Stellantis N.V. (STLA): Price and Financial Metrics

STLA Price/Volume Stats

| Current price | $17.66 | 52-week high | $29.51 |

| Prev. close | $18.09 | 52-week low | $17.42 |

| Day low | $17.42 | Volume | 12,017,125 |

| Day high | $17.74 | Avg. volume | 6,013,007 |

| 50-day MA | $20.88 | Dividend yield | N/A |

| 200-day MA | $22.71 | Market Cap | 55.33B |

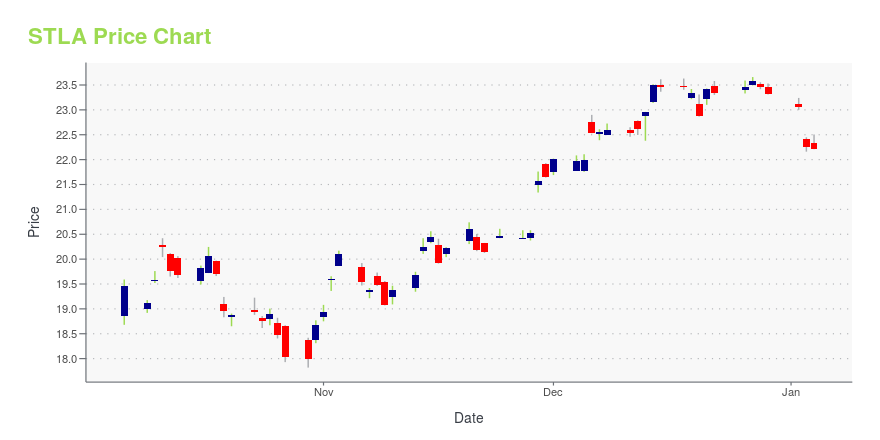

STLA Stock Price Chart Interactive Chart >

Stellantis N.V. (STLA) Company Bio

Stellantis NV is an automobile company, which engages in the manufacture of automobiles and provision of mobility solutions. It designs, engineers, manufactures, distributes, and sells vehicles under the brands Abarth, Alfa Romeo, Chrysler, Dodge, Fiat, Fiat Professional, Jeep, Lancia, Moper, Opel, Peugeot, Leasys, Free2move, Vauxhall, and Ram. The company is headquartered in Lijnden, the Netherlands.

Latest STLA News From Around the Web

Below are the latest news stories about STELLANTIS NV that investors may wish to consider to help them evaluate STLA as an investment opportunity.

Wall Street Analysts See Stellantis (STLA) as a Buy: Should You Invest?Based on the average brokerage recommendation (ABR), Stellantis (STLA) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying? |

4 Top-Ranked Auto Stocks That Crushed the Market in 2023Despite high vehicle financing costs, auto sales witnessed growth on pent-up demand and improved inventory levels. Industry players like STLA, RACE, GP and CARG handily outpaced the market. |

The 7 Highest-Yielding Dividend Gems in Warren Buffet’s CrownWarren Buffett doesn’t hide the fact he loves dividends. |

Shawn Fain, CNN Business’ labor leader of the year, plans to keep automakers sweatingThe longest US auto strike this century is over after a pretty clear win for the United Auto Workers union at all three unionized automakers. But don’t think the union is moving to repair relations between labor and management the way it has after past strikes. |

'Seized the moment': Watershed year for EVs paving way for billions in new investment, Champagne saysIn an end-of-year interview, Francois-Philippe Champagne talks battery-plant deals, sends message to junior miners looking to China for money |

STLA Price Returns

| 1-mo | -14.81% |

| 3-mo | -28.62% |

| 6-mo | -16.74% |

| 1-year | -10.81% |

| 3-year | -5.21% |

| 5-year | N/A |

| YTD | -24.27% |

| 2023 | 64.23% |

| 2022 | -24.31% |

| 2021 | 3.70% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...