Smith & Wesson Brands Inc. (SWBI): Price and Financial Metrics

SWBI Price/Volume Stats

| Current price | $16.11 | 52-week high | $18.05 |

| Prev. close | $15.74 | 52-week low | $10.38 |

| Day low | $15.75 | Volume | 316,576 |

| Day high | $16.13 | Avg. volume | 408,906 |

| 50-day MA | $15.50 | Dividend yield | 3.39% |

| 200-day MA | $14.92 | Market Cap | 733.97M |

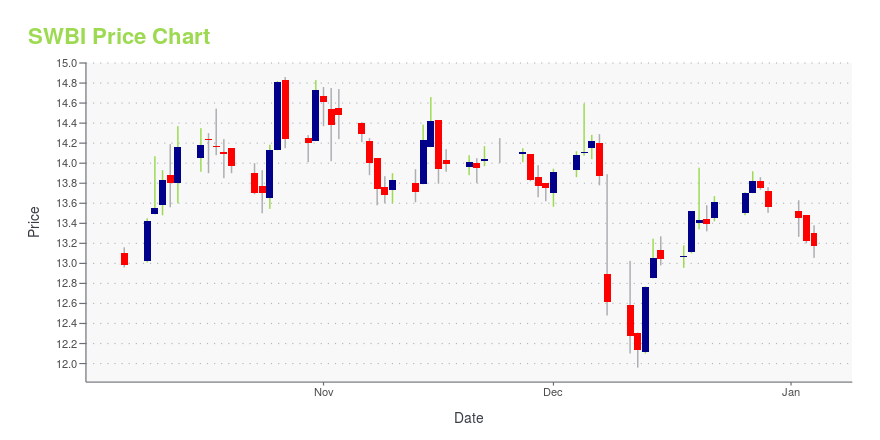

SWBI Stock Price Chart Interactive Chart >

Smith & Wesson Brands Inc. (SWBI) Company Bio

Smith & Wesson Brands, Inc. is a holding company, which engages in the manufacture, design, and provision of firearms. It operates through the Firearms and Outdoor Products & Accessories segments. The Firearms segment comprises the manufacture of handguns, long guns, handcuffs, suppressors, and other firearm-related products for sale to a wide variety of customers. The Outdoor Products & Accessories segment engages in the distribution, manufacture, and design of reloading, gunsmithing, and gun cleaning supplies; stainless-steel cutting tools and accessories; flashlights; tree saws and related trimming accessories; shooting supplies, rests, and other related accessories; apparel; vault accessories; laser grips and laser sights; and a full range of products for survival and emergency preparedness. The company was founded by Michell A. Saltz on June 17, 1991 and is headquartered in Springfield, MA.

Latest SWBI News From Around the Web

Below are the latest news stories about SMITH & WESSON BRANDS INC that investors may wish to consider to help them evaluate SWBI as an investment opportunity.

Will My Portfolio’s Top 3 Performing Stocks From 2023 Deliver Again in 2024?This stock expert takes a look at his portfolio's top performing stocks from the last year. |

Smith & Wesson Brands, Inc. (NASDAQ:SWBI) is largely controlled by institutional shareholders who own 52% of the companyKey Insights Significantly high institutional ownership implies Smith & Wesson Brands' stock price is sensitive to... |

Zacks Industry Outlook Highlights Academy Sports and Outdoors, Acushnet Holdings and American Outdoor BrandsAcademy Sports and Outdoors, Acushnet Holdings and American Outdoor Brands are part of the Zacks Industry Outlook article. |

SWBI Stock Earnings: Smith & Wesson Brands Meets EPS, Beats Revenue for Q2 2024SWBI stock results show that Smith & Wesson Brands met analyst estimates for earnings per share but beat on revenue for the second quarter of 2024. |

Stock Market Today: Dow in longest weekly win streak since 2019 as rally continuesInvesting.com - The Dow rose Friday, notching its longest weekly wining streak since 2019 after a stronger-than-expected jobs report added to optimism that the U.S. economy will avoid a recession amid ongoing bets for a rate cut early next year. |

SWBI Price Returns

| 1-mo | 10.31% |

| 3-mo | -5.30% |

| 6-mo | 23.08% |

| 1-year | 29.25% |

| 3-year | -24.42% |

| 5-year | 148.81% |

| YTD | 20.72% |

| 2023 | 62.18% |

| 2022 | -49.58% |

| 2021 | 1.64% |

| 2020 | 150.13% |

| 2019 | -27.84% |

SWBI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...