Constellation Brands, Inc. (STZ): Price and Financial Metrics

STZ Price/Volume Stats

| Current price | $253.48 | 52-week high | $274.87 |

| Prev. close | $249.38 | 52-week low | $227.50 |

| Day low | $249.75 | Volume | 846,400 |

| Day high | $254.13 | Avg. volume | 1,206,905 |

| 50-day MA | $252.87 | Dividend yield | 1.64% |

| 200-day MA | $249.72 | Market Cap | 46.38B |

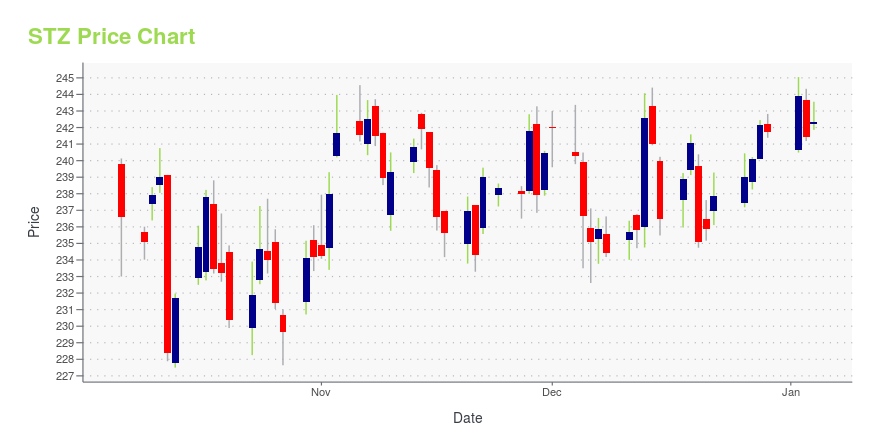

STZ Stock Price Chart Interactive Chart >

Constellation Brands, Inc. (STZ) Company Bio

Founded in 1945 by Marvin Sands in upstate New York, Constellation Brands, Inc is engaged in the beverage industry. Its core products are alcoholic drinks such as beers, wines, and other spirits. The company’s most recognizable brands include Corona Extra, Modelo Especial, Kim Crawford, Meiomi, The Prisoner, SVEDKA Vodka and High West Whiskey. Constellation’s beverages are available in approximately 100 countries and operates over 40 facilities worldwide, including the United States, Europe, and Australia. With over 8700 employees as of 2020, the company is headquartered in Victor, New York. Constellation’s current President and Chief Executive Office is Bill Newlands.

Latest STZ News From Around the Web

Below are the latest news stories about CONSTELLATION BRANDS INC that investors may wish to consider to help them evaluate STZ as an investment opportunity.

These 2 Consumer Staples Stocks Could Beat Earnings: Why They Should Be on Your RadarWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

24 States that Legalized Recreational Weed in the USIn this article, we are going to discuss the 24 states that legalized recreational weed in the US. You can skip our detailed analysis of the cannabis industry in America, the effect of legalization on prices, and the fastest growing category in the cannabis industry, and go directly to 5 States that Legalized Recreational Weed in […] |

The Bud Light Boycott Was Just the Beginning of a Crazy Year for BeerA Bud Light boycott in 2023 reshuffled the beer industry, vaulting Modelo Especial to the top spot in America. At the same time, many people simply stopped drinking beer altogether. |

20 Best White Wines Under $50In this article, we are going to discuss the 20 best white wines under $50. You can skip our detailed analysis of the global wine market, the largest winery in the world, and sustainable winemaking in the United States, and go directly to 5 Best White Wines Under $50. Wine was of enormous cultural significance […] |

3 Must-Buy Valuable Blue-Chip Stocks for 2024At under 20 times forward earnings and 10% earnings growth, these blue-chip stocks for 2024 are bargains that offer downside protection. |

STZ Price Returns

| 1-mo | -2.91% |

| 3-mo | -2.13% |

| 6-mo | 2.37% |

| 1-year | -4.93% |

| 3-year | 16.81% |

| 5-year | 33.76% |

| YTD | 5.65% |

| 2023 | 5.83% |

| 2022 | -6.43% |

| 2021 | 16.12% |

| 2020 | 17.41% |

| 2019 | 19.85% |

STZ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching STZ

Here are a few links from around the web to help you further your research on Constellation Brands Inc's stock as an investment opportunity:Constellation Brands Inc (STZ) Stock Price | Nasdaq

Constellation Brands Inc (STZ) Stock Quote, History and News - Yahoo Finance

Constellation Brands Inc (STZ) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...