Trip.com Group Ltd. ADR (TCOM): Price and Financial Metrics

TCOM Price/Volume Stats

| Current price | $43.35 | 52-week high | $58.00 |

| Prev. close | $43.43 | 52-week low | $31.55 |

| Day low | $42.66 | Volume | 3,162,436 |

| Day high | $43.67 | Avg. volume | 3,684,174 |

| 50-day MA | $50.01 | Dividend yield | N/A |

| 200-day MA | $42.67 | Market Cap | 27.92B |

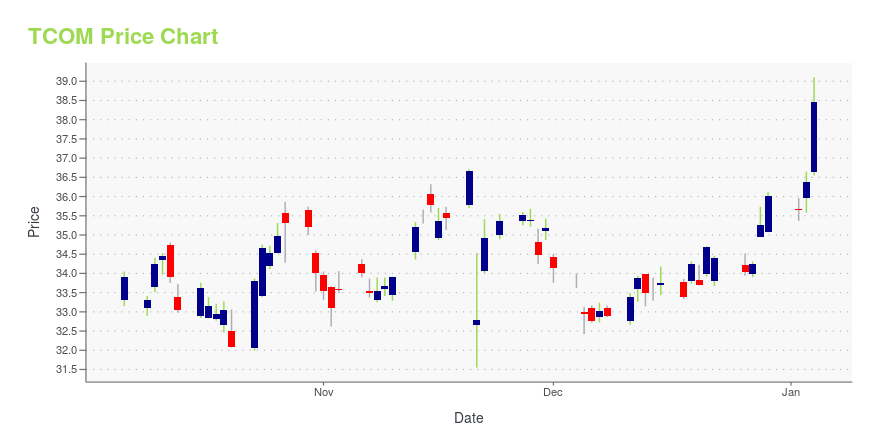

TCOM Stock Price Chart Interactive Chart >

Trip.com Group Ltd. ADR (TCOM) Company Bio

Trip.com Group Limited (Chinese: 携程集团, formerly Ctrip.com International) is a Chinese multinational online travel company that provides services including accommodation reservation, transportation ticketing, packaged tours and corporate travel management. Founded in 1999, the company owns and operates Trip.com, Skyscanner, Qunar, Travix, and Ctrip, all of which are online travel agencies. (Source:Wikipedia)

Latest TCOM News From Around the Web

Below are the latest news stories about TRIPCOM GROUP LTD that investors may wish to consider to help them evaluate TCOM as an investment opportunity.

Is There An Opportunity With Trip.com Group Limited's (NASDAQ:TCOM) 29% Undervaluation?Key Insights Using the 2 Stage Free Cash Flow to Equity, Trip.com Group fair value estimate is US$47.22 Trip.com... |

Emerging Market Marvels: 7 Stocks Set to Soar in Developing EconomiesThe past few years have been all about U.S. tech stocks. |

Trip.com sees increase in visits after China expands visa-free travel to 6 countriesChina has announced that it will expand the scope of its unilateral visa-free policy for ordinary passport holders from six countries: France, Germany, Italy, the Netherlands, Spain, and Malaysia. The policy will be implemented on a trial basis. |

Trip.com Group Limited (NASDAQ:TCOM) Q3 2023 Earnings Call TranscriptTrip.com Group Limited (NASDAQ:TCOM) Q3 2023 Earnings Call Transcript November 20, 2023 Trip.com Group Limited beats earnings expectations. Reported EPS is $1, expectations were $0.71. Operator: Good day and thank you for standing by. Welcome to Trip.com Group 2023 Q3 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the […] |

Trip.com Group Limited Reports Unaudited Third Quarter of 2023 Financial ResultsTrip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged tours, and corporate travel management, today announced its unaudited financial results for the third quarter of 2023. |

TCOM Price Returns

| 1-mo | -11.30% |

| 3-mo | -14.33% |

| 6-mo | 15.63% |

| 1-year | 15.26% |

| 3-year | 66.79% |

| 5-year | 10.61% |

| YTD | 20.38% |

| 2023 | 4.68% |

| 2022 | 39.72% |

| 2021 | -27.01% |

| 2020 | 0.57% |

| 2019 | 23.95% |

Loading social stream, please wait...