TRACON Pharmaceuticals, Inc. (TCON): Price and Financial Metrics

TCON Price/Volume Stats

| Current price | $0.63 | 52-week high | $14.75 |

| Prev. close | $0.66 | 52-week low | $0.60 |

| Day low | $0.63 | Volume | 1,578 |

| Day high | $0.65 | Avg. volume | 171,886 |

| 50-day MA | $1.11 | Dividend yield | N/A |

| 200-day MA | $3.18 | Market Cap | 2.10M |

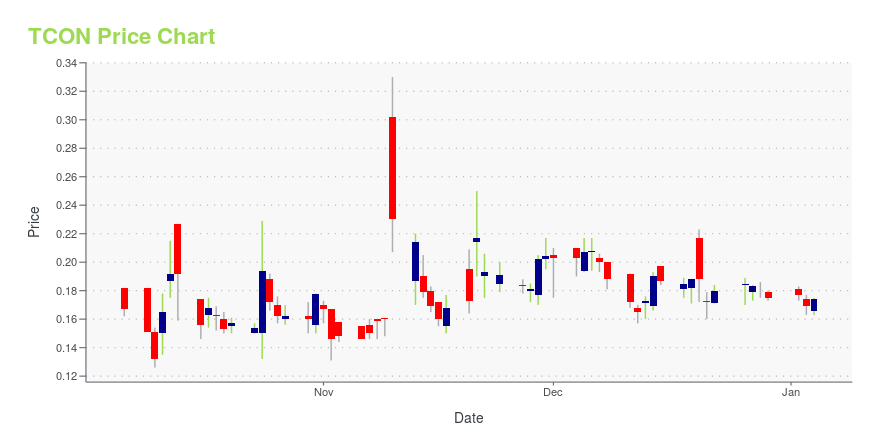

TCON Stock Price Chart Interactive Chart >

TRACON Pharmaceuticals, Inc. (TCON) Company Bio

Tracon Pharmaceuticals develops targeted therapies for cancer, wet age-related macular degeneration and fibrotic diseases. The company was founded in 2004 and is based in San Diego, California.

Latest TCON News From Around the Web

Below are the latest news stories about TRACON PHARMACEUTICALS INC that investors may wish to consider to help them evaluate TCON as an investment opportunity.

Why Is Tracon Pharmaceuticals (TCON) Stock Up 19% Today?Tracon Pharmaceuticals stock is rising higher on Tuesday as investors in TCON react to news of a new licensing agreement. |

Why Is LQR House (LQR) Stock Up 30% Today?LQR House stock is rising higher on Tuesday after the company announced plans to repurchase up to $2 million worth of its shares. |

Why Is Reliance Global (RELI) Stock on the Move Today?Reliance Global stock is on the move Tuesday after the company first announced, and then withdrew, a public offering for RELI shares. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to start Tuesday trading with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

TRACON Pharmaceuticals Announces License of Product Development Platform for $3.0 Million Upfront PaymentSAN DIEGO, Nov. 20, 2023 (GLOBE NEWSWIRE) -- TRACON Pharmaceuticals, Inc. (Nasdaq: TCON), a clinical stage biopharmaceutical company utilizing a cost-efficient, CRO-independent product development platform (PDP) to advance its pipeline of novel targeted cancer therapeutics and to partner with other life science companies, today announced it has licensed its proprietary PDP of CRO-independent clinical research to a clinical stage biotech company for a $3.0 million upfront payment. “We are excited |

TCON Price Returns

| 1-mo | -56.55% |

| 3-mo | -65.19% |

| 6-mo | -84.78% |

| 1-year | -88.67% |

| 3-year | -99.17% |

| 5-year | -99.40% |

| YTD | -82.01% |

| 2023 | -88.25% |

| 2022 | -46.21% |

| 2021 | -76.32% |

| 2020 | 400.00% |

| 2019 | -62.86% |

Loading social stream, please wait...