Suzano S/A ADR (SUZ): Price and Financial Metrics

SUZ Price/Volume Stats

| Current price | $9.18 | 52-week high | $12.98 |

| Prev. close | $9.33 | 52-week low | $8.78 |

| Day low | $9.15 | Volume | 933,266 |

| Day high | $9.30 | Avg. volume | 1,951,774 |

| 50-day MA | $9.54 | Dividend yield | 1.87% |

| 200-day MA | $10.75 | Market Cap | 12.16B |

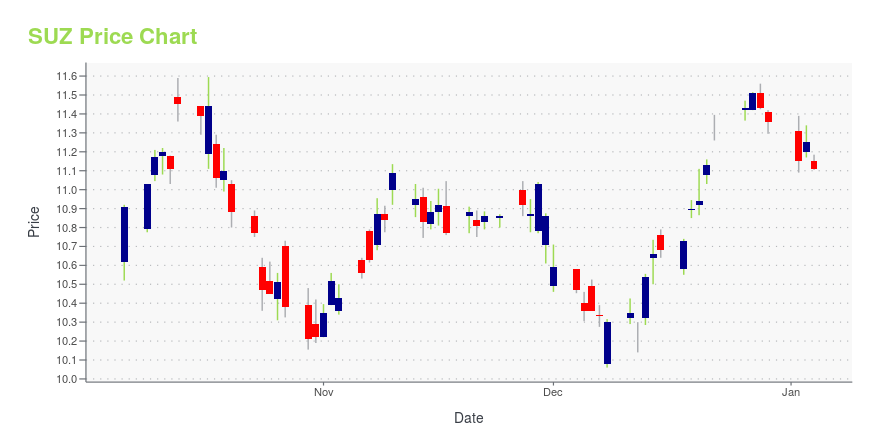

SUZ Stock Price Chart Interactive Chart >

Suzano S/A ADR (SUZ) Company Bio

Suzano Papel e Celulose (English: Suzano Paper and Pulp) is a Brazilian producer of paper and pulp with a presence in over 80 countries. It is the largest paper and pulp company in Latin America. The company is headquartered in Salvador and has offices in São Paulo, Buenos Aires, Fort Lauderdale, London, Shanghai and Signy-Avenex and is one of the largest in its sector in the world. (Source:Wikipedia)

Latest SUZ News From Around the Web

Below are the latest news stories about SUZANO SA that investors may wish to consider to help them evaluate SUZ as an investment opportunity.

Are Basic Materials Stocks Lagging Denison Mine Corp (DNN) This Year?Here is how Denison Mine (DNN) and Suzano S.A. Sponsored ADR (SUZ) have performed compared to their sector so far this year. |

Zacks.com featured highlights include NRG Energy, Thomson Reuters, Suzano, Cboe Global Markets and Arch Capital GroupNRG Energy, Thomson Reuters, Suzano, Cboe Global Markets and Arch Capital Group are part of the Zacks Screen of the Week article. |

5 Stocks With High ROE to Buy as Fed Spurs Santa Claus RallyNRG Energy (NRG), Thomson Reuters (TRI), Suzano (SUZ), Cboe Global (CBOE) and Arch Capital (ACGL) are some of the stocks with high ROE to profit from as Fed Buoyed the ongoing Santa Claus rally. |

Are Investors Undervaluing Suzano (SUZ) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Focus on These 5 Stocks That Recently Hiked DividendsInvestors may keep a tab on stocks like ARE, SUZ, GGG, COFS and LZB, which have lately hiked their dividend payments. |

SUZ Price Returns

| 1-mo | -0.33% |

| 3-mo | -21.34% |

| 6-mo | -14.60% |

| 1-year | -5.93% |

| 3-year | -8.85% |

| 5-year | 20.16% |

| YTD | -19.19% |

| 2023 | 25.10% |

| 2022 | -9.59% |

| 2021 | -3.40% |

| 2020 | 13.62% |

| 2019 | 0.38% |

SUZ Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...