Firsthand Technology Value Fund, Inc. (SVVC): Price and Financial Metrics

SVVC Price/Volume Stats

| Current price | $0.05 | 52-week high | $0.64 |

| Prev. close | $0.06 | 52-week low | $0.04 |

| Day low | $0.05 | Volume | 621 |

| Day high | $0.05 | Avg. volume | 5,854 |

| 50-day MA | $0.13 | Dividend yield | N/A |

| 200-day MA | $0.26 | Market Cap | 310.19K |

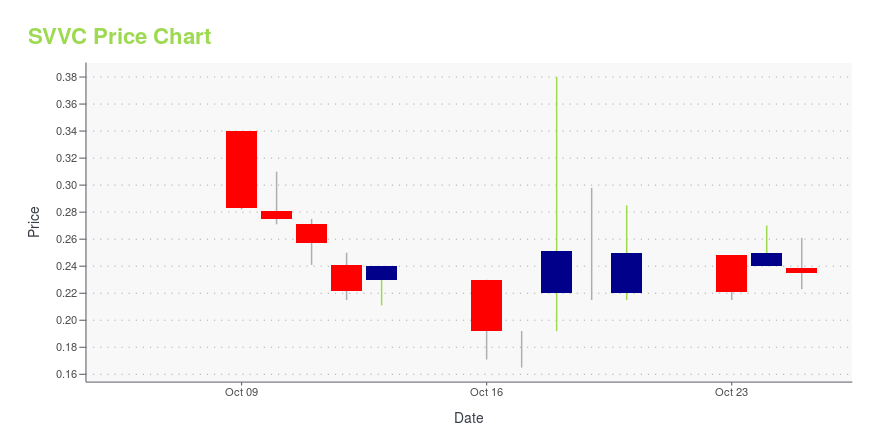

SVVC Stock Price Chart Interactive Chart >

Latest SVVC News From Around the Web

Below are the latest news stories about FIRSTHAND TECHNOLOGY VALUE FUND INC that investors may wish to consider to help them evaluate SVVC as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic worth checking out on Wednesday and we have all the latest news happening this morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start off the week with a breakdown of the biggest pre-market stock movers worth watching on Monday morning! |

Firsthand Technology Value Fund Announces Plan to Seek Stockholder Approval to Withdraw BDC Election and Pursue LiquidationSAN JOSE, Calif., October 13, 2023--Firsthand Technology Value Fund, Inc. (NASDAQ: SVVC) (the "Fund" or "Firsthand"), a publicly-traded venture capital fund that invests in technology and cleantech companies, today announced that its Board of Directors (the "Board") has approved a plan to seek stockholder approval to withdraw the Fund’s election to be regulated as a business development company ("BDC") under the Investment Company Act of 1940, as amended. The Board will also be seeking stockhold |

Firsthand Technology Value Fund Announces Voluntary Delisting from Nasdaq Global MarketSAN JOSE, Calif., October 06, 2023--Firsthand Technology Value Fund, Inc. (NASDAQ: SVVC) (the "Fund" or "Firsthand"), a publicly-traded venture capital fund that invests in technology and cleantech companies, today notified the Nasdaq Stock Market LLC ("Nasdaq") of the Fund’s decision to voluntarily delist its common stock from the Nasdaq Global Market and its intent to file a Form 25 with the U.S. Securities and Exchange Commission (the "SEC") on or about October 16, 2023. As a result, the Fund |

Firsthand Technology Value Fund Announces Second Quarter Financial Results, NAV of $1.61 Per ShareSAN JOSE, Calif., August 15, 2023--Firsthand Technology Value Fund, Inc. (NASDAQ: SVVC) (the "Fund"), a publicly traded venture capital fund that invests in technology and cleantech companies, announced today its financial results for the quarter ended June 30, 2023. |

SVVC Price Returns

| 1-mo | -29.58% |

| 3-mo | N/A |

| 6-mo | -82.14% |

| 1-year | -92.06% |

| 3-year | -99.11% |

| 5-year | -99.44% |

| YTD | -83.33% |

| 2023 | -68.30% |

| 2022 | -76.40% |

| 2021 | -10.29% |

| 2020 | -30.48% |

| 2019 | -42.59% |

Continue Researching SVVC

Want to see what other sources are saying about Firsthand Technology Value Fund Inc's financials and stock price? Try the links below:Firsthand Technology Value Fund Inc (SVVC) Stock Price | Nasdaq

Firsthand Technology Value Fund Inc (SVVC) Stock Quote, History and News - Yahoo Finance

Firsthand Technology Value Fund Inc (SVVC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...