Star Equity Holdings, Inc. (STRR): Price and Financial Metrics

STRR Price/Volume Stats

| Current price | $2.29 | 52-week high | $5.35 |

| Prev. close | $2.27 | 52-week low | $2.06 |

| Day low | $2.27 | Volume | 11,300 |

| Day high | $2.38 | Avg. volume | 17,245 |

| 50-day MA | $2.68 | Dividend yield | N/A |

| 200-day MA | $3.87 | Market Cap | 7.37M |

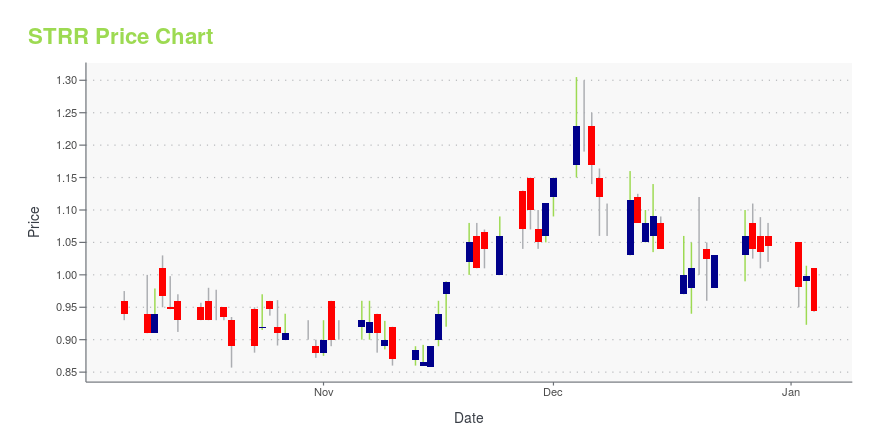

STRR Stock Price Chart Interactive Chart >

Star Equity Holdings, Inc. (STRR) Company Bio

Star Equity Holdings, Inc. is a diversified holding company with three divisions: Healthcare, Building & Construction, and Real Estate & Investments.

STRR Price Returns

| 1-mo | 6.02% |

| 3-mo | -40.98% |

| 6-mo | -53.27% |

| 1-year | -53.17% |

| 3-year | -63.36% |

| 5-year | -84.68% |

| YTD | 1.33% |

| 2024 | -56.75% |

| 2023 | 22.24% |

| 2022 | -66.47% |

| 2021 | -28.97% |

| 2020 | N/A |

Loading social stream, please wait...