TAT Technologies Ltd. - Ordinary Shares (TATT): Price and Financial Metrics

TATT Price/Volume Stats

| Current price | $14.46 | 52-week high | $16.24 |

| Prev. close | $13.97 | 52-week low | $6.99 |

| Day low | $13.97 | Volume | 8,510 |

| Day high | $14.49 | Avg. volume | 11,913 |

| 50-day MA | $14.49 | Dividend yield | N/A |

| 200-day MA | $11.75 | Market Cap | 146.09M |

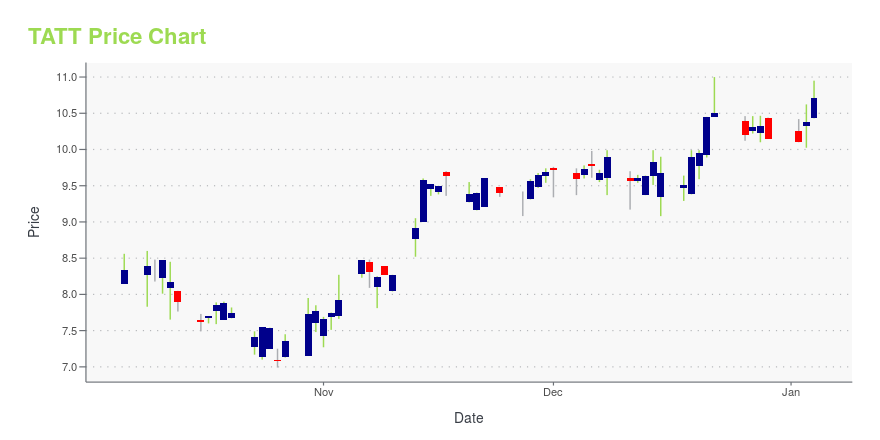

TATT Stock Price Chart Interactive Chart >

TAT Technologies Ltd. - Ordinary Shares (TATT) Company Bio

TAT Technologies Ltd., together with its subsidiaries, provides various solutions and services to the commercial and military aerospace, and ground defense industries worldwide. It designs, develops, and manufactures a range of heat transfer solutions, such as pre-cooler and oil/fuel hydraulic heat exchangers used in mechanical and electronic systems in commercial, military, and business aircraft; environmental control and power electronics cooling systems for use in aircraft and ground applications; and a range of other mechanical aircraft accessories and systems, such as pumps, valves, and turbine power units. The company was founded in 1985 and is based in Gedera, Israel.

Latest TATT News From Around the Web

Below are the latest news stories about TAT TECHNOLOGIES LTD that investors may wish to consider to help them evaluate TATT as an investment opportunity.

TAT Technologies completed Private Placement to Israeli Institutional and Accredited InvestorsTAT Technologies Ltd. (NASDAQ: TATT) ("TAT" or the "Company"), a leading provider of products and services to the commercial and military aerospace and ground defense industries, reported the completion of its placement to Israeli institutional and accredited investors. |

Investors in TAT Technologies (NASDAQ:TATT) have seen strong returns of 131% over the past three yearsThe worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put... |

TAT Technologies Announces Proposed Private Placement to Israeli Institutional and Accredited InvestorsTAT Technologies Ltd. (NASDAQ: TATT) ("TAT" or the "Company"), a leading provider of products and services to the commercial and military aerospace and ground defense industries, announced today that, following the approval of its Board of Directors, it has received and accepted commitments from Israeli institutional and accredited investors (as defined under Israel's Securities Law, 5728-1968 (the "Investors"), to participate in a in a private placement (the "Private Placement") of Ordinary Sha |

TAT Technologies Ltd.'s (NASDAQ:TATT) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?Most readers would already be aware that TAT Technologies' (NASDAQ:TATT) stock increased significantly by 27% over the... |

Thinking about buying stock in Tivic Health Systems, Tigo Energy, TAT Technologies, Plus Therapeutics, or Acumen Pharmaceuticals?InvestorsObserver issues critical PriceWatch Alerts for TIVC, TYGO, TATT, PSTV, and ABOS. |

TATT Price Returns

| 1-mo | 1.54% |

| 3-mo | 21.61% |

| 6-mo | 24.12% |

| 1-year | 93.57% |

| 3-year | 127.72% |

| 5-year | 154.13% |

| YTD | 42.46% |

| 2023 | 91.51% |

| 2022 | -16.00% |

| 2021 | 39.28% |

| 2020 | -10.32% |

| 2019 | -17.86% |

Continue Researching TATT

Here are a few links from around the web to help you further your research on Tat Technologies Ltd's stock as an investment opportunity:Tat Technologies Ltd (TATT) Stock Price | Nasdaq

Tat Technologies Ltd (TATT) Stock Quote, History and News - Yahoo Finance

Tat Technologies Ltd (TATT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...