TC Bancshares, Inc. (TCBC): Price and Financial Metrics

TCBC Price/Volume Stats

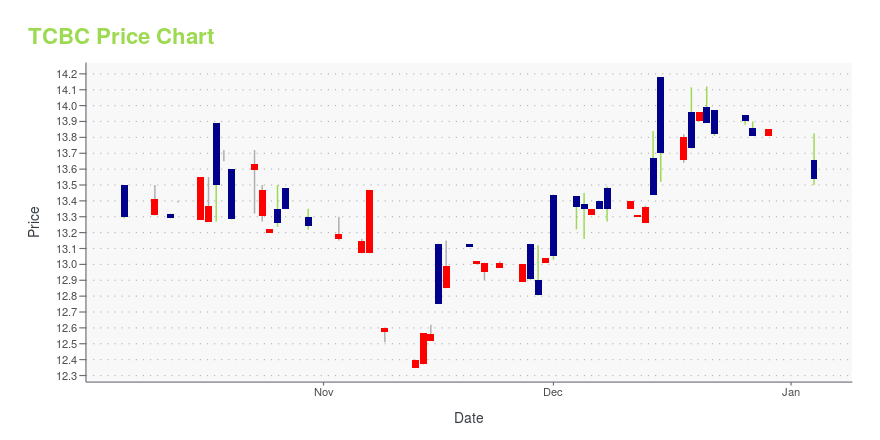

| Current price | $12.95 | 52-week high | $14.60 |

| Prev. close | $13.26 | 52-week low | $12.35 |

| Day low | $12.91 | Volume | 76,180 |

| Day high | $13.30 | Avg. volume | 9,287 |

| 50-day MA | $13.65 | Dividend yield | 0.73% |

| 200-day MA | $13.59 | Market Cap | 54.77M |

TCBC Stock Price Chart Interactive Chart >

TC Bancshares, Inc. (TCBC) Company Bio

TC Bancshares, Inc. operates as the holding company for TC Federal Bank that provides various banking services for individual and commercial customers in the United States. It accepts various deposit products, including personal checking accounts, business checking accounts, savings accounts, money market accounts, and certificates of deposit. The company also offers lending products comprising single-family residential loans, home equity lines of credit, consumer loans, commercial and multi-family residential real estate loans, commercial and industrial loans, construction loans, land development loans, and SBA/USDA guaranteed loans. It operates through its main office in Thomasville, Georgia, a branch office and a residential mortgage center in Tallahassee, Florida, and a commercial loan production office in Savannah, Georgia. The company was founded in 1934 and is based in Thomasville, Georgia.

Latest TCBC News From Around the Web

Below are the latest news stories about TC BANCSHARES INC that investors may wish to consider to help them evaluate TCBC as an investment opportunity.

Investing in TC Bancshares (NASDAQ:TCBC) a year ago would have delivered you a 14% gainPassive investing in index funds can generate returns that roughly match the overall market. But investors can boost... |

TCBC Price Returns

| 1-mo | -3.26% |

| 3-mo | -4.85% |

| 6-mo | -6.13% |

| 1-year | -8.59% |

| 3-year | 9.23% |

| 5-year | N/A |

| YTD | -5.54% |

| 2023 | -6.99% |

| 2022 | 12.41% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

TCBC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...