SuRo Capital Corp. (SSSS): Price and Financial Metrics

SSSS Price/Volume Stats

| Current price | $9.00 | 52-week high | $9.08 |

| Prev. close | $8.87 | 52-week low | $3.52 |

| Day low | $8.87 | Volume | 189,790 |

| Day high | $9.08 | Avg. volume | 241,774 |

| 50-day MA | $7.15 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 214.99M |

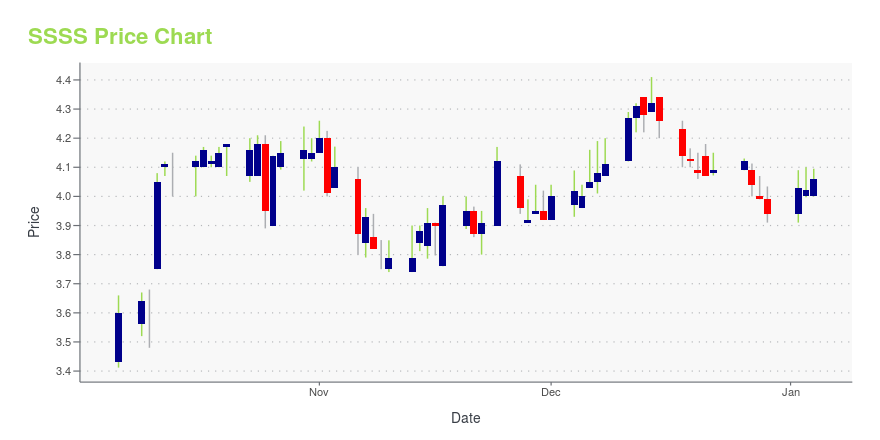

SSSS Stock Price Chart Interactive Chart >

SuRo Capital Corp. (SSSS) Company Bio

SuRo Capital Corp. operates as a venture capital investment company. The Company focuses on late-stage institutionally backed private companies. SuRo Capital serves customers in the United States.

SSSS Price Returns

| 1-mo | 22.45% |

| 3-mo | N/A |

| 6-mo | 41.96% |

| 1-year | 128.43% |

| 3-year | 37.61% |

| 5-year | 26.39% |

| YTD | 53.06% |

| 2024 | 49.24% |

| 2023 | 3.68% |

| 2022 | -70.31% |

| 2021 | 72.62% |

| 2020 | 114.25% |

Loading social stream, please wait...