Taseko Mines, Ltd. (TGB): Price and Financial Metrics

TGB Price/Volume Stats

| Current price | $2.15 | 52-week high | $3.15 |

| Prev. close | $2.15 | 52-week low | $1.05 |

| Day low | $2.13 | Volume | 1,612,500 |

| Day high | $2.19 | Avg. volume | 2,661,730 |

| 50-day MA | $2.52 | Dividend yield | N/A |

| 200-day MA | $1.85 | Market Cap | 628.61M |

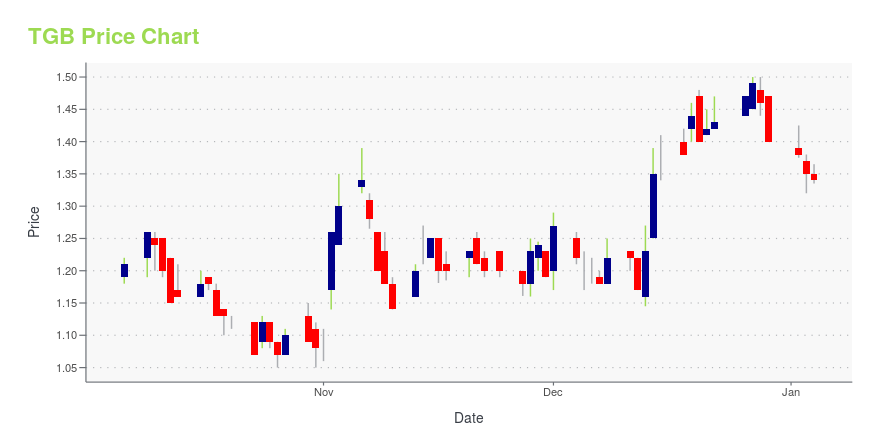

TGB Stock Price Chart Interactive Chart >

Taseko Mines, Ltd. (TGB) Company Bio

Taseko Mines Limited, a mining company, acquires, develops, and operates mineral properties in Canada and the United States. The company explores for copper, molybdenum, gold, and niobium deposits. The company was founded in 1966 and is based in Vancouver, Canada.

Latest TGB News From Around the Web

Below are the latest news stories about TASEKO MINES LTD that investors may wish to consider to help them evaluate TGB as an investment opportunity.

Investing in Taseko Mines (TSE:TKO) five years ago would have delivered you a 174% gainWhen you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose... |

New Strong Buy Stocks for December 18thACR, PLAB, RYI, SHOP and TGB have been added to the Zacks Rank #1 (Strong Buy) List on December 18, 2023. |

Taseko Mines Announces Senior Management AppointmentsTaseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) ("Taseko" or the "Company") is pleased to announce the following executive management appointments. Richard Tremblay, MBA, P.Eng., has been appointed Chief Operating Officer, and Terry Morris, P.Eng., has joined Taseko as Vice President, Operations. |

These 3 Penny Stocks Could Soar in the Coming YearsFinding penny stocks to buy is the name of the game. |

Taseko Receives Approvals for US$100 Million in Additional Financing for Florence CopperTaseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) ("Taseko" or the "Company") is pleased to provide an update on two additional financing transactions, totalling US$100 million, for its Florence Copper Project in Arizona, USA. The Company has been notified that Taurus Mining Royalty Fund L.P. ("Taurus") has obtained investment committee approval for a US$50 million royalty, and Societe Generale has received credit approval for a US$50 million senior secured debt facility. Upon clos |

TGB Price Returns

| 1-mo | -13.31% |

| 3-mo | -17.31% |

| 6-mo | 51.41% |

| 1-year | 53.57% |

| 3-year | 24.28% |

| 5-year | 353.49% |

| YTD | 53.57% |

| 2023 | -4.76% |

| 2022 | -28.29% |

| 2021 | 55.30% |

| 2020 | 175.00% |

| 2019 | 1.48% |

Continue Researching TGB

Want to do more research on Taseko Mines Ltd's stock and its price? Try the links below:Taseko Mines Ltd (TGB) Stock Price | Nasdaq

Taseko Mines Ltd (TGB) Stock Quote, History and News - Yahoo Finance

Taseko Mines Ltd (TGB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...