Sunlight Financial LLC (SUNL): Price and Financial Metrics

SUNL Price/Volume Stats

| Current price | $0.22 | 52-week high | $0.24 |

| Prev. close | $0.00 | 52-week low | $0.21 |

| Day low | $0.21 | Volume | 41,700 |

| Day high | $0.24 | Avg. volume | 0 |

| 50-day MA | $0.00 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 1.43M |

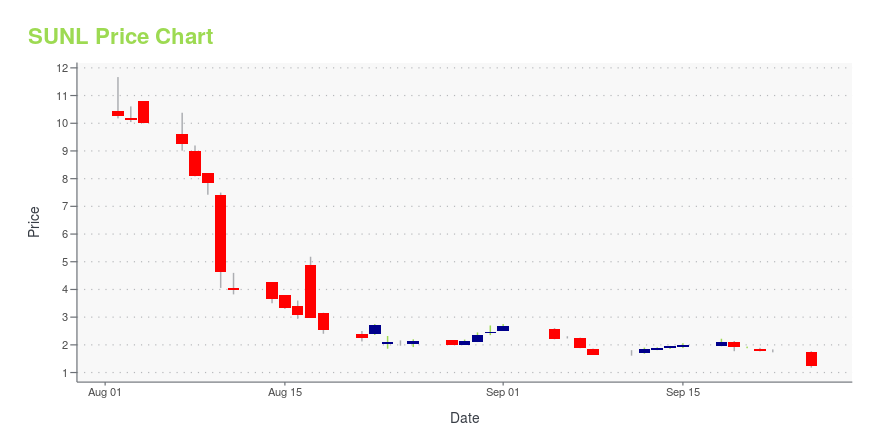

SUNL Stock Price Chart Interactive Chart >

Sunlight Financial LLC (SUNL) Company Bio

Sunlight Financial LLC provides home improvement financing solutions to homeowners and contractors in the United States. It offers point-of-sale financing to facilitate and accelerate the purchase, sale, and installation of residential solar systems and home improvements. The company partners with solar companies and home improvement contractors to secure financing for solar systems and home improvement projects. It serves home improvement projects, including roofing, HVAC, decks/patios, energy efficiency, windows, interior remodel, home automation, and fencing contractors; and contractors of solar systems, batteries, and roofs. The company was founded in 2014 and is based in New York, New York.

Latest SUNL News From Around the Web

Below are the latest news stories about SUNLIGHT FINANCIAL HOLDINGS INC that investors may wish to consider to help them evaluate SUNL as an investment opportunity.

Sunlight Financial and Bodhi Partner to Expedite Post-Sale Documentation, Save Residential Solar Installers Time and Drive Operational ExcellenceNEW YORK & CHARLOTTE, N.C., September 06, 2023--Sunlight Financial Holdings Inc. ("Sunlight Financial", "Sunlight" or the "Company") (NYSE: SUNL), a premier, technology-enabled point-of-sale finance company and Bodhi®, a leading solar customer experience platform, today announced a new partnership through which solar installers are empowered to automatically submit the post-sale documents Sunlight requires via an integration between Sunlight’s technology portal, Orange®, and Bodhi’s digital cust |

Sunlight Financial Announces 1-for-20 Reverse Stock SplitNEW YORK & CHARLOTTE, N.C., August 18, 2023--Sunlight Financial Holdings Inc. ("Sunlight Financial", "Sunlight" or the "Company") (NYSE: SUNL), a premier, technology-enabled point-of-sale finance company, today announced that its Board of Directors approved a 1-for-20 reverse stock split of the Company’s common stock that will become effective at 11:59 p.m. Eastern Time on August 22, 2023. The Company’s common stock will begin trading on a split-adjusted basis on the New York Stock Exchange (NYS |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time for another dive into the biggest pre-market stock movers this morning as we check out the latest news on Thursday! |

Sunlight Financial and Solar Insure Partner to Offer a 30-Year Monitoring and Warranty Service for Residential Solar InstallationsNEW YORK & CHARLOTTE, N.C., May 25, 2023--Sunlight Financial Holdings Inc. ("Sunlight Financial," "Sunlight" or the "Company") (NYSE: SUNL), a premier, technology-enabled point-of-sale finance company, and Solar Insure, a leading solar monitoring and warranty company for consumers and installers, today announced a strategic partnership. The collaboration will enable Sunlight’s installer partners to seamlessly offer homeowners Solar Insure’s 30-year monitoring and solar warranty service for resid |

Sunlight Financial Reports First Quarter 2023 ResultsNEW YORK & CHARLOTTE, N.C., May 15, 2023--Sunlight Financial Holdings Inc. ("Sunlight Financial", "Sunlight" or the "Company") (NYSE: SUNL), a premier, technology-enabled point-of-sale finance company, today announced its results for the first quarter 2023. |

SUNL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -97.92% |

| 3-year | -99.87% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -73.01% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...