Sarcos Technology and Robotics Corporation (STRC): Price and Financial Metrics

STRC Price/Volume Stats

| Current price | $2.46 | 52-week high | $3.25 |

| Prev. close | $1.93 | 52-week low | $0.40 |

| Day low | $1.86 | Volume | 1,687,700 |

| Day high | $2.62 | Avg. volume | 919,282 |

| 50-day MA | $1.24 | Dividend yield | N/A |

| 200-day MA | $1.06 | Market Cap | 63.71M |

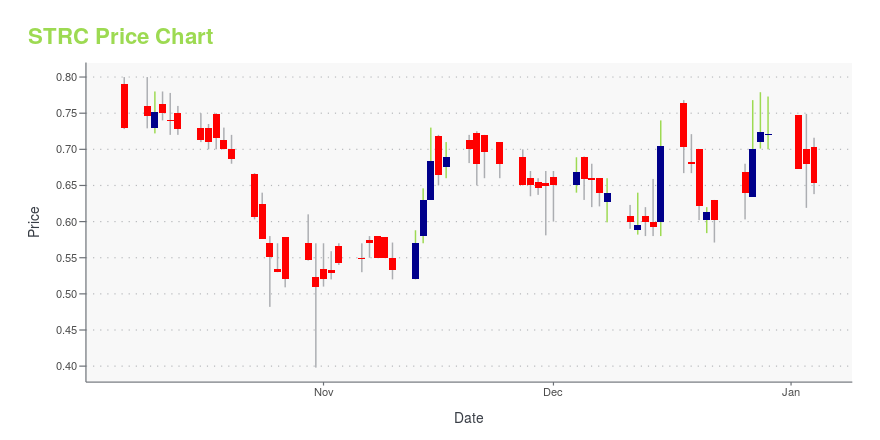

STRC Stock Price Chart Interactive Chart >

Sarcos Technology and Robotics Corporation (STRC) Company Bio

Sarcos Technology and Robotics Corporation engages in the development of robotic systems. Its robotic systems augment human performance by combining human intelligence, instinct, and judgment with the machines to enhance employee safety and productivity. The company's mobile robotic systems include the Guardian S, a remote controlled visual inspection and surveillance robotic system; Guardian XO, a full-body battery-powered dexterous exoskeleton; Guardian XT, a highly dexterous remote controlled robotic system; and Guardian GT, a force-multiplying dexterous robotic system. Sarcos Technology and Robotics Corporation is headquartered in Salt Lake City, Utah.

Latest STRC News From Around the Web

Below are the latest news stories about SARCOS TECHNOLOGY & ROBOTICS CORP that investors may wish to consider to help them evaluate STRC as an investment opportunity.

What You Need To Know About The Sarcos Technology and Robotics Corporation (NASDAQ:STRC) Analyst Downgrade TodayMarket forces rained on the parade of Sarcos Technology and Robotics Corporation ( NASDAQ:STRC ) shareholders today... |

Sarcos Technology and Robotics Corporation (NASDAQ:STRC) Q3 2023 Earnings Call TranscriptSarcos Technology and Robotics Corporation (NASDAQ:STRC) Q3 2023 Earnings Call Transcript November 14, 2023 Sarcos Technology and Robotics Corporation misses on earnings expectations. Reported EPS is $-0.66 EPS, expectations were $-0.59. Operator: Good day, and thank you for standing by. Welcome to the Q3 2023 Sarcos Technology and Robotics Corporation Earnings Conference Call. At this […] |

Market Cool On Sarcos Technology and Robotics Corporation's (NASDAQ:STRC) RevenuesIt's not a stretch to say that Sarcos Technology and Robotics Corporation's ( NASDAQ:STRC ) price-to-sales (or "P/S... |

Sarcos Technology and Robotics Corporation Announces Third Quarter 2023 Financial ResultsPivots to Artificial Intelligence, Machine Learning Software BusinessSALT LAKE CITY, Nov. 14, 2023 (GLOBE NEWSWIRE) -- Sarcos Technology and Robotics Corporation (“Sarcos”) (NASDAQ: STRC and STRCW, a leader in advanced robotic technology designed to increase the intelligence, efficiency, capability and productivity of advanced robotic systems through applied autonomy, today announced financial results for the quarter ended September 30, 2023. Highlights Laura Peterson appointed as President and |

Sarcos Pivots to Robotics AI Software Near-Term OpportunitySALT LAKE CITY, November 14, 2023--Sarcos Technology and Robotics Corporation today announced that it is pivoting its business to focus on AI and ML software platform. |

STRC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 362.23% |

| 1-year | 46.43% |

| 3-year | -95.87% |

| 5-year | N/A |

| YTD | 241.05% |

| 2023 | -78.58% |

| 2022 | -94.38% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...