Teck Resources Ltd. (TECK): Price and Financial Metrics

TECK Price/Volume Stats

| Current price | $47.45 | 52-week high | $55.13 |

| Prev. close | $45.70 | 52-week low | $34.38 |

| Day low | $45.90 | Volume | 8,553,777 |

| Day high | $48.48 | Avg. volume | 3,652,164 |

| 50-day MA | $49.25 | Dividend yield | 0.8% |

| 200-day MA | $43.20 | Market Cap | 24.24B |

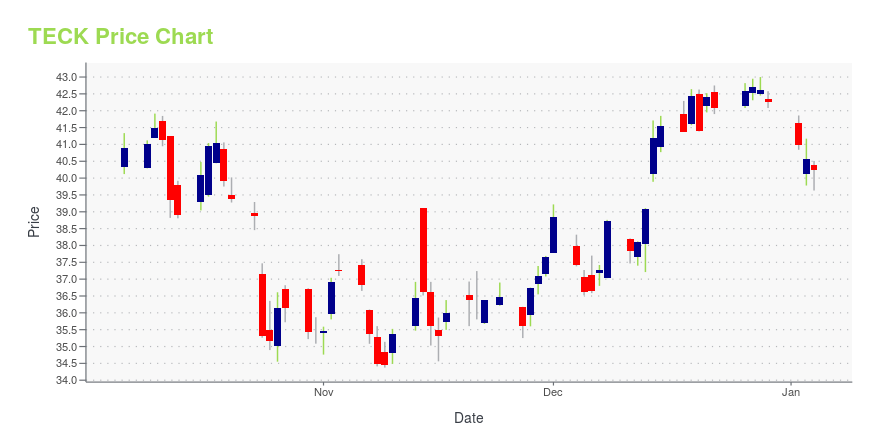

TECK Stock Price Chart Interactive Chart >

Teck Resources Ltd. (TECK) Company Bio

Teck Resources develops, and produces copper, including copper concentrates and cathode copper, steelmaking coal, and refined zinc and zinc concentrates in the Americas, the Asia Pacific, Europe, and Africa. The company was founded in 1913 and is based in Vancouver, Canada.

Latest TECK News From Around the Web

Below are the latest news stories about TECK RESOURCES LTD that investors may wish to consider to help them evaluate TECK as an investment opportunity.

Teck Resources' 2023 copper output from Quebrada Blanca below targetMore on Teck Resources |

13 Best Mining Stocks To Buy NowIn this piece, we will take a look at the 13 best mining stocks to buy now. If you want to skip our analysis of the mining industry and want to jump to the top five stocks in this list, head on over to 5 Best Mining Stocks To Buy Now. The global supply of […] |

Trail Carbon Capture Pilot Plant Now OperationalTRAIL, British Columbia, Dec. 20, 2023 (GLOBE NEWSWIRE) -- Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (“Teck”) today announced the Carbon Capture Pilot Plant at its Trail Operations in southern British Columbia is now operating and successfully capturing carbon dioxide (CO2). “This is an important milestone as we advance our understanding of the potential of carbon capture technology to reduce emissions at our operations,” said Jonathan Price, President & CEO. “This project is p |

Long-delayed Minnesota copper-nickel mining project wins a round in court after several setbacksThe Minnesota Court of Appeals on Monday affirmed a decision by a state agency to grant a major permit for the proposed NewRange copper-nickel mine, saying regulators adequately considered the possibility that developers might expand the project in the future. It was a win for NewRange Copper Nickel, which remains stalled by court and regulatory setbacks. The $1 billion open-pit mine near Babbitt and processing plant near Hoyt Lakes would be Minnesota's first copper-nickel mine. |

Glencore's prized Canadian coal mines come with rising environmental scrutinyA Glencore-led consortium's successful $9 billion bid for Teck Resources' steelmaking coal unit could face tougher environmental clean-up obligations, as water pollution from the mines comes under increasing scrutiny in the U.S. and Canada. Canada's Environment Minister Steven Guilbeault told Reuters that Ottawa and Washington are close to requesting a study of selenium contamination from Teck's Elk Valley mines in southeast British Columbia. The research would be carried out by International Joint Commission (IJC), a bi-national organization set up under the 1909 Boundary Waters Treaty between the U.S. and Canada to prevent and resolve disputes over shared waters. |

TECK Price Returns

| 1-mo | -1.64% |

| 3-mo | -5.63% |

| 6-mo | 18.23% |

| 1-year | 13.31% |

| 3-year | 128.86% |

| 5-year | 137.37% |

| YTD | 12.47% |

| 2023 | 13.97% |

| 2022 | 33.83% |

| 2021 | 59.55% |

| 2020 | 5.88% |

| 2019 | -18.73% |

TECK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TECK

Want to see what other sources are saying about Teck Resources Ltd's financials and stock price? Try the links below:Teck Resources Ltd (TECK) Stock Price | Nasdaq

Teck Resources Ltd (TECK) Stock Quote, History and News - Yahoo Finance

Teck Resources Ltd (TECK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...