Sensata Technologies Holding plc Ordinary Shares (ST): Price and Financial Metrics

ST Price/Volume Stats

| Current price | $38.23 | 52-week high | $43.14 |

| Prev. close | $37.25 | 52-week low | $30.56 |

| Day low | $37.53 | Volume | 1,752,836 |

| Day high | $38.56 | Avg. volume | 2,118,643 |

| 50-day MA | $39.69 | Dividend yield | 1.23% |

| 200-day MA | $36.30 | Market Cap | 5.75B |

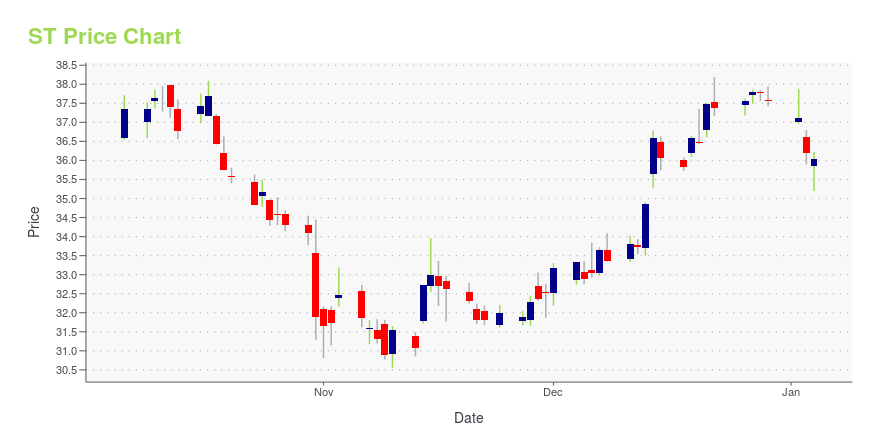

ST Stock Price Chart Interactive Chart >

Sensata Technologies Holding plc Ordinary Shares (ST) Company Bio

Sensata Technologies Holdings develops, manufactures, and sells sensors and controls. It operates in two segments, Sensors and Controls. The company was founded in 1916 and is based in Almelo, the Netherlands.

Latest ST News From Around the Web

Below are the latest news stories about SENSATA TECHNOLOGIES HOLDING PLC that investors may wish to consider to help them evaluate ST as an investment opportunity.

11 Most Profitable Lithium Stocks NowIn this article, we will take a look at 11 of the most profitable lithium stocks to buy now. To skip our analysis of the lithium industry and its impacts on the battery and EV sectors, go directly to the 5 Most Profitable Lithium Stocks Now. The worldwide demand for lithium batteries has been on […] |

Is Sensata Technologies Holding plc (NYSE:ST) Trading At A 38% Discount?Key Insights The projected fair value for Sensata Technologies Holding is US$54.52 based on 2 Stage Free Cash Flow to... |

Sensata to Unveil New Electrification Initiative at CES 2024SWINDON, England, November 29, 2023--Sensata Technologies (NYSE: ST), a global industrial technology company and leading provider of sensors, sensor-rich solutions and electrical protection devices used in mission-critical systems that create valuable business insights for customers, will showcase innovative technologies and a portfolio of impactful new products that are helping lead the world’s transformation to electrification at the upcoming 2024 Consumer Electronics Show in Las Vegas, Januar |

Sensata Technologies Holding plc Announces Upcoming Redemption of 5.625% Senior Notes due 2024 by Sensata Technologies B.V.SWINDON, England, November 16, 2023--Sensata Technologies Holding plc (NYSE: ST) ("Sensata Technologies") today announced that its indirect wholly owned subsidiary, Sensata Technologies B.V. (the "Issuer"), intends to redeem in full all $400,000,000 in aggregate principal amount of its outstanding 5.625% Senior Notes due 2024 (the "Notes"). The redemption will be made in accordance with the terms of the indenture governing the Notes and the terms of the notice of redemption being delivered to al |

One bargain-bin tech stock to buyNovember's bullish market makes it smart to buy stocks opportunistically.Stocks where price has trailed business performance, and P/E ratios are historically low can offer upside.One low-valuation technology stock value investors can buy. This week's stock market rally has been driven by improving ... |

ST Price Returns

| 1-mo | 3.16% |

| 3-mo | 9.61% |

| 6-mo | 8.55% |

| 1-year | -7.37% |

| 3-year | -28.00% |

| 5-year | -19.63% |

| YTD | 2.42% |

| 2023 | -5.87% |

| 2022 | -34.05% |

| 2021 | 16.97% |

| 2020 | -2.10% |

| 2019 | 20.14% |

ST Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ST

Want to see what other sources are saying about Sensata Technologies Holding plc's financials and stock price? Try the links below:Sensata Technologies Holding plc (ST) Stock Price | Nasdaq

Sensata Technologies Holding plc (ST) Stock Quote, History and News - Yahoo Finance

Sensata Technologies Holding plc (ST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...