Teradyne Inc. (TER): Price and Financial Metrics

TER Price/Volume Stats

| Current price | $126.46 | 52-week high | $163.21 |

| Prev. close | $124.33 | 52-week low | $81.07 |

| Day low | $123.03 | Volume | 2,617,182 |

| Day high | $126.59 | Avg. volume | 2,050,194 |

| 50-day MA | $145.79 | Dividend yield | 0.32% |

| 200-day MA | $112.93 | Market Cap | 19.74B |

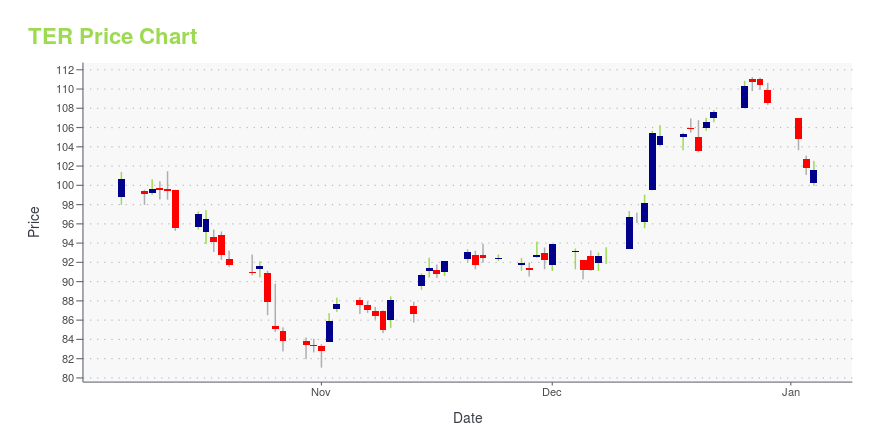

TER Stock Price Chart Interactive Chart >

Teradyne Inc. (TER) Company Bio

Teradyne, Inc. is an American automatic test equipment (ATE) designer and manufacturer based in North Reading, Massachusetts. Teradyne's high-profile customers include Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments and IBM. (Source:Wikipedia)

Latest TER News From Around the Web

Below are the latest news stories about TERADYNE INC that investors may wish to consider to help them evaluate TER as an investment opportunity.

AI and Automation: 3 Stocks Leading the Digital Revolution in 2024Get the edge in the market with expert advice on AI and automation stocks. |

ITRI or TER: Which Is the Better Value Stock Right Now?ITRI vs. TER: Which Stock Is the Better Value Option? |

3 Robotics Stocks to Automate Your Future in 2024When it comes to forward-looking investment ideas, few are as relevant as robotics stocks. |

Jim Cramer Says Recession Is Not Coming and Recommends These 11 StocksIn this article, we will take a detailed look at the Jim Cramer Says Recession Is Not Coming and Recommends These 11 Stocks. For a quick overview of such stocks, read our article Jim Cramer Says Recession Is Not Coming and Recommends These 5 Stocks. On December 14, an enthusiastic Jim Cramer announced on his program on CNBC that the […] |

Teradyne (TER) Soars 7.4%: Is Further Upside Left in the Stock?Teradyne (TER) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

TER Price Returns

| 1-mo | -13.90% |

| 3-mo | 10.90% |

| 6-mo | 20.16% |

| 1-year | 14.81% |

| 3-year | 3.70% |

| 5-year | 129.43% |

| YTD | 16.77% |

| 2023 | 24.78% |

| 2022 | -46.35% |

| 2021 | 36.81% |

| 2020 | 76.73% |

| 2019 | 118.93% |

TER Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TER

Here are a few links from around the web to help you further your research on Teradyne Inc's stock as an investment opportunity:Teradyne Inc (TER) Stock Price | Nasdaq

Teradyne Inc (TER) Stock Quote, History and News - Yahoo Finance

Teradyne Inc (TER) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...