Tenax Therapeutics, Inc. (TENX): Price and Financial Metrics

TENX Price/Volume Stats

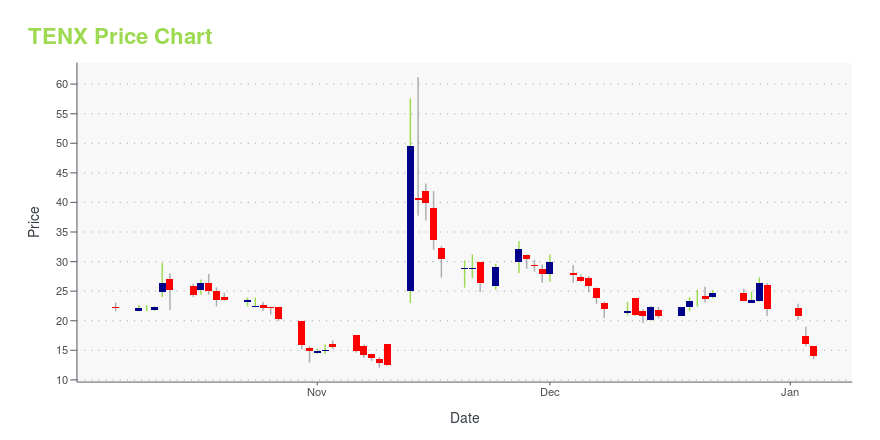

| Current price | $3.39 | 52-week high | $61.20 |

| Prev. close | $3.32 | 52-week low | $2.77 |

| Day low | $3.35 | Volume | 1,700 |

| Day high | $3.42 | Avg. volume | 167,420 |

| 50-day MA | $3.34 | Dividend yield | N/A |

| 200-day MA | $10.65 | Market Cap | 6.64M |

TENX Stock Price Chart Interactive Chart >

Tenax Therapeutics, Inc. (TENX) Company Bio

Tenax Therapeutics, Inc., a specialty pharmaceutical company, focused on the identification, development, and commercialization of a portfolio of products for the critical care market in the United States and Canada. It focuses on the development and commercialization of pharmaceutical products containing levosimendan, 2.5 mg/ml concentrate for solution for infusion/5ml vial for use in the reduction of morbidity and mortality in cardiac surgery patients at risk for developing Low Cardiac Output Syndrome. The company was formerly known as Oxygen Biotherapeutics, Inc. and changed its name to Tenax Therapeutics, Inc. in September 2014. The company was founded in 1967 and is based in Morrisville, North Carolina.

Latest TENX News From Around the Web

Below are the latest news stories about TENAX THERAPEUTICS INC that investors may wish to consider to help them evaluate TENX as an investment opportunity.

TENX: IND Clears Way for Phase IIIBy John Vandermosten, CFA NASDAQ:TENX READ THE FULL TENX RESEARCH REPORT Third Quarter Financial and Operational Review Tenax Therapeutics, Inc. (NASDAQ:TENX) reported 3Q:23 results on November 13, 2023 via its filing of Form 10-Q with the SEC. Since the filing of the second quarter 10-Q in mid-August, the company has finished compiling and submitting its investigational new drug (IND) |

Tenax Therapeutics Announces Professor Javed Butler, M.D., M.P.H, M.B.A., joins PH-HFpEF Scientific Advisory BoardCHAPEL HILL, N.C., Nov. 17, 2023 (GLOBE NEWSWIRE) -- Tenax Therapeutics, Inc. (Nasdaq: TENX), a specialty pharmaceutical company focused on identifying, developing and commercializing products that address cardiovascular and pulmonary diseases with high unmet medical need, today announced the appointment of Javed Butler, M.D., M.P.H, M.B.A., to the Company’s PH-HFpEF Scientific Advisory Board (SAB). “We are thrilled to welcome Dr. Butler to our Scientific Advisory Board,” said Stuart Rich, M.D., |

Why Is Tenax Therapeutics (TENX) Stock Up 300% Today?Although Tenax Therapeutics has received a green light for its investigational drug, investors should exercise caution with TENX stock. |

Tenax Therapeutics Announces FDA Clearance of IND for TNX-103 (oral levosimendan) for the Treatment of Pulmonary Hypertension with Heart Failure with Preserved Ejection Fraction (PH-HFpEF), Initiation of Phase 3 sites expected 2023First Phase 3 study of TNX-103 in PH-HFpEF patients to start in 4Q 2023 (The LEVEL Study)FDA agreement that 6MWD will be the primary endpoint for both Phase 3 studies Phase 3 program designed to satisfy FDA’s request for subject drug exposure of 300 patients for 6 months, 100 patients for 1 year (minimum requirements per ICH guidelines)No FDA requirement for a cardiovascular outcomes trial Oral levosimendan use in PH-HFpEF is protected by USPTO granted patent that will not expire until the end o |

TENX: Second Quarter ResultsBy John Vandermosten, CFA NASDAQ:TENX READ THE FULL TENX RESEARCH REPORT Second Quarter Financial and Operational Review Tenax Therapeutics, Inc. (NASDAQ:TENX) reported 2Q:23 results on August 14, 2023 via its filing of Form 10-Q with the SEC. Despite the slow pace of advancement, we are impressed with the clinical data for both of Tenax’ PAH assets: levosimendan and imatinib. We see tremendous |

TENX Price Returns

| 1-mo | 8.31% |

| 3-mo | -2.59% |

| 6-mo | -66.40% |

| 1-year | -86.74% |

| 3-year | -99.88% |

| 5-year | -99.84% |

| YTD | -84.57% |

| 2023 | -87.68% |

| 2022 | -89.29% |

| 2021 | -44.09% |

| 2020 | 31.91% |

| 2019 | 16.53% |

Loading social stream, please wait...