Subsea 7 S.A. (SUBCY): Price and Financial Metrics

SUBCY Price/Volume Stats

| Current price | $18.96 | 52-week high | $19.60 |

| Prev. close | $19.60 | 52-week low | $12.13 |

| Day low | $18.94 | Volume | 3,867 |

| Day high | $19.32 | Avg. volume | 24,865 |

| 50-day MA | $18.26 | Dividend yield | 1.5% |

| 200-day MA | $15.44 | Market Cap | 5.77B |

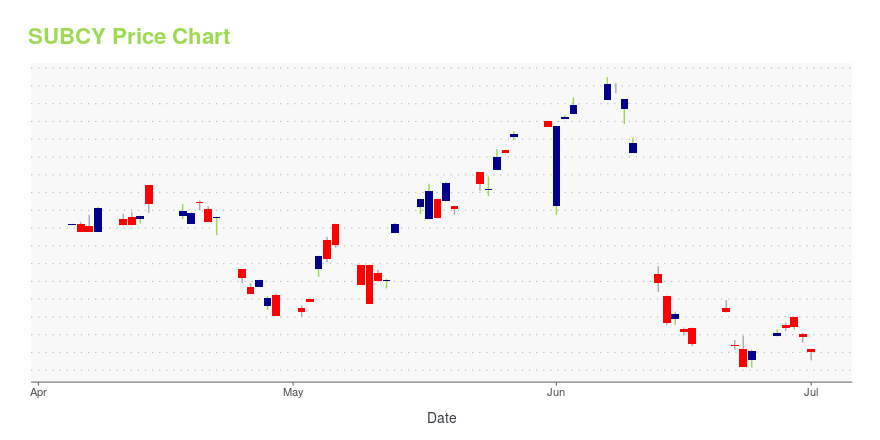

SUBCY Stock Price Chart Interactive Chart >

Subsea 7 S.A. (SUBCY) Company Bio

Subsea 7 S.A. offers oilfield services. The Company designs, fabricates, builds, and installs equipment for the offshore oil industry. Subsea 7 builds flexible flowlines, risers, umbilicals and other equipment. The Company operates in the Gulf of Mexico, the Asia Pacific region, the North Sea and the Mediterranean, and offshore Africa, the Middle East, and South America.

Latest SUBCY News From Around the Web

Below are the latest news stories about Subsea 7 Sa that investors may wish to consider to help them evaluate SUBCY as an investment opportunity.

Subsea 7 SA (SUBCY) Could Find Support Soon, Here's Why You Should Buy the Stock NowAfter losing some value lately, a hammer chart pattern has been formed for Subsea 7 SA (SUBCY), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term. |

Subsea 7 - conference call notification (Q4 and Full Year 2021)Luxembourg – 1 February 2022 – Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) will publish its fourth quarter and full year results for the period ended 31 December 2021 on 3 March 2022 at 07:00 UK time. A conference call and simultaneous webcast for the investment community will be held on 3 March 2022 at 12:00 noon UK time. From 07:00 UK time the results announcement and the presentation to be reviewed during the conference call and webcast will be available on the Subsea 7 website: www.subsea7.c |

Subsea 7 awarded project offshore US Gulf of MexicoLuxembourg – 26 January 2022 - Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) today announced the award of a substantial1 project for subsea installation services related to Beacon Offshore Energy LLC’s Shenandoah Development, located offshore Gulf of Mexico in water depths up to 6,300 feet. The project covers the tie-back of four subsea wells to the Shenandoah host facility through a subsea manifold with dual flowlines and risers. The work scope includes engineering, procurement, construction, ins |

Subsea 7 awarded up to $150m contract by Aker BPSubsea 7 has won a contract worth between $50m and $150m from Aker BP for the Hanz field development in the Norwegian North Sea. The project involves a subsea tie-back of around 15 km to the Ivar Aasen platform. The contract scope includes engineering, procurement, construction and installation (EPCI) of the gas lift and production |

Comparing Subsea 7 (OTCMKTS:SUBCY) & National Energy Services Reunited (NASDAQ:NESR)Subsea 7 (OTCMKTS:SUBCY) and National Energy Services Reunited (NASDAQ:NESR) are both oils/energy companies, but which is the better investment? We will compare the two businesses based on the strength of their earnings, analyst recommendations, dividends, valuation, institutional ownership, profitability and risk. Profitability This table compares Subsea 7 and National Energy Services Reuniteds net margins, return [] |

SUBCY Price Returns

| 1-mo | 3.89% |

| 3-mo | 17.13% |

| 6-mo | 33.50% |

| 1-year | 44.77% |

| 3-year | 119.33% |

| 5-year | 77.99% |

| YTD | 32.97% |

| 2023 | 31.33% |

| 2022 | 63.11% |

| 2021 | -26.99% |

| 2020 | -16.19% |

| 2019 | 22.08% |

SUBCY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...