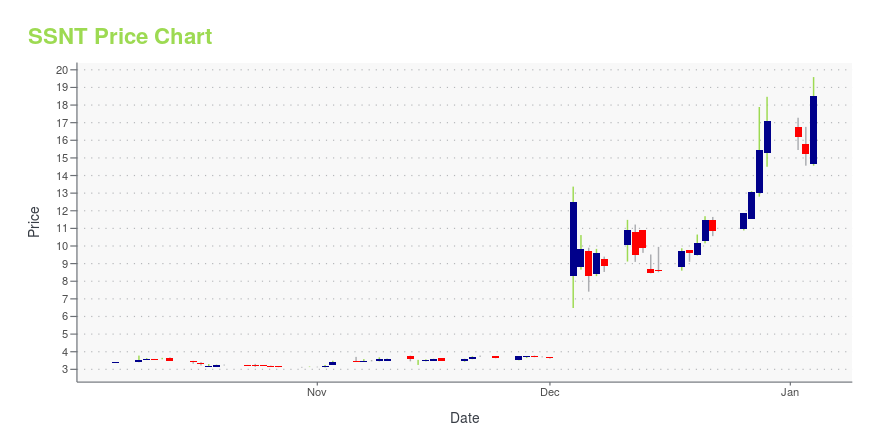

SilverSun Technologies, Inc. (SSNT): Price and Financial Metrics

SSNT Price/Volume Stats

| Current price | $130.48 | 52-week high | $143.92 |

| Prev. close | $19.61 | 52-week low | $2.99 |

| Day low | $116.08 | Volume | 40,500 |

| Day high | $143.92 | Avg. volume | 108,837 |

| 50-day MA | $14.75 | Dividend yield | N/A |

| 200-day MA | $10.25 | Market Cap | 693.63M |

SSNT Stock Price Chart Interactive Chart >

SilverSun Technologies, Inc. (SSNT) Company Bio

SilverSun Technologies, Inc. provides software solutions. The Company develops business application software for accounting and business management, financial reporting, enterprise resource planning, warehouse management systems, and customer relationship management, as well as offers consulting services for programming, training, and technical support.

Latest SSNT News From Around the Web

Below are the latest news stories about SILVERSUN TECHNOLOGIES INC that investors may wish to consider to help them evaluate SSNT as an investment opportunity.

Brad Jacobs to Enter Building Products Distribution IndustryWill Launch “QXO” with Tech-Forward Strategy in Large and Growing Industry, Rich with Acquisition Opportunities Sets Revenue Run-Rate Targets of at Least $1 Billion by End of Year One, at Least $5 Billion within Three Years, and Tens of Billions of Dollars over Next Decade GREENWICH, Conn., Dec. 11, 2023 (GLOBE NEWSWIRE) -- After a comprehensive year-long search, Brad Jacobs has announced his intention to create a market leader in building products distribution — an industry with approximately $ |

XPO's Brad Jacobs talks SilverSun acquisition, equity growthXPO Logistics (XPO) Executive Chairman and serial entrepreneur Brad Jacobs joins Yahoo Finance Live to detail his approach to building companies, most recently through acquiring and scaling SilverSun Technologies (SSNT). Jacobs explains why he avoids SPACs, seeing no "fair alignment" in the model. Instead, his method is injecting $1 billion into a small-cap company and then spinning it back to legacy shareholders, leaving him and other investors with a billion-dollar public entity. Sitting down with Julie Hyman and Josh Lipton, Jacobs outlines his ideal ownership layout and why he targeted SilverSun. He also discusses the sectors he looks to operate in through his holding companies. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Fina... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the hottest trading news for Tuesday morning! |

Piper Sandler Is Souring on Albemarle (ALB) StockAlbemarle stock is falling on Tuesday alongside a downgrade and price target reduction for ALB shares from a Piper Sandler analyst. |

Why Is Allarity Therapeutics (ALLR) Stock Up 42% Today?Allarity Therapeutics stock is rising higher on Tuesday with heavy trading of ALLR stock alongside early clinical trial data. |

SSNT Price Returns

| 1-mo | N/A |

| 3-mo | 17.00% |

| 6-mo | 18.36% |

| 1-year | 363.62% |

| 3-year | 67.97% |

| 5-year | 462.41% |

| YTD | -4.68% |

| 2023 | 478.04% |

| 2022 | -33.78% |

| 2021 | 56.29% |

| 2020 | -34.25% |

| 2019 | 87.50% |

Continue Researching SSNT

Here are a few links from around the web to help you further your research on SilverSun Technologies Inc's stock as an investment opportunity:SilverSun Technologies Inc (SSNT) Stock Price | Nasdaq

SilverSun Technologies Inc (SSNT) Stock Quote, History and News - Yahoo Finance

SilverSun Technologies Inc (SSNT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...