Takeda Pharmaceutical Co. Ltd. ADR (TAK): Price and Financial Metrics

TAK Price/Volume Stats

| Current price | $14.75 | 52-week high | $15.53 |

| Prev. close | $15.04 | 52-week low | $12.80 |

| Day low | $14.70 | Volume | 3,701,000 |

| Day high | $14.96 | Avg. volume | 2,065,530 |

| 50-day MA | $14.84 | Dividend yield | 3.76% |

| 200-day MA | $14.22 | Market Cap | 46.93B |

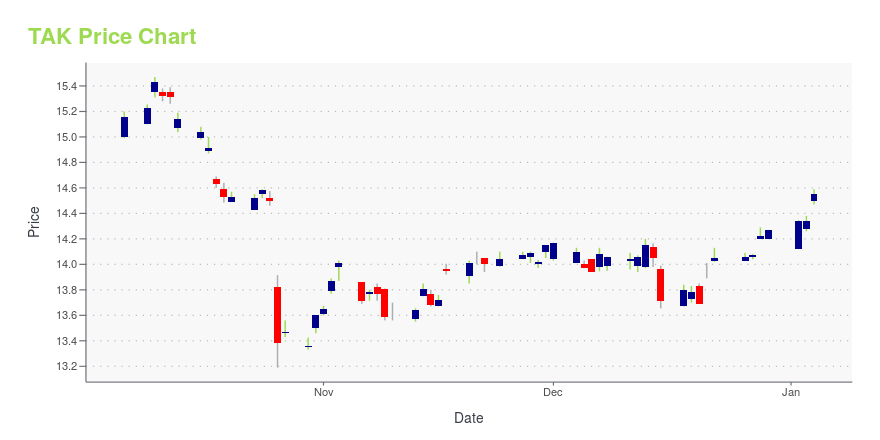

TAK Stock Price Chart Interactive Chart >

Takeda Pharmaceutical Co. Ltd. ADR (TAK) Company Bio

The Takeda Pharmaceutical Company Limited (武田薬品工業株式会社, Takeda Yakuhin Kōgyō kabushiki gaisha) [takeꜜda jakɯçiŋ koꜜːɡʲoː] is a Japanese multinational pharmaceutical company, with partial American and British roots. It is the largest pharmaceutical company in Asia and one of the top 20 largest pharmaceutical companies in the world by revenue (top 10 following its merger with Shire). The company has over 49,578 employees worldwide and achieved US$19.299 billion in revenue during the 2018 fiscal year. The company is focused on oncology, rare diseases, neuroscience, gastroenterology, plasma-derived therapies and vaccines. Its headquarters is located in Chuo-ku, Osaka, and it has an office in Nihonbashi, Chuo, Tokyo. In January 2012, Fortune Magazine ranked the Takeda Oncology Company as one of the 100 best companies to work for in the United States. As of 2015, Christophe Weber was appointed as the CEO and president of Takeda. (Source:Wikipedia)

TAK Price Returns

| 1-mo | -2.96% |

| 3-mo | 0.68% |

| 6-mo | 13.03% |

| 1-year | 12.22% |

| 3-year | 7.72% |

| 5-year | -5.89% |

| YTD | 11.40% |

| 2024 | -5.48% |

| 2023 | -7.00% |

| 2022 | 16.87% |

| 2021 | -23.58% |

| 2020 | -5.97% |

TAK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...