Save Foods Inc. (SVFD): Price and Financial Metrics

SVFD Price/Volume Stats

| Current price | $1.41 | 52-week high | $16.52 |

| Prev. close | $1.42 | 52-week low | $1.35 |

| Day low | $1.41 | Volume | 37,800 |

| Day high | $1.54 | Avg. volume | 34,483 |

| 50-day MA | $1.62 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 2.07M |

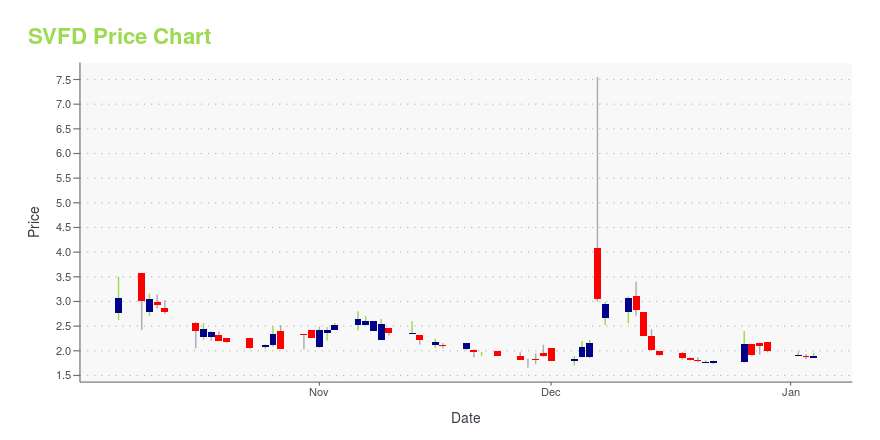

SVFD Stock Price Chart Interactive Chart >

Save Foods Inc. (SVFD) Company Bio

Save Foods, Inc. engages in the research and development of green solutions for extending storability and shelf life of vegetables and fruits. The company was founded by Nimrod Ben-Yehuda on April 1, 2009 and is headquartered in Haifa, Israel.

SVFD Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -65.44% |

| 5-year | N/A |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | 164.90% |

| 2022 | -81.17% |

| 2021 | 226.02% |

| 2020 | N/A |

Loading social stream, please wait...