STMicroelectronics N.V. (STM): Price and Financial Metrics

STM Price/Volume Stats

| Current price | $33.99 | 52-week high | $55.85 |

| Prev. close | $33.47 | 52-week low | $33.16 |

| Day low | $33.16 | Volume | 5,584,100 |

| Day high | $33.99 | Avg. volume | 3,536,265 |

| 50-day MA | $41.53 | Dividend yield | 0.76% |

| 200-day MA | $43.49 | Market Cap | 30.71B |

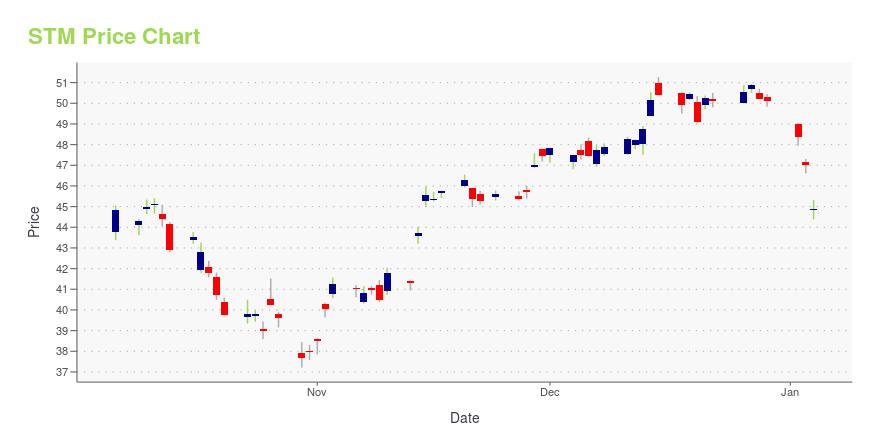

STM Stock Price Chart Interactive Chart >

STMicroelectronics N.V. (STM) Company Bio

STMicroelectronics NV is a semiconductor company. It designs, develops, manufactures, and markets semiconductor products used in different microelectronic applications, including automotive products, consumer products and control systems and others. Chips from ST are used in a wide variety of products, including cars and key fobs, giant factory machines and data center power supplies, washing machines and hard disks, and smartphones and toothbrushes. The company has over 46,000 employees and sells its products to over 100,000 different customers worldwide. ST has 11 manufacturing sites and over 8,100 of its employees and 16% of its yearly revenue is dedicated to Research and Development. Since May 31st, 2018, the company’s President and Chief Executive Officer is Jean-Marc Chery.

Latest STM News From Around the Web

Below are the latest news stories about STMICROELECTRONICS NV that investors may wish to consider to help them evaluate STM as an investment opportunity.

STMicroelectronics Announces Status of Common Share Repurchase ProgramSTMicroelectronics Announces Status ofCommon Share Repurchase Program Disclosure of Transactions in Own Shares – Period from Dec 18, 2023 to Dec 20, 2023 AMSTERDAM – December 27, 2023 -- STMicroelectronics N.V. (the “Company” or “STMicroelectronics”), a global semiconductor leader serving customers across the spectrum of electronics applications, announces full details of its common share repurchase program (the “Program”) disclosed via a press release dated July 1, 2021. The Program was approve |

STMicroelectronics (STM) Surpasses Market Returns: Some Facts Worth KnowingIn the most recent trading session, STMicroelectronics (STM) closed at $50.43, indicating a +1.04% shift from the previous trading day. |

STMicroelectronics (STM) Rises Yet Lags Behind Market: Some Facts Worth KnowingSTMicroelectronics (STM) reachead $48.77 at the closing of the latest trading day, reflecting a +1.12% change compared to its last close. |

STMicroelectronics (STM) Ascends But Remains Behind Market: Some Facts to NoteSTMicroelectronics (STM) closed at $47.76 in the latest trading session, marking a +0.61% move from the prior day. |

STMicroelectronics reveals a new global-shutter image sensor that offers high resolution in a compact form factor and low power consumptionP4591D -- Dec 7 2023 -- VD55G1 global-shutter image sensor_IMAGE P4591D -- Dec 7 2023 -- VD55G1 global-shutter image sensor_IMAGE STMicroelectronics reveals a new global-shutter image sensor that offers high resolution in a compact form factor and low power consumption The sensor is designed for use in a range of applications, including AR/VR, personal and industrial robotics, drones, barcodes, biometrics and gestures, and embedded vision and scene recognition Geneva, Switzerland, December 7, 20 |

STM Price Returns

| 1-mo | -14.56% |

| 3-mo | -17.60% |

| 6-mo | -23.59% |

| 1-year | -36.99% |

| 3-year | -10.95% |

| 5-year | 82.50% |

| YTD | -31.99% |

| 2023 | 41.55% |

| 2022 | -26.83% |

| 2021 | 32.28% |

| 2020 | 38.76% |

| 2019 | 95.97% |

STM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching STM

Here are a few links from around the web to help you further your research on STMicroelectronics NV's stock as an investment opportunity:STMicroelectronics NV (STM) Stock Price | Nasdaq

STMicroelectronics NV (STM) Stock Quote, History and News - Yahoo Finance

STMicroelectronics NV (STM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...