TaskUs, Inc. (TASK): Price and Financial Metrics

TASK Price/Volume Stats

| Current price | $16.90 | 52-week high | $17.36 |

| Prev. close | $16.68 | 52-week low | $7.95 |

| Day low | $16.76 | Volume | 92,000 |

| Day high | $17.18 | Avg. volume | 204,941 |

| 50-day MA | $14.52 | Dividend yield | N/A |

| 200-day MA | $12.53 | Market Cap | 1.49B |

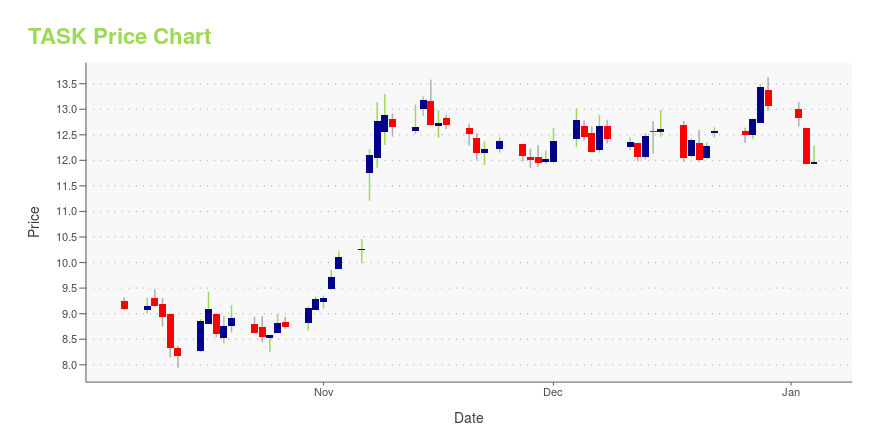

TASK Stock Price Chart Interactive Chart >

TaskUs, Inc. (TASK) Company Bio

TaskUs, Inc. provides outsourcing services to Internet companies worldwide. It offers digital customer experience that consists of omni-channel customer care services primarily delivered through digital channels; and other solutions, including customer care services for new product or market launches, trust and safety solutions, and customer acquisition solutions. The company also offers content security services, such as review and disposition of user and advertiser generated content for various proposals (removal or labeling of policy violating, and offensive or misleading content); and artificial intelligence (AI) solutions that consist of data labeling, annotation, and transcription services for training and tuning AI algorithms through the process of machine learning. Its clients include online or app-based businesses transforming industries, such as ride-sharing, e-commerce, food and grocery delivery, streaming media, and online digital marketplaces. TaskUs, Inc. was formerly known as TU TopCo, Inc. and changed its name to TaskUs, Inc. in December 2020. The company was incorporated in 2008 and is headquartered in New Braunfels, Texas.

Latest TASK News From Around the Web

Below are the latest news stories about TASKUS INC that investors may wish to consider to help them evaluate TASK as an investment opportunity.

TaskUs recognized as the Leader in the 2023 SPARK Matrix™ for Financial Crime and Compliance (FCC) Operations Services by Quadrant Knowledge SolutionsQuadrant Knowledge Solutions announced today that it has named TaskUs, Inc. (Nasdaq: TASK), a leading provider of outsourced digital services and next-generation customer experience to the world's most innovative companies, as a 2023 technology leader in SPARK Matrix™: Financial Crime and Compliance (FCC) Operations Services. |

Returns At TaskUs (NASDAQ:TASK) Are On The Way UpIf we want to find a potential multi-bagger, often there are underlying trends that can provide clues. In a perfect... |

TaskUs, Inc. (NASDAQ:TASK) Q3 2023 Earnings Call TranscriptTaskUs, Inc. (NASDAQ:TASK) Q3 2023 Earnings Call Transcript November 6, 2023 TaskUs, Inc. beats earnings expectations. Reported EPS is $0.32, expectations were $0.29. Operator: Good evening, and welcome to TaskUs Third Quarter 2023 Investor Call. My name is Sherry, and I will be your conference facilitator today. At this time, all lines have been placed […] |

Q3 2023 Taskus Inc Earnings CallQ3 2023 Taskus Inc Earnings Call |

TaskUs (TASK) Q3 2023 Earnings Call TranscriptGood afternoon, and thank you for joining us for the TaskUs third quarter 2023 earnings call. Joining me on today's call are Bryce Maddock, our co-founder and chief executive officer; and Balaji Sekar, our chief financial officer. |

TASK Price Returns

| 1-mo | 30.60% |

| 3-mo | 45.82% |

| 6-mo | 26.50% |

| 1-year | 44.20% |

| 3-year | -46.30% |

| 5-year | N/A |

| YTD | 29.30% |

| 2023 | -22.66% |

| 2022 | -68.68% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...