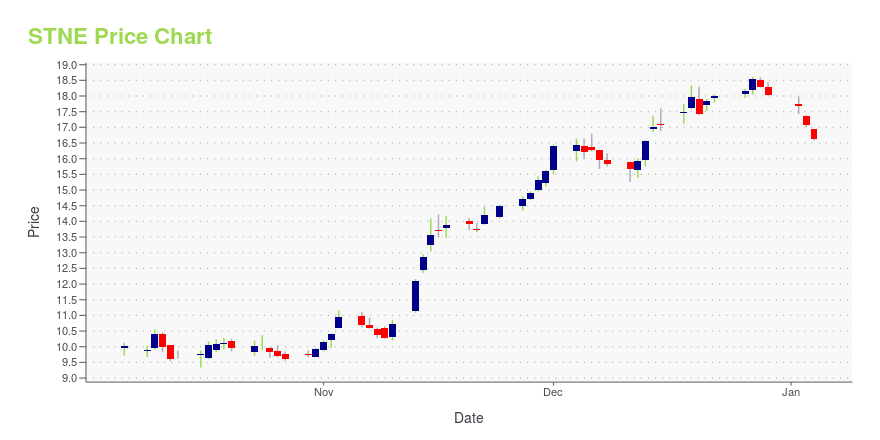

StoneCo Ltd. Cl A (STNE): Price and Financial Metrics

STNE Price/Volume Stats

| Current price | $13.50 | 52-week high | $19.46 |

| Prev. close | $13.34 | 52-week low | $9.34 |

| Day low | $13.47 | Volume | 4,746,000 |

| Day high | $13.78 | Avg. volume | 5,228,255 |

| 50-day MA | $13.16 | Dividend yield | N/A |

| 200-day MA | $14.95 | Market Cap | 4.24B |

STNE Stock Price Chart Interactive Chart >

StoneCo Ltd. Cl A (STNE) Company Bio

StoneCo Ltd. engages in the provision of financial technology solutions. It caters to merchants and partners that conduct electronic commerce across in-store, online, and mobile channels. It offers cloud-based technology platform, electronic payments, and automation of business processes at the point-of-sale. The company was founded on March 11, 2014 and is headquartered in São Paulo, Brazil.

Latest STNE News From Around the Web

Below are the latest news stories about STONECO LTD that investors may wish to consider to help them evaluate STNE as an investment opportunity.

7 Emerging Markets Stocks With Strong Growth PotentialEmerging market stocks are a great way to diversify a portfolio that may be too focused on U.S.-based stocks. |

3 Dirt-Cheap Stocks Primed for Massive GrowthThese three overlooked cheap stocks are trading at inexpensive valuations compared to their earnings potential over the next several years. |

3 Ultracheap Stocks to Buy for Big GainsWall Street tends to focus on the short-term. |

StoneCo. Announces $467.5 million credit facility from DFC to strengthen working capital of micro, small, and medium businessesGEORGE TOWN, Grand Cayman, Dec. 18, 2023 (GLOBE NEWSWIRE) -- StoneCo Ltd. (Nasdaq: STNE; B3: STOC31) (“Stone” or “the Company”) announced that it has obtained a commitment of US$467.5 million in the form of a revolving securitization facility from the United States International Development Finance Corporation (DFC), an agency of the United States government. The facility, which has a final maturity of seven years, and a six-month availability period, acquires accounts receivables due by over tw |

StoneCo Ltd. (STNE) Faced Near-Term Challenges in Q3Investment management company Ave Maria recently released its “Ave Maria World Equity Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund returned -4.88% compared to the MSCI All Country World Index’s -3.40% return. Year-to-date the fund returned 9.62% compared to the 10.06% return […] |

STNE Price Returns

| 1-mo | 14.41% |

| 3-mo | -17.43% |

| 6-mo | -25.41% |

| 1-year | 1.81% |

| 3-year | -75.66% |

| 5-year | -60.48% |

| YTD | -25.12% |

| 2023 | 91.00% |

| 2022 | -44.01% |

| 2021 | -79.91% |

| 2020 | 110.38% |

| 2019 | 116.32% |

Continue Researching STNE

Want to do more research on StoneCo Ltd's stock and its price? Try the links below:StoneCo Ltd (STNE) Stock Price | Nasdaq

StoneCo Ltd (STNE) Stock Quote, History and News - Yahoo Finance

StoneCo Ltd (STNE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...