Smith & Wesson Brands Inc. (SWBI): Price and Financial Metrics

SWBI Price/Volume Stats

| Current price | $10.33 | 52-week high | $18.05 |

| Prev. close | $10.31 | 52-week low | $9.68 |

| Day low | $10.21 | Volume | 317,800 |

| Day high | $10.44 | Avg. volume | 405,336 |

| 50-day MA | $11.71 | Dividend yield | 5.04% |

| 200-day MA | $14.18 | Market Cap | 454.55M |

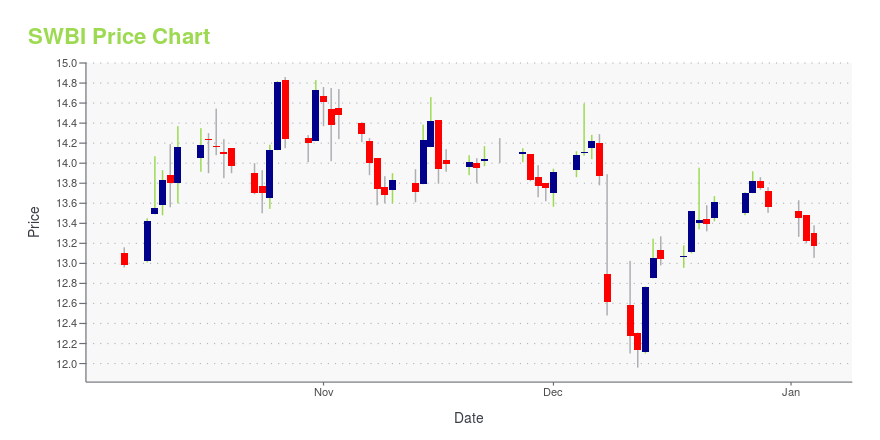

SWBI Stock Price Chart Interactive Chart >

Smith & Wesson Brands Inc. (SWBI) Company Bio

Smith & Wesson Brands, Inc. is a holding company, which engages in the manufacture, design, and provision of firearms. It operates through the Firearms and Outdoor Products & Accessories segments. The Firearms segment comprises the manufacture of handguns, long guns, handcuffs, suppressors, and other firearm-related products for sale to a wide variety of customers. The Outdoor Products & Accessories segment engages in the distribution, manufacture, and design of reloading, gunsmithing, and gun cleaning supplies; stainless-steel cutting tools and accessories; flashlights; tree saws and related trimming accessories; shooting supplies, rests, and other related accessories; apparel; vault accessories; laser grips and laser sights; and a full range of products for survival and emergency preparedness. The company was founded by Michell A. Saltz on June 17, 1991 and is headquartered in Springfield, MA.

SWBI Price Returns

| 1-mo | 2.89% |

| 3-mo | -20.11% |

| 6-mo | -32.90% |

| 1-year | -19.31% |

| 3-year | -29.12% |

| 5-year | 65.77% |

| YTD | 2.23% |

| 2024 | -22.59% |

| 2023 | 62.17% |

| 2022 | -49.58% |

| 2021 | 1.64% |

| 2020 | 150.14% |

SWBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...